Advertisement

Advertisement

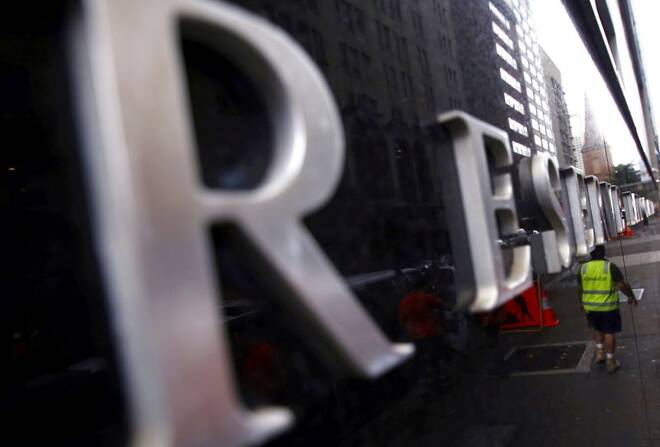

Australia’s central bank sees potential in wholesale digital currency

By:

SYDNEY (Reuters) - Australia's central bank on Wednesday said it saw promise in establishing a wholesale digital currency that would make syndicated lending more efficient and less risky.

SYDNEY (Reuters) – Australia’s central bank on Wednesday said it saw promise in establishing a wholesale digital currency that would make syndicated lending more efficient and less risky.

The report comes as the Australian government is set to overhaul its regulatory framework for payment systems for the first time in over 20 years.

Concluding a year-long study, the Reserve Bank of Australia (RBA) said a tokenised form of central bank digital currency (CBDC) could be used by the wholesale market for the funding, settlement and repayment of a tokenised syndicated loan on an Ethereum-based distributed ledger technology (DLT) platform.

The project showed the platform could provide efficiency gains and reduce operational risk by replacing highly manual and paper-based processes.

An enterprise-grade DLT platform with appropriate controls on access and security could address many of the potential requirements for a wholesale CBDC system and tokenised assets platform, the RBA said.

The research project, which looked only at wholesale use of a digital currency, was run in conjunction with Commonwealth Bank of Australia, National Australia Bank, Perpetual and ConsenSys, with input from King & Wood Mallesons.

(Reporting by Wayne Cole; editing by Richard Pullin)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement