Advertisement

Advertisement

Scalping for FX Beginners

By:

Intro

Scalping, as the name suggests, is a trading strategy that takes advantage of a very small fluctuation within a trading pair over a large number of

Scalping, as the name suggests, is a trading strategy that takes advantage of a very small fluctuation within a trading pair over a large number of trading lots. They are mainly interested in executing a higher number of trades as they believe it will reduce the losses on a single trade, and increase their chances of making more profit. Technical breakouts are considered to be a good scalping strategy, however, using fast moving technical indicators on lower time frames (particularly M1, M5 and M15) can result in the desired target return. (say around 10-20 pips). As the target range is small, scalpers depend strictly on smaller stop-loss points. Moreover, due to the expected higher frequency of trades, scalping is conducted on such pairs which are highly liquid and volatile enough (generally the majors).

As the forex market is a 24-hour market, it is important for the forex beginner to identify the best time for scalping. Scalping shouldn’t be practiced during low volatility and low momentum time periods. Hence, the best time is when London and the US markets intersect (13:30:00 GMT to 16:30:00 GMT). Moreover, the first three hours of both these sessions viz. 08:30:00 to 11:30:00 GMT and 13:30:00 to 16:30:00 can also be considered as a good time for scalping. Good scalping setups are usually found 10 minutes prior and 10 minutes after TOTH (Top of The Hour or start of the hour). MTrading want it’s clients to be careful as scalping proves to be harmful during important announcements and holidays (NFP days, Bank holidays, Stress test, 15m prior to and 15m after the strong news data release).

There are various ways of scalping: some traders use price bars and some – range bars as they eliminate noise from the chart. Price bars close after a stipulated period of time while range bars close after completing a defined range. To use the latter you must know the range bar formations and range bar differential for the specified currencies (EURUSD- 3 pip-8 pip bars, GBPUSD 5-10 pip bars etc.). Range bars are mostly used with Bollinger Bands and MACD in order to capture the desired movement. Moreover, Range bars can also be traded as Breakouts. Still, due to its complex nature range bars are quite difficult to understand and, therefore, are unsuitable for beginners.

Forex Scalping System

Now, knowing the basics of scalping and when to scalp, you must understand how scalping is conducted in the forex market. Here are two examples which describe scalping in the forex market.

Example: 1

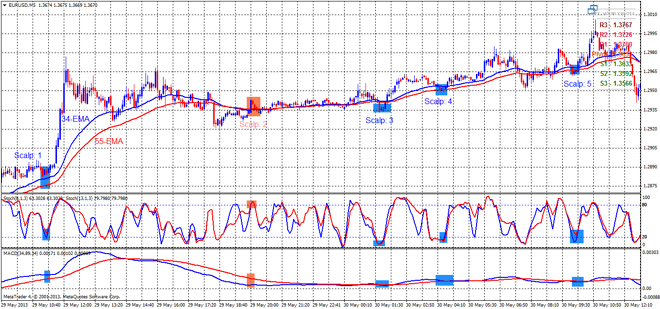

In the M5 chart of EURUSD below on May 29-30, 2013 we used the following technical indicators.

- 34 and 55 period EMA

- Stochastic (8, 1, 3) and Stochastic (13, 1, 3) are being overlaid.

- MACD 2 line( 34, 89, 34)

- Hourly Pivot Point indicator

The entry Rules for Long (and vice versa for Short) include:

- Blue 34 EMA should be above Red 55 EMA

- MACD blue line needs to be above red line

- Stochastic, at least one of them, should be recently oversold at the 20 level and be crossed up

- Hourly PP are more accurate when scalping on lower Time Frames, so daily pivot points need to be used for identifying the Stop-loss and the target points.

We can notice five scalping situations on the M5 chart of EURUSD above. Scalp 2 signifies the sell trade as 55-EMA is above 34-EMA, stochastic indicators are thrusting down from 80 level and MACD red line is above the blue Line. The rest of the scalping signals, namely 1, 3, 4 and 5, are the buying ones wherein the blue MACD line is above the red line, stochastic indicators are reversing from 20 level and 34-EMA is above 55-EMA. The target and stop-loss points should be based on the hourly pivot points as it can give us precise levels for scalping on M5 charts. The hourly pivot points are calculated at the start of every hour based on the previous hourly candle. You can calculate these hourly pivot points on your own or you can also use one of the technical indicators.

Example: 2

This is an example of an “Extreme” scalping system based on M1 Chart on EURUSD. Here we use only these two indicators – Bollinger Bands (21, 2) and RSI (14).

What we are looking for is the price to move above the upper or the lower Bollinger Bands and RSI to rise above the 70 line or below the 30 line at the same time. The target should be the middle line of the Bollinger Band. The stop-Loss can be between 5-7 pips.

In the example above we can see six potential scalps on EURUSD. Scalps 1, 2 and 3 marked in Blue are the long signals generated as the RSI was reversing from the oversold region and the prices were near the lower line of the Bollinger Band. Scalps 1, 2 and 3 marked in Red are the short signals generated on the bases of RSI reversal from the overbought region while the prices were also diving from the upper line of the Bollinger Band.

Concluding Remarks

Scalping, as the article explains it, is a short-term trading strategy with strict stop-loss and target limits. Though scalping is considered to be a dangerous way of trading due to the rapidly changing frequency of trades, it is also the most desirable and profitable one. The trader should be capable enough of using various technical indicators, which can help a lot in capitalizing the sharp movements in the currency pairs. Always remember that the pairs chosen for scalping should necessarily be highly liquid..

Anil Panchal

Market Analyst

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement