Advertisement

Advertisement

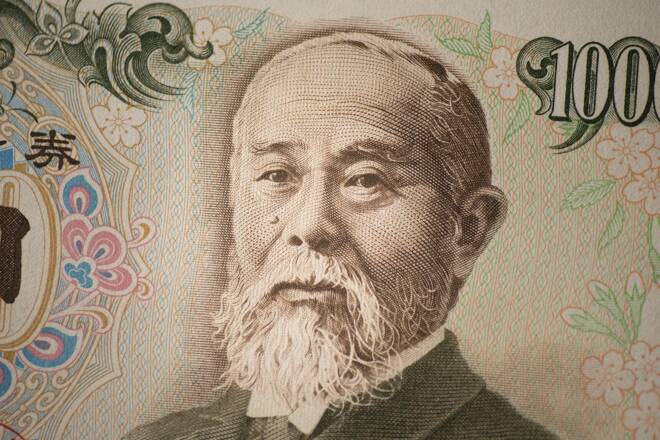

USD/JPY Weekly Price Forecast – US Dollar Continues to React to Bank of Japan

Published: Sep 23, 2022, 15:10 GMT+00:00

The US dollar had recently been very bullish against the Japanese yen, but the last couple of weeks has been a little rocky.

US Dollar vs Japanese Yen Weekly Technical Analysis

The US dollar has been all over the place this past week against the Japanese in, but that should not be a huge surprise considering that the Bank of Japan decided to come in and intervene in the markets. After all, the Japanese yen was getting crushed in ways that we hadn’t seen in a long time, and I do believe that was something they had to do in order to combat inflation. After all, they are trying to keep interest rates down at the same time, which is the same thing as printing unlimited currency. They have to buy unlimited bonds, which does nothing good for the currency itself.

On the other hand, you have the Federal Reserve in the United States raising rates aggressively and doing everything they can to keep the markets in line. We are in the midst of breaking one of the biggest speculative bubbles of all time, and this is what it looks like. That being said, I do think that the upside is probably quite a bit more limited than it once was, but it is also worth noting that most of the time that central banks do these type of things, they end up failing.

The best that they can hope for most of the time is to slow down the type of move that we have seen. So far, they have accomplished that, so it does make quite a sense that they would be happy with how things have turned out in the short term. Whether or not they can keep it up as a completely different question, but we are stretched at the very least.

USD/JPY Price Forecast Video 26.09.22

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement