Advertisement

Advertisement

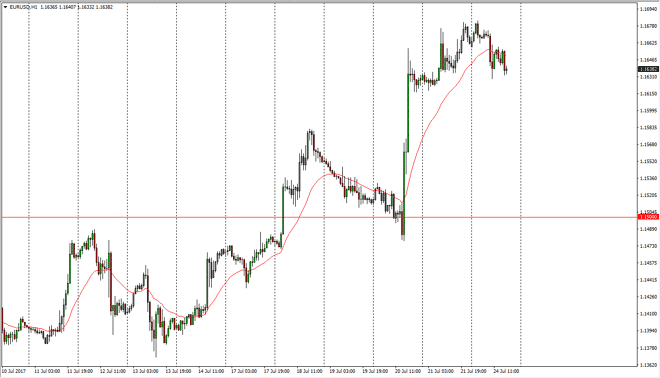

EUR/USD Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:16 GMT+00:00

The EUR/USD pair went sideways during the session on Monday, and broke down towards the 1.1625 handle underneath. The market finding support underneath is

The EUR/USD pair went sideways during the session on Monday, and broke down towards the 1.1625 handle underneath. The market finding support underneath is not much of a surprise, because it had been resistive. I believe that the buyers are going to jump back into this market, and then eventually push the EUR/USD pair much higher. I think that the 1.17 level is in the sights of traders, and I think that every time we pull back people look at it as value in the currency. I also recognize that we are perhaps a bit overbought currently, so don’t be surprised to see pullbacks. Those pullbacks are buying opportunities and I have no interest in selling as it is becoming clearer that perhaps the Federal Reserve is a bit less sure than it was previously about the rate of its interest rate hikes.

Buying dips

I believe in buying dips, and I believe that the 1.15 level will now act as massive support. Because of this, this is a “one-way trade” if I’ve ever seen one, but I also recognize that it is going to be volatile due to the Brexit negotiations. The US dollar is on its back foot around the world, and the EUR is one of the first places money goes to when that happens. It also looks as if the European Central Bank may be looking to step away from some of its quantitative easing, and that of course is bullish for the currency as well. The next major resistance barrier that I see on the longer-term charts is closer to the 1.1850 level, so I think we have quite a way to go to the upside as the recent breakout cleared 2 ½ years of consolidation.

EUR USD Forecast Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement