Advertisement

Advertisement

Marketmind: Putting the back in greenback

By:

(Reuters) - A look at the day ahead in Asian markets from Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever

The greenback is back.

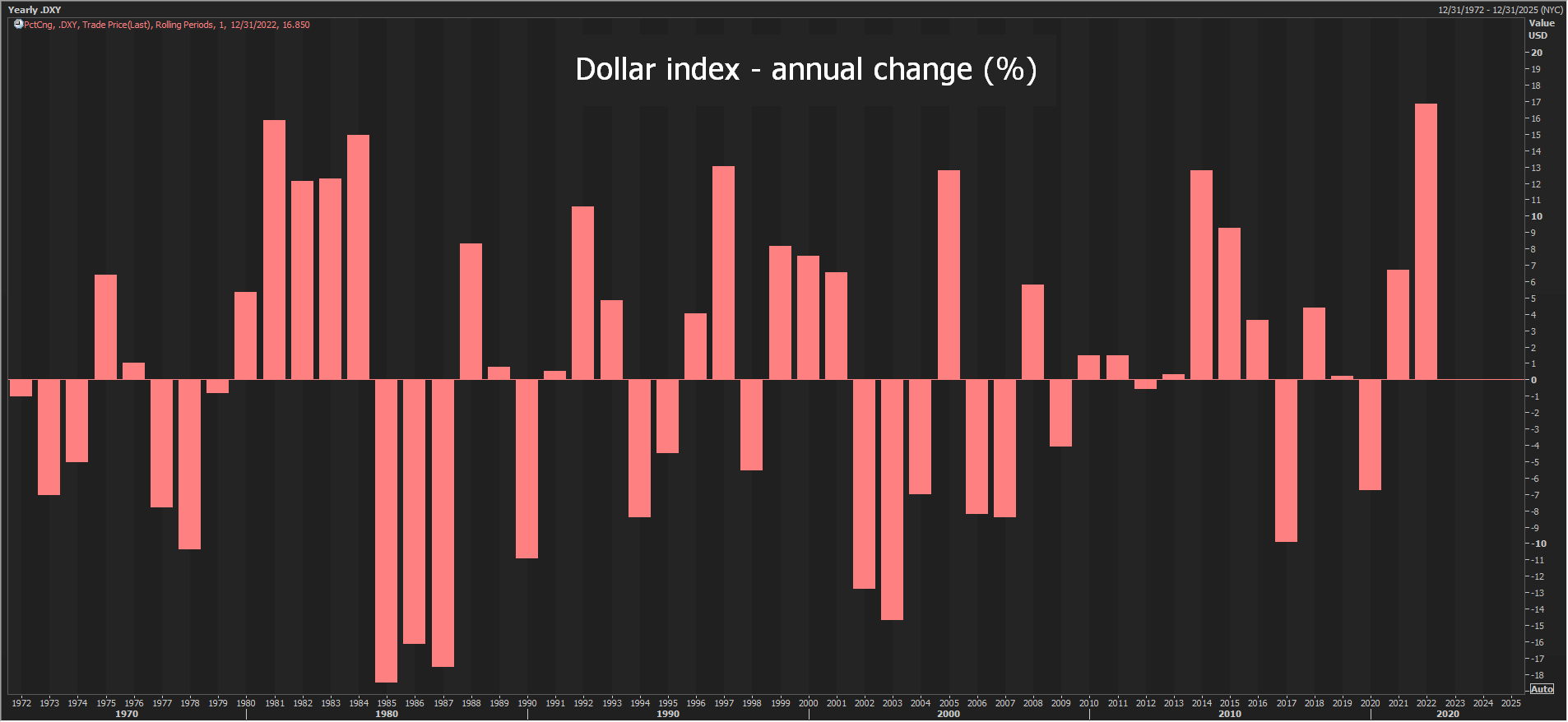

The dollar chalked up its second straight daily increase of around 1% on Thursday to bring its year-to-date rise up to 17%. This would be the biggest annual appreciation since the era of free-floating exchange rates was introduced half a century ago.

This is ominous for U.S. corporate profits, global financial conditions and central banks around the world battling to prevent historically low exchange rates from weakening further.

Many Asian currencies enjoyed a breather over the past week as the U.S. dollar’s rally lost steam, although the Indian rupee hit a record low on Thursday and the Japanese yen was set for its lowest New York daily close in 24 years around 145 per dollar. Intervention territory? You’d think so.

These pressures look set to dominate Friday’s session, contributing to a more volatile end to the week.

The resurgent dollar is also a suitable backdrop against which China and Japan – the world’s largest FX reserve holders with a combined $4.3 trillion, about a third of the global total – release their September reserves data.

They will be closely scrutinized to see how much may have been spent on FX intervention in the month, official or otherwise.

Asian stocks are likely to open lower on Friday, following Wall Street’s slide into the red on Thursday. The dollar’s drag on U.S. and global stocks cannot be underestimated – around a third of S&P 500 firms’ revenues come from overseas.

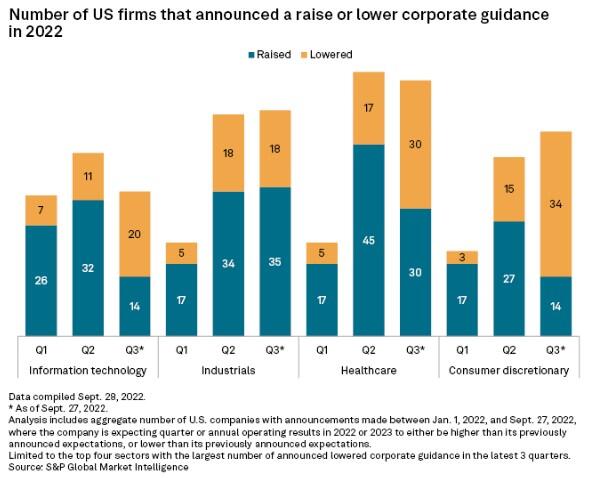

Morgan Stanley reckons the dollar represents a 10% headwind to U.S. earnings this year and Citi reckons FX effects will have the greatest impact on discretionary retail, the sector S&P Global says is fast becoming the riskiest on Wall Street.

Key developments that could provide more direction to markets on Friday:

South Korea current account (August)

Japan household spending (August)

Japan FX reserves (September)

China FX reserves (September)

Indonesia FX reserves (September)

Australia RBA financial stability review

U.S. non-farm payrolls (September)

Fed’s Williams, Bostic and Kashkari speak

(Reporting by Jamie NcGeever in Orlando, Fla.; Editing by Josie Kao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement