Advertisement

Advertisement

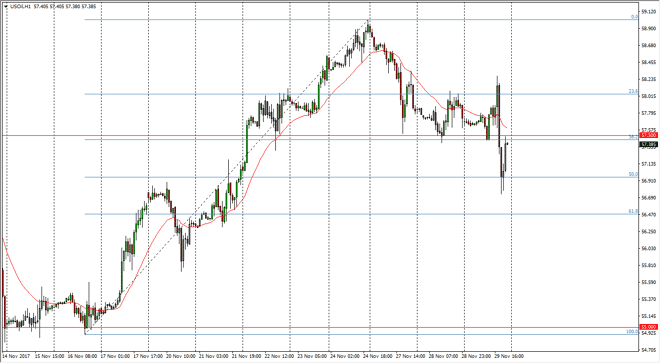

Crude Oil Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:05 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went sideways initially during the trading session on Wednesday, originally rallying after the better than expected

WTI Crude Oil

The WTI Crude Oil market went sideways initially during the trading session on Wednesday, originally rallying after the better than expected inventory draw headline number from the Crude Oil Inventories announcement is in the United States. However, distillate numbers were less than great. Beyond that, a lot of that draw from the inventory had to do with Thanksgiving, so the knee-jerk reaction was turned around almost immediately and we sliced through the $57.50 level. Pay very close attention to that level, because if it starts to sell the market off again, that’s a head and shoulders the just triggered on the hourly chart, which could send this market as low as $56. There are a lot of concerns about OPEC being able to do a production cut again, so I think the sentiment is starting to roll over again.

Crude Oil Price Forecast Video 30.11.17

Brent

Brent markets continue to be very noisy as well, reaching towards the $64 level during the day but also rolling over. We have bounced since then, but we have made a lower low yet again. I think at this point the market is very likely to struggle, at the first signs of exhaustion or a roll over, I am more than willing to start selling this market as it should go down to the $62 level without too many issues. If we were to break above the $64 handle, I think there is even more resistance at the $65 level beyond that. This could be a very noisy affair, as the trading action has been rather sloppy, but I think that the sellers are certainly starting to flex their muscles. Longer-term, I would not be surprised to see the market reaches low as $60 given enough time as well.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement