Advertisement

Advertisement

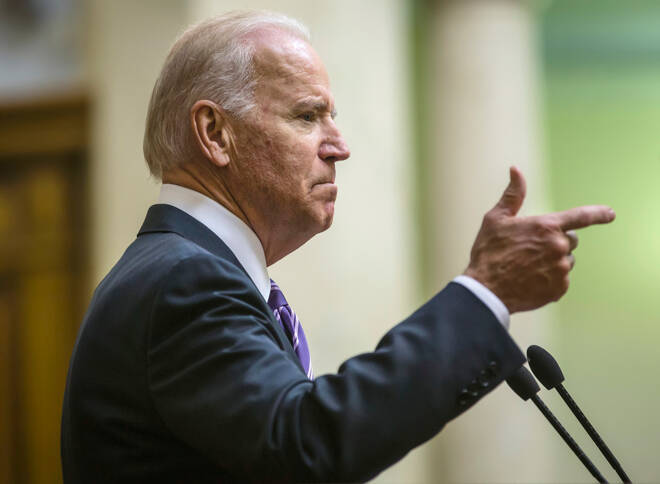

Biden’s Future Depends On Reducing Oil (And Gas) Prices Fast

By:

The chances of the US Democratic Party at the mid-term elections in November and of re-election for a Democrat president in 2024 hinge on Biden's administration significantly lowering oil prices and the US Energy Secretary announced it is taking steps to dramatically increase domestic supplies

Key Highlights

- US Energy Secretary states that US oil producers will ramp up production in 2022

- This is in line with the necessity for President Biden to lower oil prices dramatically

- The negative economic and political repercussions for him of this are huge

US Energy Secretary Jennifer Granholm stated clearly yesterday that the government of President Joe Biden is confident that US oil and gas producers have already started taking steps that should result in a “significant increase” in domestic energy supply by the end of the year. Despite the rhetoric of moving towards a greener energy matrix that marked his early presidency, Biden has now come to grips with the cold hard fact that high oil and gas prices damage the US (and all other industrialised countries that are not self-sufficient in energy supplies) economically and are catastrophic for the re-election chances of presidents and their parties.

Specifically, in terms of the US economy, a broad rule of thumb has long been that every US$10 per barrel change in the price of crude oil results in a 25-30 cent change in the price of a gallon of gasoline. The corollary longstanding precedent is that for every one cent that the U.S.’s average price of gasoline increases, more than US$1 billion per year in discretionary additional consumer spending is lost. Similarly, for the Eurozone, the broad rule is that every 10 percent rise in the oil price in Euro terms increases the Zone’s inflation by 0.1 to 0.2 percentage points, with corollary negative spending and growth effects.

High Oil Prices Are Catastrophic For Democrats’ Re-election Chances

Worse though for Biden is that these economic effects directly feed through into the chance of him – or whomever is elected by the Democratic Party to replace him – being re-elected. It is a matter of historical fact, as evidenced by cross-referencing the business cycles and recessions’ data of the US’s National Bureau of Economic Research with the US Presidential election results, that since World War I, the sitting US president has won re-election 11 times out of 11 if the US economy was not in recession within two years of an upcoming election.

However, presidents who went into a re-election campaign with the economy in recession won only once out of seven times (Calvin Coolidge in 1924, although strictly speaking he had not won the previous election but rather had taken up the position on the death in office of Warren G Harding). President Biden – or whomever the Democratic candidate may be – will face another presidential election in 2024, but even before that he faces critical mid-term elections in November 2022, when his Democrats could lose their narrow majority in the House of Representatives.

US Targeting 3 Million Barrels Per Day Of New Oil Supply

It is little wonder then that despite an earlier consensus among many oil analysts that Biden would not, and could not, put pressure on US oil producers to ramp up production, he is doing precisely that. Indeed, according to Granholm the US is working to identify at least 3 million barrels per day (bpd) of new global oil supply, with assurances from several high-level oil and gas executives that their companies are set to dramatically increase investments, and bring online new rigs. According to the US’s Energy Information Administration, the US’s oil supply was estimated at 11.7 million bpd in March.

About the Author

Simon Watkinsauthor

Simon Watkins is a former senior FX trader and salesman, financial journalist, and best-selling author. He was Head of Forex Institutional Sales and Trading for Credit Lyonnais, and later Director of Forex at Bank of Montreal. He was then Head of Weekly Publications and Chief Writer for Business Monitor International, Head of Fuel Oil Products for Platts, and Global Managing Editor of Research for Renaissance Capital in Moscow.

Advertisement