Advertisement

Advertisement

How to reverse a losing MT4 expert advisor into a profitable forex trading system?

Updated: Mar 5, 2019, 16:14 GMT+00:00

Intro

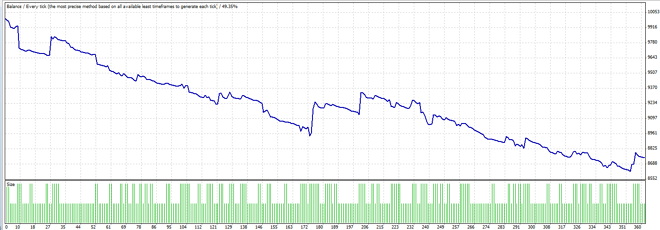

Very often when backtesting forex MT4 EAs, we come across charts that look like this: The concept of reverse trade copy The above is the performance of

Very often when backtesting forex MT4 EAs, we come across charts that look like this:

The concept of reverse trade copy

The above is the performance of the default Moving Average EA found pre-installed on MT4 platforms, very bad isn’t it? What if there was a way to reverse all the trades, to buy when the EA sells, and sell when the EA buys, won’t we then get a profitable mirror image of the above graph?

We put this theory to test and fortunately for the forex markets this can be tested; the same reverse strategy will be difficult to implement on other trade-able assets such as stocks. This attempt to reverse the trades can be achieved using a reverse trade copier software, and we tried this provider. While the software worked like it should reversing all trades almost instantly, we made the following important discoveries:

Requires larger Stop Loss and Take Profit Pip Values

Broker spreads get in the way of the reverse strategy. Because of spreads incurred, the Master EA can have a loss of $10, but the reverse Slave EA will only have a gain of less than $10 due to broker spreads. Conversely, a Master EA can have a gain of $50, but the reverse Slave EA will again lose more than $50 due to broker spreads. So use larger stop loss and take profit values on the Master EA so that the impact of broker spreads are less significant.

In general, the reverse Slave EA wins less and loses more in magnitude, compared to the Master EA’s respective losing and winning magnitudes. The Master EA must therefore have losses much larger than wins for the reverse strategy to be viable.

Backtest results are misleading

When we observed the backtest trades, an EA can have a fixed Take Profit of $50 and Stop Loss of $200 as pre-determined by us. When forward testing however, the EA was not able to follow this rule, often taking profit very early with just a few pips. This was disastrous for reverse trade copying, which leads us to the next point.

Better to program your own EA

If you are just downloading forex trading robots off the internet, you run a huge risk of not knowing the coding and rules behind the strategy. As explained, they do not always trade like they do on backtest.

No way to verify performance

Unlike a traditional EA that we hope to be upward sloping in performance, there is no way to backtest the reverse strategy easily. And if you rely on forward testing, it could take years for any sound conclusions. So a reverse copy trader will likely be trading in the dark, with minimal data for analysis. This usually does not offer traders the confidence to proceed.

Surprising results

On the whole this study did positively surprise us because despite selecting only EAs which performed extremely poorly on backtest, many of these EAs actually made profits during our few months of testing. The negative surprise is that as sound as the reverse trade logic might be, it’s execution is actually challenging unless we are able to code a consistently losing EA.

Our conclusion is that finding a consistent loser for a reverse trade strategy is as challenging as finding a consistent winning EA.

About the Author

Advertisement