Advertisement

Advertisement

Philippines sees no significant impact from global banking crisis

By:

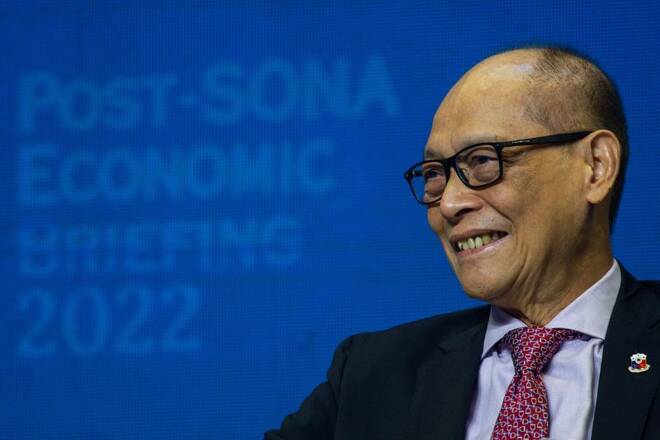

MANILA (Reuters) - Philippine Finance Secretary Benjamin Diokno said on Monday the central bank could decide to either hike the key interest rate by 25 basis points (bps) or keep policy settings unchanged at its next meeting on Thursday amid uncertainties. Diokno, who also sits in the central bank's policy-making monetary board, expressed optimism that inflation will ease to around 4% towards end of the third quarter.

By Neil Jerome Morales

MANILA (Reuters) – Philippine financial authorities expressed optimism on Monday that a deepening crisis in the global banking sector does not pose a significant risk for the local industry and the domestic economy as a whole.

Global financial markets are reeling from a string of bank failures and fears of contagion, with a deal to rescue Credit Suisse and promises of liquidity from central banks doing little to stem fears of a wider crisis in the financial system.

“It does not look like other Global Systemically Important Banks have the same problem, in which case the impact on the global economy, and therefore the Philippines, will not be significant,” Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla said.

In notes prepared for President Ferdinand Marcos Jr. on the stability of the local banking system following the collapse of Silicon Valley Bank and Signature Bank in the United States, the BSP said the local banking system remains strong.

The sector is also ready to withstand possible shocks posed by the collapse of some U.S. banks, the BSP said, though it added it would continue to closely monitor developments, assess their impact on the banking system and respond accordingly.

“The BSP has long implemented structural reforms to ensure the safety and soundness of banks,” it said.

The BSP has also imposed prudent limits and requirements, including the Basel III reforms on capital and liquidity standards which enable banks to maintain adequate capital and liquidity, as well as strengthened surveillance mechanisms for risk monitoring, it said.

To address any serious liquidity conditions, the BSP said solvent banks can tap emergency loan facilities.

“There’s very little contagion on the Philippine side and in fact it can be a positive in the sense that central banks are likely to ease on hiking of interest rates,” Finance Secretary Benjamin Diokno said separately.

In remarks made at a forum organised by foreign journalists, Diokno said the BSP could decide to opt for a narrower 25 basis points interest rate hike or keep policy settings unchanged at its meeting on Thursday, amid global uncertainty.

“The option now is not to hike or to hike by 25 basis points,” said Diokno, though he added he is just one of the seven-person policy-making monetary board and that he could be outvoted.

(Reporting by Neil Jerome Morales; Editing by Ed Davies, Kanupriya Kapoor)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement