Advertisement

Advertisement

So what is a comdoll?

Updated: Mar 5, 2019, 14:40 GMT+00:00

Intro

A comdoll is a nickname for a commodity currency. A commodity currency is a currency that theoretically moves in tandem with changes in commodity prices

A comdoll is a nickname for a commodity currency. A commodity currency is a currency that theoretically moves in tandem with changes in commodity prices such as crude oil, soy beans, coffee, metals or any other commodity that a country would rely on to export.

So why would a country’s economy move in tandem with a commodity price. A perfectly reasonable scenario is that growth in that country relies on the price of the underlying commodity. A perfect example of a comdoll is Canada.

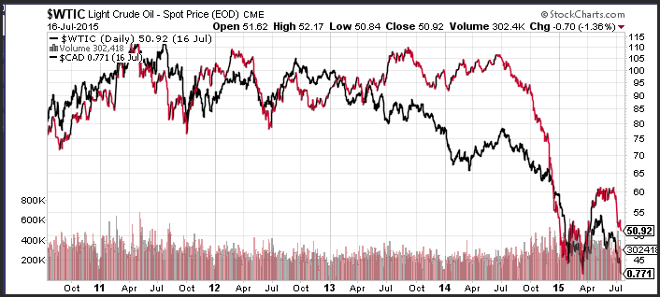

Recently the Bank of Canada reduced its benchmark interest rate by 25 basis points, despite a red hot housing market. The reason is that growth declined and the forecast for inflation dipped significantly. This came in the wake of a large drop in the price of crude oil which has continued to decline to the $50 per barrel on a WTI basis.

With the Bank of Canada reducing interest rates, somewhat because of the decline in the price of oil, the Canadian dollar becomes less attractive. As the price of oil continues to decline the amount of money Canadian oil producers are able to generate declines, and therefore the economic outlook and the strength of their currency also moves lower.

If you observe the price movements of the Canadian dollar and the price of WTI crude oil over the past 5-years you can see that the prices often move in tandem. Of course there will be times when the exchange rate and the commodity diverge, but in general these moves correlate to each other.

The reason this is helpful is that currency traders that focus on technical analysis and fundamentals of comdolls may also use the movements in the commodity space to help them make a decision on the direction of a currency.

If your view, for example, is that oil prices will continue to move lower because of increasing supply with Iran coming back on line, and contracting demand in China, you might then use that information to purchase the USD/CAD with the belief that another rate cut from the Bank of Canada might be in the cards.

Other currencies that have significant exposure to the commodity markets are the Australian dollar. This country exports oil, iron ore, and a wide range of grains. Brazil is one of the largest exporters of soybeans in the world. Mexico, Saudi Arabia and Venezuela rely heavily on the price of oil to run their counties. South Africa is one of the largest precious and base metal producers in the world.

Risk warning: Forward Rate Agreements, Options and CFDs (OTC Trading) are leveraged products that carry a substantial risk of loss up to your invested capital and may not be suitable for everyone. Please ensure that you understand fully the risks involved and do not invest money you cannot afford to lose. Our group of companies through its subsidiaries is licensed by the Cyprus Securities & Exchange Commission (Easy Forex Trading Ltd- CySEC, License Number 079/07), which has been passported in the European Union through the MiFID Directive and in Australia by ASIC (Easy Markets Pty Ltd -AFS license No. 246566).

This article is a guest blog written by easy-forex

About the Author

Advertisement