Advertisement

Advertisement

Confronting the inflation beast: Five questions for the ECB

By:

By Dhara Ranasinghe, Tommy Wilkes and Saikat Chatterjee

By Dhara Ranasinghe, Tommy Wilkes and Saikat Chatterjee

LONDON (Reuters) – The European Central Bank looks all but certain to announce on Thursday that its years of bond-buying stimulus are over and that high inflation means interest rate rises are imminent.

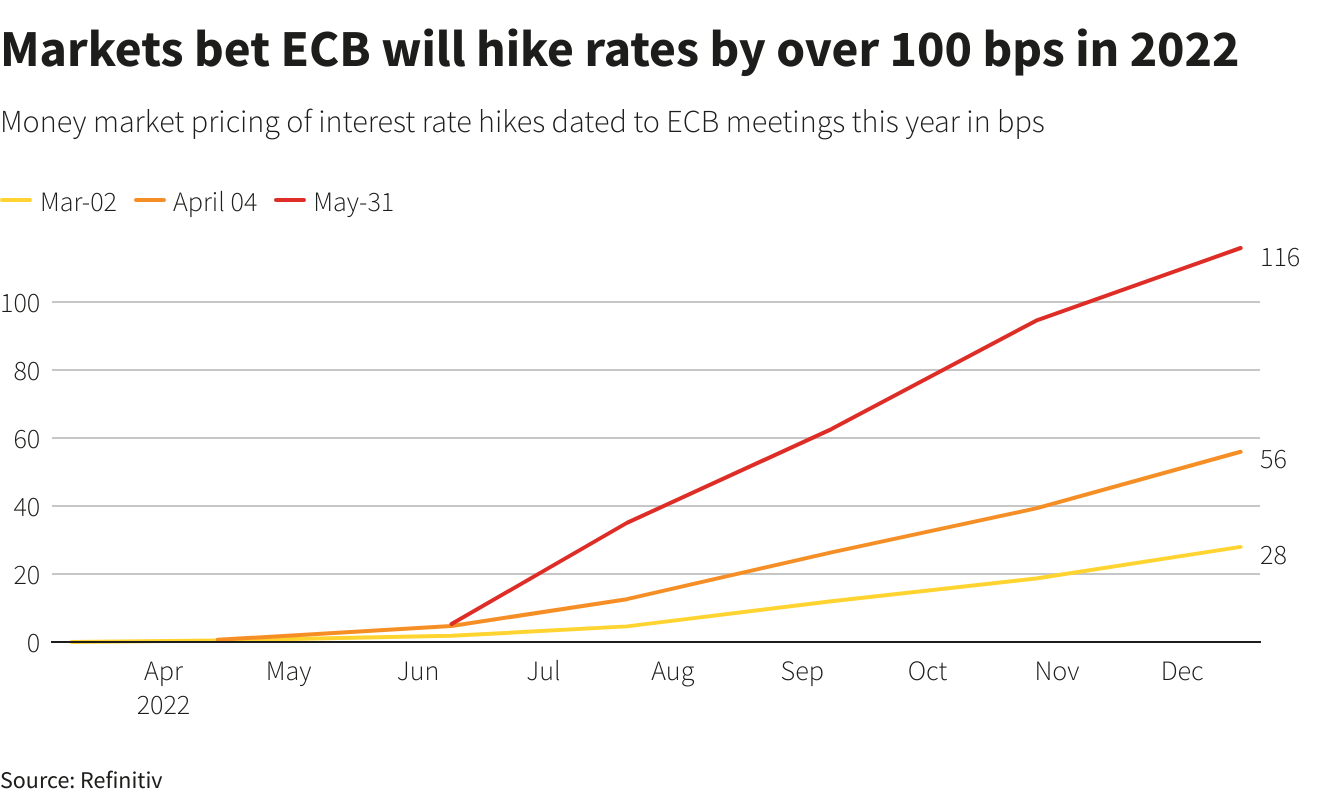

Markets want more clarity on what comes next, and whether policy tightening might be accelerated to get ahead of soaring prices.

“This could be the ‘whatever it takes’ moment for (ECB chief Christine) Lagarde as there are some doubts as to whether the ECB really could hike aggressively,” said LBBW chief economist Moritz Kraemer.

Here are five key questions for markets.

1/ What will the ECB do on Thursday?

The ECB will almost certainly announce that its bond purchases will end mid-year, paving the way for a rate increase in July that would be its first hike since 2011.

Lagarde has said the -0.50% deposit rate should be at zero or “slightly above” by end-September, implying a rise of at least 50 basis points (bps) from current levels.

Policymakers are also likely to restate their commitment to continue reinvesting proceeds from maturing bonds back into the market, helping support the euro zone’s weaker economies.

2/ Is a big July rate hike possible?

Economists and markets anticipate a 25 bps rate rise in July but speculation about a bigger move has increased and was further fuelled by euro zone inflation hitting record highs in May.

The Dutch, Austrian, Latvian and Slovak central bank governors say a 50 bps hike should be an option.

Remarks from Lagarde before the latest inflation numbers pointed to a 25 bps rise but also left the door open to bigger moves in coming months.

With euro area inflation accelerating to 8.1% in May, four times the ECB’s 2% target, Lagarde will be pressed on the scope for a large rate hike.

3/ What’s so important about the neutral rate?

Well, Lagarde has flagged further rate hikes towards the neutral level, or even above it, so a sense of where the ECB sees neutral would point towards how far it sees rates rising.

The neutral rate is an unobservable rate that brings economic output into line with its potential and is neither stimulative nor restrictive.

It’s estimated to be between 1% and 2%, suggesting that the ECB could raise rates well into 2023. The ECB’s Fabio Panetta believes policy normalisation should not aim to get rates back to neutral.

4/ What does weakening economic growth mean for rate hikes?

The ECB faces a narrowing window of opportunity to normalise rates before growth slows and it could end up forced to choose between fighting inflation and propping up growth, although ultimately its mandate is price stability.

High inflation which is squeezing consumption, the war in Ukraine and China’s COVID-19 lockdowns are hurting the global economy. The latest ECB forecasts on Thursday could see sharp downward revisions to growth and inflation estimates revised up.

According to a recent Reuters poll, economists attach a median 30% probability of a recession in the next year.

ECB Chief Economist Philip Lane cautions that any rate moves beyond September will depend on how inflation develops and the impact of the Ukraine war.

5/ Is the ECB worried about a weak euro?

Recent commentary suggests the currency is back on the ECB worry list. An overly weak euro could threaten efforts to steer inflation towards its target, ECB policymaker Francois Villeroy de Galhau said in May.

But publicly, the ECB is likely to stick to the line that it monitors but does not target exchange rates.

The euro is down 6% against the dollar this year, although the drop has been driven by Federal Reserve tightening that has boosted the dollar. On a trade-weighted basis, the euro is down a more modest 1.6%.

(Reporting by Dhara Ranasinghe, Tommy Wilkes and Saikat Chatterjee; Editing by Catherine Evans)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement