Advertisement

Advertisement

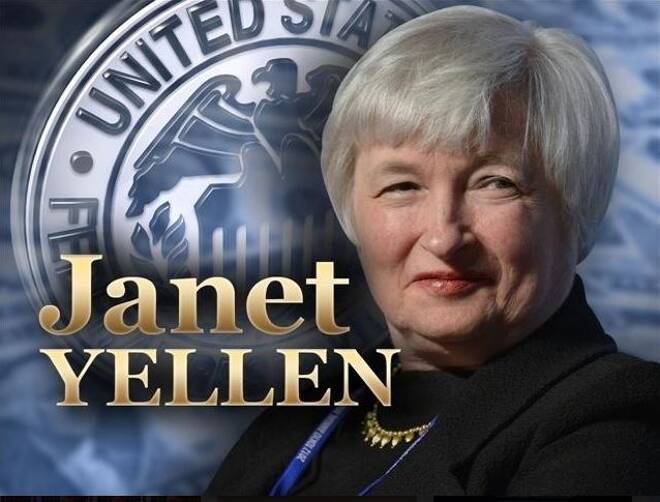

Yellen Comes Out as More Dovish than You Probably Thought

By:

Investors have been focusing primarily on the December 13-14, U.S. Federal Reserve meeting recently because most believe the central bank’s monetary

Investors have been focusing primarily on the December 13-14, U.S. Federal Reserve meeting recently because most believe the central bank’s monetary policy committee will vote to raise interest rates for only the second time in ten years at this meeting. However, the November 1-2, FOMC meeting could prove to be one of the most dramatic and entertaining in recent history. This is because of recent comments from Fed Chair Janet Yellen, which may have created an increasingly contentious climate at the central bank.

There is an old adage that reads, “If you want to bury a story, put it in the late addition of Friday’s newspaper.” Late last week, Yellen did just that when she delivered comments on October 14 that suggests she is interested in running a “high-pressure economy.” In her remarks, she stated the benefits of allowing inflation to run a little higher than the 2.0 percent mandate while allowing the unemployment rate to drop below the point that historically would lead to Fed tightening activity.

U.S. Treasury traders didn’t get the chance to react to the comments on Friday, but for two days at the start of the week, investors mulled over her words and tried to make sense about what she was actually saying. This is known in the business as “digesting” economic data. I’m sure you saw it in the news early last week when Treasury yields abruptly stopped rallying after the strong close on October 14. During the “digesting” process, yields started to retreat, taking the U.S. Dollar with them. In other words, she disrupted a nice trend that had developed while creating uncertainty in the financial and Forex markets.

Based on the price action, her comments were clearly a dovish sign that she favors a longer-term, cautious approach when it comes to raising interest rates.

Her suggestion that the Fed may consider allowing inflation to run a little hotter than normal probably did not sit well with other FOMC voting members. I don’t recall seeing this strategy even mentioned in previous monetary policy statements. And I am sure that this issue will be raised at the November 1-2 monetary policy meeting because she is going to have to explain her case before all the Federal Open Market Committee members, including the three dissenters from the September meeting who were arguing for an immediate rate hike.

Some analysts are saying the Fed is on the brink of a “civil war” with Yellen the cause of most of the developing turmoil. Although there is virtually no chance of a November rate hike, this FOMC meeting could prove to be quite entertaining especially since Yellen introduced an unexpected development that could cause an even deeper division in the ranks.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement