Advertisement

Advertisement

Marketmind: Powell has spoken – bullish or bearish?

By:

By Jamie McGeever (Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

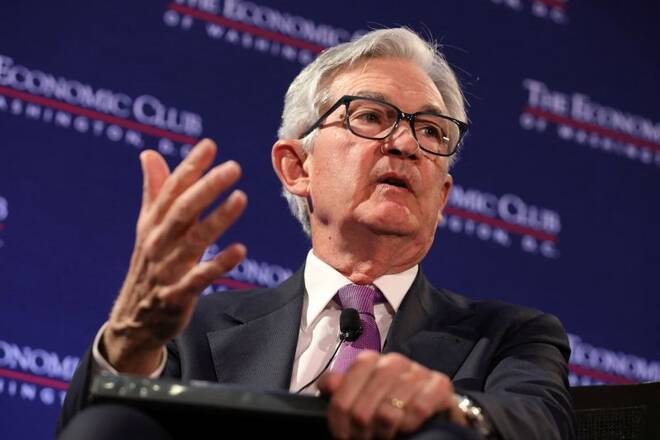

Fed Chair Jerome Powell has spoken and luckily for bulls and bears, there was something for everyone, so where Asian markets go on Wednesday is something a coin flip.

With an expected interest rate rise in India taking center stage regionally, investors in Asia will be digesting the mixed U.S. picture that saw stocks rise but the dollar and Treasuries ease lower on Tuesday.

Wall Street was boosted and the dollar was dented by Powell’s reluctance – indeed, refusal – to say January’s blowout jobs data necessarily means interest rates need to be higher than Fed officials estimated late last year.

But he also said “it will take some time” to get the inflation genie back in the 2% bottle. Bond prices slipped, yield curves steepened, the expected “terminal rate” clung to 5.15% and the amount of implied policy easing this year steadied at around just 15 basis points.

The Reserve Bank of India is likely to raise its key interest rate by 25 basis points to 6.50%, which most economists reckon will be the last of the hiking cycle.

More than three-quarters of the 52 economists polled by Reuters last month expect the quarter point increase, and 12 predict no change. But as Australia’s central bank showed on Tuesday, beware surprises.

The Indian rupee goes into the meeting at a one-month low against the dollar, pressured by the rate outlook and beaten by the Adani Group financial crisis, which has morphed into a political crisis.

It was revealed on Tuesday that the group is considering independent evaluation of issues relating to legal compliance, related party transactions and internal controls after a U.S. short-seller’s critical report on its businesses sparked over $110 billion losses in the group’s market value.

Adani got some reprieve after JP Morgan said the group’s companies are still eligible for inclusion in the bank’s influential bond indexes, while ratings agencies say Indian banks’ credit profiles are safe.

With the rupee within a whisker of October’s record low, however, traders will be on RBI intervention alert.

Elsewhere in regional FX, the Aussie dollar has a spring in its step after the Australian central bank on Tuesday raised rates to a decade-high and signaled it may tighten policy more than markets had expected.

The yen shot higher too on Tuesday, snapping a heavy two-day losing run after strong wage growth data. December’s current account figures are next up on Wednesday.

Here are three key developments that could provide more direction to markets on Wednesday:

– India interest rate decision

– Japan current account (December)

– Fed’s Williams, Cook, Bostic, Barr, Kashkari and Waller all speak

(By Jamie McGeever; Editing by Lisa Shumaker)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement