Advertisement

Advertisement

Trading Market Sentiment

By:

Intro

Market sentiment plays a major role when trading the forex markets. Each and every forex trader has some opinion on what the direction the markets are moving in.

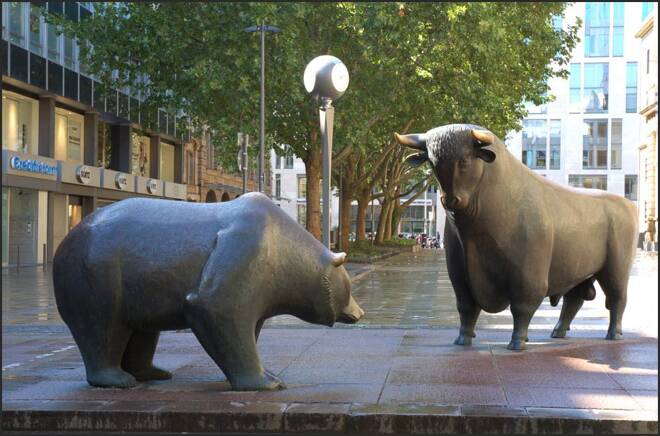

There are traders who believe that the markets will either be bullish or bearish and it’s these sentiments that influence which direction the market is headed in.

On the bearish side, forex traders will stick to the idea that the markets are going to hell in a handbasket, while on the bullish side traders believe things are going to be rosy and the sky is the limit. Again, the sentiment that a trader has is what can influence the market and what makes horse races.

When placing a trade, and utilizing their strategies, forex traders will have an idea or believe on the overall direction of the market. However, regardless of how convinced a trader might be when it comes to the direction that the market is going to take, and how accurate they believe the trend lines are the forex trader can still lose money on their trades.

One of the most important aspect of market sentiment for forex traders is the understanding that the total/overall market is a conglomeration of all participants point of view, opinions and ideas of the direction that the market is headed. That is correct, market sentiment incorporates everyones views on the direction of the market.

To best develop a market sentiment based approach, it is best that the forex trader gauge what/how the market is feeling. To do this, there are numerous indicators to help direct ones ideas of wheather the market is going in a specific direction.

Some of the best technical indicators a forex trader can use are; the moving average (MA), the exponential moving average (EMA), weighted moving average (WMA). The moving average indicator is deemed one of the strongest and most powerful indicators used today by forex traders.

The best explanation of a simple moving average is an indicator which invariably helps the forex trader to determine overall market sentiment. The simple moving average provides a forex trader with a comparative view of the most recent market closings over a specific period of time.

The simple moving average gives the forex trader a directional guide of the market. The exponential moving average is deemed a heavier weighting average than that of the simple moving average and is usually used on values which are more up to date. The weighted moving average closely resembles that of the simple moving average; however the weighted moving average helps to smooth price curve for more established trend identification.

How can you trade market sentiment? A forex trader needs to keep a close eye on the overall direction of the markets as well as use indicators to be successful in trading market sentiment. Again, by using specific indicators a forex trader can make a pretty penny by studying the markets and using technical indicators to drive their trades.

In closing, market sentiment distinguishes which direction investors/traders believe the overall market is headed. In conjunction with technical indicators forex traders can leverage these tools to uncover opportunities while making money.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement