Advertisement

Advertisement

US equity funds received biggest inflow in 18 weeks – Lipper

By:

(Reuters) - U.S. equity funds received their biggest inflow in 18 weeks in the week ended Oct. 26, buoyed by hopes that the Federal Reserve would slow the pace of its interest rate hikes to combat the economic downtrend.

(Reuters) – U.S. equity funds received their biggest inflow in 18 weeks in the week ended Oct. 26, buoyed by hopes that the Federal Reserve would slow the pace of its interest rate hikes to combat the economic downtrend.

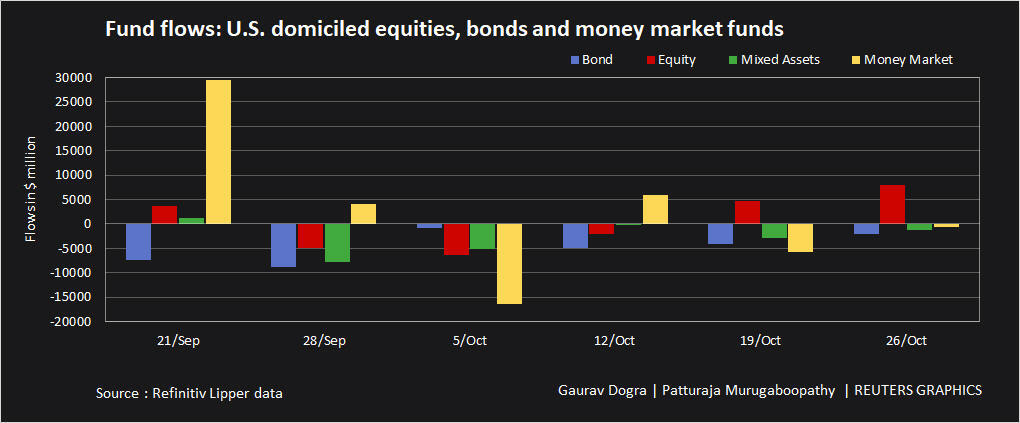

U.S. equity funds obtained a net $7.9 billion in the week, the biggest inflow since the end of June, data from Refinitiv Lipper showed.

U.S. business activity contracted for a fourth straight month, data on Monday showed, suggesting that the Fed’s rate increases have softened the economy, which in turn raised hopes that the central bank could begin slowing the pace of the hikes.

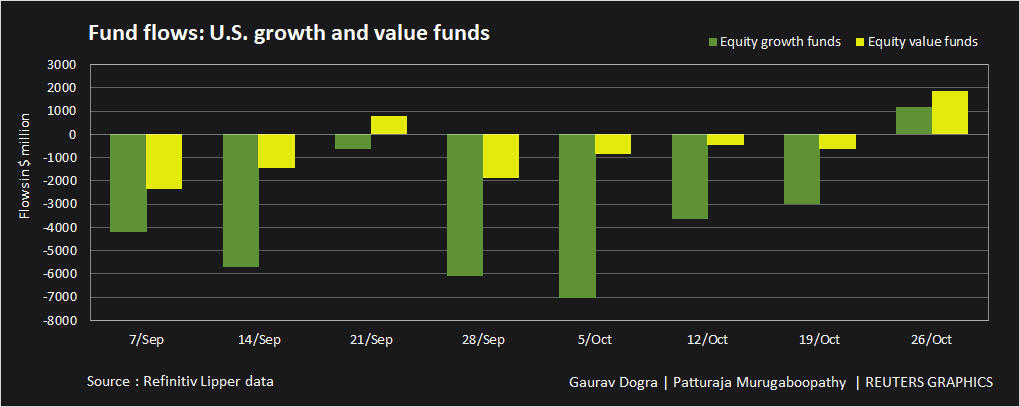

U.S. value funds attracted $1.8 billion, while growth funds received just $1.1 billion, indicating investors continue to prefer value over growth stocks.

At the same time, U.S. bond funds continued to witness outflows, as they faced net sales worth $2.1 billion, their sixth consecutive outflow.

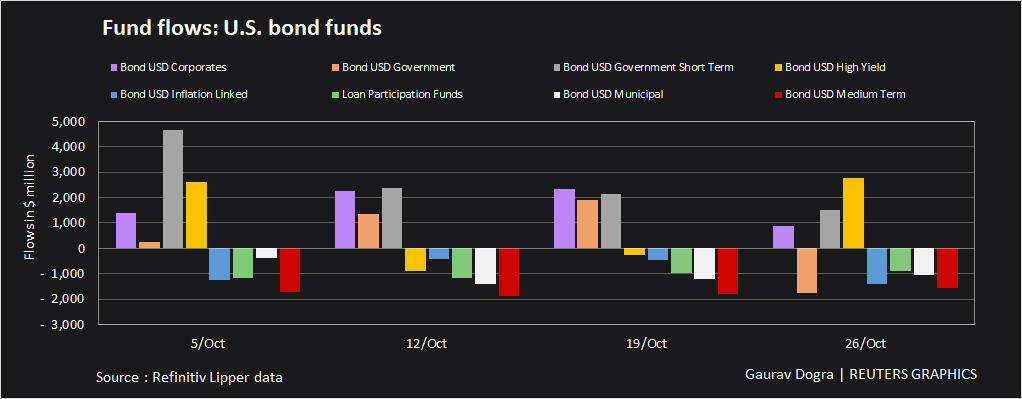

U.S. government bond funds and inflation-linked funds faced outflows worth $1.7 billion and $1.4 billion respectively.

On the other hand, U.S. high-yield bonds funds obtained $2.75 billion their biggest inflow in three months, suggesting investor interest in junk bonds after the big selloff in recent months.

(Reporting By Patturaja Murugaboopathy in Bengaluru; Editing by Maju Samuel)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement