Advertisement

Advertisement

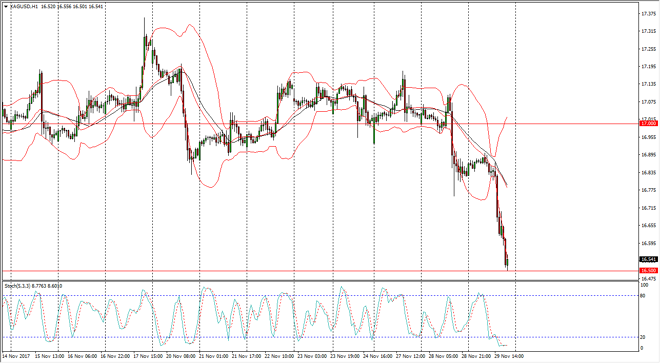

Silver Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:05 GMT+00:00

Silver markets fell significantly during the trading session on Wednesday, slicing down to the $16.50 level, which was an area that I had anticipated

Silver markets fell significantly during the trading session on Wednesday, slicing down to the $16.50 level, which was an area that I had anticipated previously could be support. The question now is whether the $16.50 level can offer enough support to keep the market afloat. We are in the oversold region of the stochastic oscillator and crossing, but also we are at the oversold region of the Bollinger Bands. Because of this, it’s likely that the market will continue to find some interest in this area, and if we can get a rally, it’s likely that we may go towards the $16.75 level. In general, I think that this is going to come down to the US dollar in its reaction to any congressional bills passed as far as tax reform is concerned. Quite frankly, if we do get meaningful tax legislation, that should be good for the US dollar, least in the short term.

Obviously, the exact opposite would produce the exact opposite movement in the market, but we also have to concern ourselves with geopolitical issues. After all, North Korea just launched another missile so I think it’s probably only a matter of time before something like that flares up again and that could be bullish for silver. Attention to gold, it tends to lead the way for silver as silver is considered to be the “little brother” to the market, and the 2 markets typically moving the same direction. In general, I believe that there is a chance that we get a bit of buying pressure here, but if we were to break down below the $16.40 level, I think then the market will go looking towards the $16 handle below which is even more supportive based upon historical action.

SILVER Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement