Advertisement

Advertisement

WCU: Tight supply commodities reign

By:

Commodity investors are watching supply as the growth narrative remains uncertain.

With the jury still out on the direction of global growth, and with that the future demand outlook for commodities, investors have instead been taking their cue from the outlook for supply across the different sectors. Due to voluntary and not least involuntary production cuts, crude oil been the star of this show so far while ample supplies have kept several key agriculture markets under pressure.

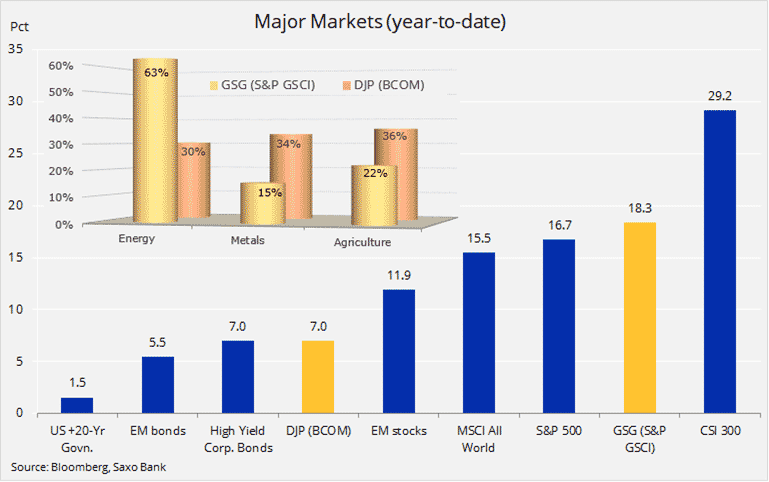

The table below shows the year-to-date performance across different asset classes. The continued rally in global stocks and riskier assets such as corporate bonds together with renewed strength of the dollar has (for now) once again reduced the appeal of gold despite an increasingly dovish shift from global central banks.

Investors seeking general exposure to commodities have so far witnessed very different returns depending on which vehicle they have chosen. Commodity index funds are easily accessed through exchange-traded funds or notes and for comparison, we have highlighted two of the most popular below.

The more than 11% difference between the Bloomberg Commodity Index (ETN ticker DJP) and the S&P GSCI (ETF ticker GSG) is due to a difference in composition between the two. In this respect, the broad, evenly cross-sector BCOM has come up short against the heavily energy-focused SPGSCI.

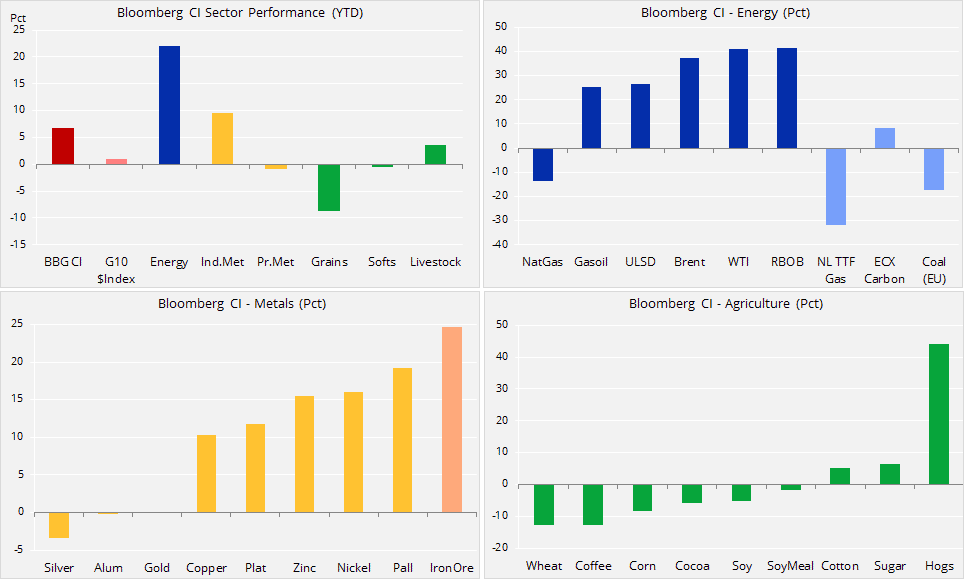

Digging deeper, we can see how the tight supply story has played out across the different sectors. While it remains down 6% year-on-year, the politically motivated tightness in crude oil through Opec+ production cuts and US sanctions against Iran and Venezuela have taken both WTI and Brent higher by close to 40% so far this year.

In the metals space, palladium has rallied strongly as the market is expected to remain in a deficit in 2019 on increasing usage in autocatalysts and other industrial applications. Platinum has started to enjoy the tailwind provided by its deep discount to palladium and worries about South African labour disputes.

Over the past few weeks, the spread between the two has narrowed from a record $740 to the current $530. Iron ore has been supported by the Brazil dam disaster and subsequent removal of production.

The agriculture sector led by grains remains troubled by ample supply, a stronger dollar and no sign of challenging spring weather developments that could impact current stock and future production levels. Speculative positioning across the key crops has reached a record short and this may limit the extent of further fund selling.

The meat sector stands out with a dramatic pick-up in demand for pork from China having sent the price, and with that the speculative interest, sharply higher. A dramatic drop in the Chinese pork herd due to African swine fever is likely to keep the US price supported over the coming months as export demand picks up. Should a US-China trade deal be reached, the long-awaited rally in soybeans might consequently fail to materialize with millions of fever animals to feed in China reducing demand for feed such as soybean meal.

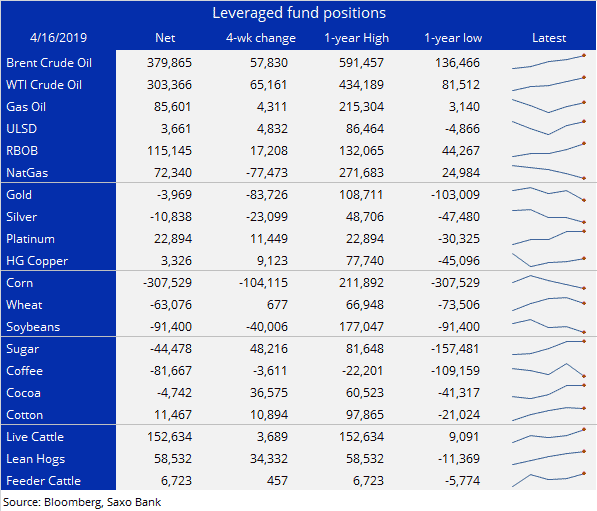

The table below shows hedge funds’ positioning across key commodity futures measured in number of contacts (one contract equals 1,000 barrels of oil, 100 ounces of gold and 5,000 bushels of corn, for example). The performance divergence is clear to see with elevated longs in crude oil, platinum and meats while big short positions have emerged across several agriculture commodities.

Gold and silver have been bouncing between long and short with the current short positions emerging on the back of reduced demand given the continued surge in stocks and recent dollar strength.

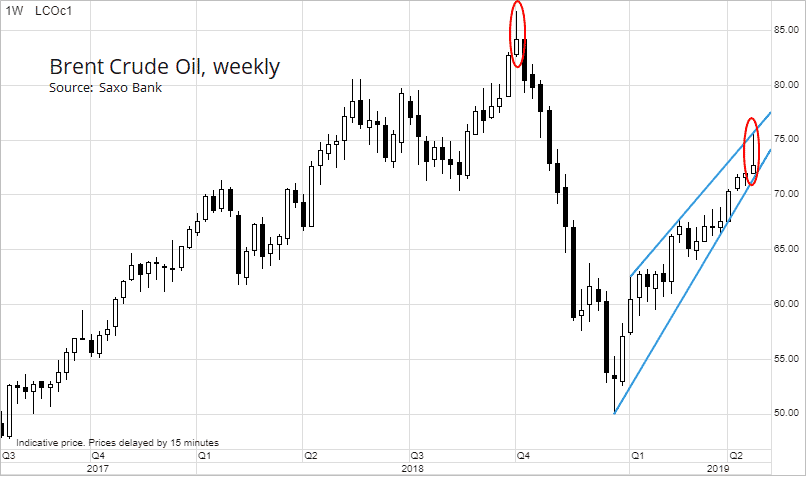

Crude oil was on the defensive towards the end of the week but was still heading for its fifth consecutive weekly gain. Ongoing supply cuts from Opec, supported by Russia, have provided the fundamental support for crude oil since December and traders have found very few reasons for going against the trend. The latest move higher was triggered the US’ announcement that waivers granted to eight buyers of Iranian crude last November would not be extended beyond May 4. By doing so, Washington seeks a complete removal of Iranian barrels from the global market.

Expectations that Saudi Arabia and others would promptly make up the shortfall to avoid a major spike were somewhat dented when the Saudis, wrong-footed by the waivers last November, adopted a wait-and-see approach. However, with the International Energy Agency, the Energy Information Administration and Opec all seeing the market well-supplied at this stage, the market has once again surged higher on expectations of what may happen over the coming months, just as it did last October.

A bullish outcome is by far the most likely outcome. But until fundamentals on the ground begin to support current and potentially even higher prices, the market has also been left exposed to technical setbacks.

Emerging doubts amid resistance from several key buyers of Iranian oil (most noticeably China) and a bearish weekly US stock report helped trigger some end-of-week profit-taking. The weekly bar pointing towards some additional technical weakness with support at $72/barrel followed by $70/b coming back into focus.

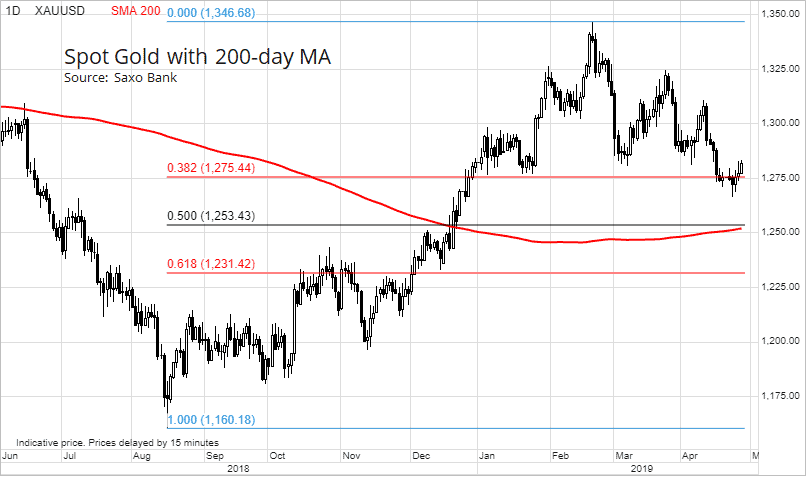

Gold retraced all its gains for the year as it struggled amid fading safe-haven and diversification demand from investors who are instead focusing on rising stocks and a stronger dollar. These developments have seen the price challenge support at $1,275/oz and forced speculators such as hedge funds to revert to a net-short position.

The yellow metal has nevertheless managed to put up a fight against multiple headwinds, most notably stocks. Equities led by the Nasdaq index have hit a fresh record and the dollar has also reached a fresh high for the year against a broad basket of currencies and a 10-month high against the euro.

Against these developments, we are seeing gold finding some underlying support from the actions currently seen at central banks across the world. Apart from turning increasingly dovish with the focus on stimulus instead of tightening, they also bought gold last year at the fastest pace since 1971.

This buying spree look set to continue with Russia, China and Turkey seeking to de-dollarise their reserves have been joined by central banks from India to Kazakhstan and Hungary according to a report from the World Gold Council.

The short-term direction for gold will be determined by whether it manages to put up a successful fight against recent short-sellers looking for a downward extension towards $1,250/oz. Failure to break lower this week has left the market exposed to short-covering. A stronger recovery, however, is unlikely without the support from lower stocks and not least the dollar.

We maintain a gold-supportive, bearish outlook for the dollar but at this stage do not expect such a move to unfold before sometime during the second half of the year.

This article is provided by Saxo Capital Markets (Australia) Pty. Ltd, part of Saxo Bank Group through RSS feeds on FX Empire.

About the Author

Ole Hansencontributor

Ole Hansen joined Saxo Bank in 2008 and has been Head of Commodity Strategy since 2010.

Advertisement