Advertisement

Advertisement

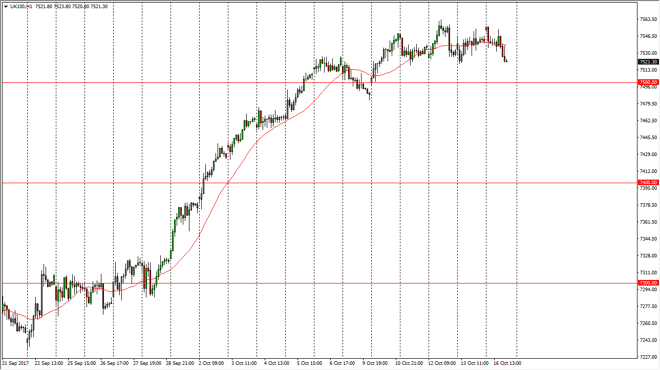

FTSE 100 Index Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:06 GMT+00:00

The FTSE 100 gapped higher at the open on Monday, but then rolled over to fall towards the 7520 level. I think that the market has plenty of support just

The FTSE 100 gapped higher at the open on Monday, but then rolled over to fall towards the 7520 level. I think that the market has plenty of support just below, especially near the 7500 level, but where we are right now has been supportive as well. Because of this, I’m looking for some type of bounce or supportive candle that I can start buying. After all, a break above the 7500 level was a very bullish sign, as we overcame a large, round, psychologically significant number. I think now that we’ve cleared this area, we can probably go to the 7750 level over the longer term. Ultimately, I think that we go even higher than that, but these pullbacks continue to offer value the people can take advantage of. I have no interest in shorting this market, least not until we get below the 7480 handle. If we did, then I think we would probably drop towards the 7400 level, but clearing the 7500 level is a sign that we should continue to go higher.

Continued volatility

I believe that we continue to see a lot of volatility in this pair, so adding to your position slowly is probably the best way to trade it, as that way you can protect your account. The 24-hour exponential moving average is starting to turn lower, but I think that the large, round, psychologically significant barriers underneath should continue to keep the market afloat. I think that there is a certain amount of resistance at every 100 point level, but ultimately that is psychological resistance at best. Clearly, we have a lot of momentum to the upside, so I think that the overall uptrend should continue to come into play when it comes to the British index.

FTSE 100 Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement