Advertisement

Advertisement

Watch for Major Shift in Investor Sentiment if Friday’s Jobs Report is Bullish

By:

Traders should be focusing on several asset classes this week based on the price action last Friday. The boost to U.S. consumer spending and GDP already

Traders should be focusing on several asset classes this week based on the price action last Friday. The boost to U.S. consumer spending and GDP already has investors talking about a sooner than expected rate hike. This puts the emphasis on the February jobs data report due out on March 4.

The January Non-Farm Payrolls report showed unemployment falling to an eight-year low of 4.9%, but job growth of 151,000 came in below consensus. However, investors put their money behind the stronger-than-expected growth of 0.5% in average hourly earnings to $25.39 an hour. The consensus is betting that the economy added 195,000 jobs in February, with unemployment holding steady at 4.9% and no growth in wages.

Solid U.S. consumer spending in January and a pick-up in inflation by the most in four years, has put a Federal Reserve interest rate hike in 2016 back on the table.

According to data released on February 26 by the Commerce Department, consumer spending increased 0.5 percent as households spent more on a variety of items and the return of cold weather led to increased demand for heating oil and natural gas. Consumer spending, which accounts for more than tw0-thirds of U.S. economic activity, rose by an upwardly revised 0.1 percent in December.

U.S. Gross Domestic Product increased at a 1.0 percent annual pace in the fourth quarter. Adding in stronger data on manufacturing and employment suggests that economic growth picked up at the start of the year.

The core PCE, the Fed’s preferred inflation measure, rose 1.5 percent in December. The PCE index advanced 0.7 percent in December. Excluding food and energy, prices rose 0.3 percent. That was the largest increase since January 2012 and followed a 0.1 percent gain in December. The so-called core PCE price index increased 1.7 percent in the 12 months through January, the largest rise since July 2014.

That’s it in a nutshell. That’s all it took for investors to raise their bets for at least one Fed interest rate hike in 2016. The emphasis now shifts to Friday’s U.S. Non-Farm Payrolls report. Another report showing robust jobs growth will lead to speculation of a rate hike later this year.

Investors have eliminated a March rate hike, but if consumers continue to spend, companies continue to hire and rising oil prices continue to underpin inflation then investors are likely to increase bets for a rate hike later in the year with June a strong possibility.

A greater than expected increase in the number of jobs will likely put the pressure on the Fed to raise rates in June. Treasury yields will likely rise on good news from the labor market. This should lead to increased demand for the U.S. Dollar, putting pressure on several foreign currencies especially the Japanese Yen and the Euro.

Gold prices are likely to break if the dollar rises. Stocks should also give back some of its recent gains. If you recall, stocks began to accelerate when investors began to price in the possibility the Fed will refrain from hiking rates in 2016. If the odds shift the other way then these investors will be encouraged to book profits by paring positions.

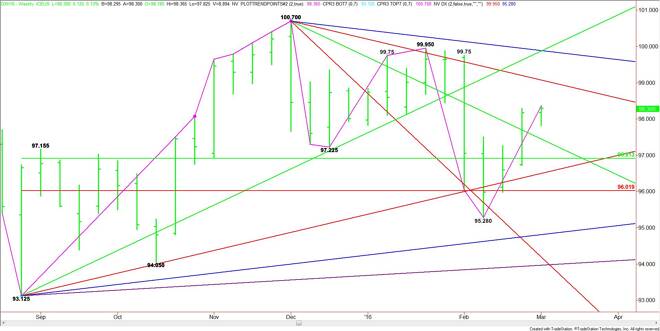

Treasury Bonds and Treasury Notes should also feel downside pressure.

In conclusion, we may see some sideways price action going into Friday’s U.S. Non-Farm Payrolls report. Many of the major players will be on the sidelines ahead of the release of the number. There should be a reaction in several markets so investors should be prepared for increased volatility. A stronger-than-expected number should raise the odds for a rate hike in June.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement