Advertisement

Advertisement

Cryptoverse-Elon Musk frees the bird and the dog coin flies

By:

By Vidya Ranganathan SINGAPORE (Reuters) - It's no joke. Elon Musk's acquisition of Twitter has put fresh wind in the sails of dogecoin, the meme cryptocurrency he catapulted to fame.

By Vidya Ranganathan

SINGAPORE (Reuters) – It’s no joke. Elon Musk’s acquisition of Twitter has put fresh wind in the sails of dogecoin, the meme cryptocurrency he catapulted to fame.

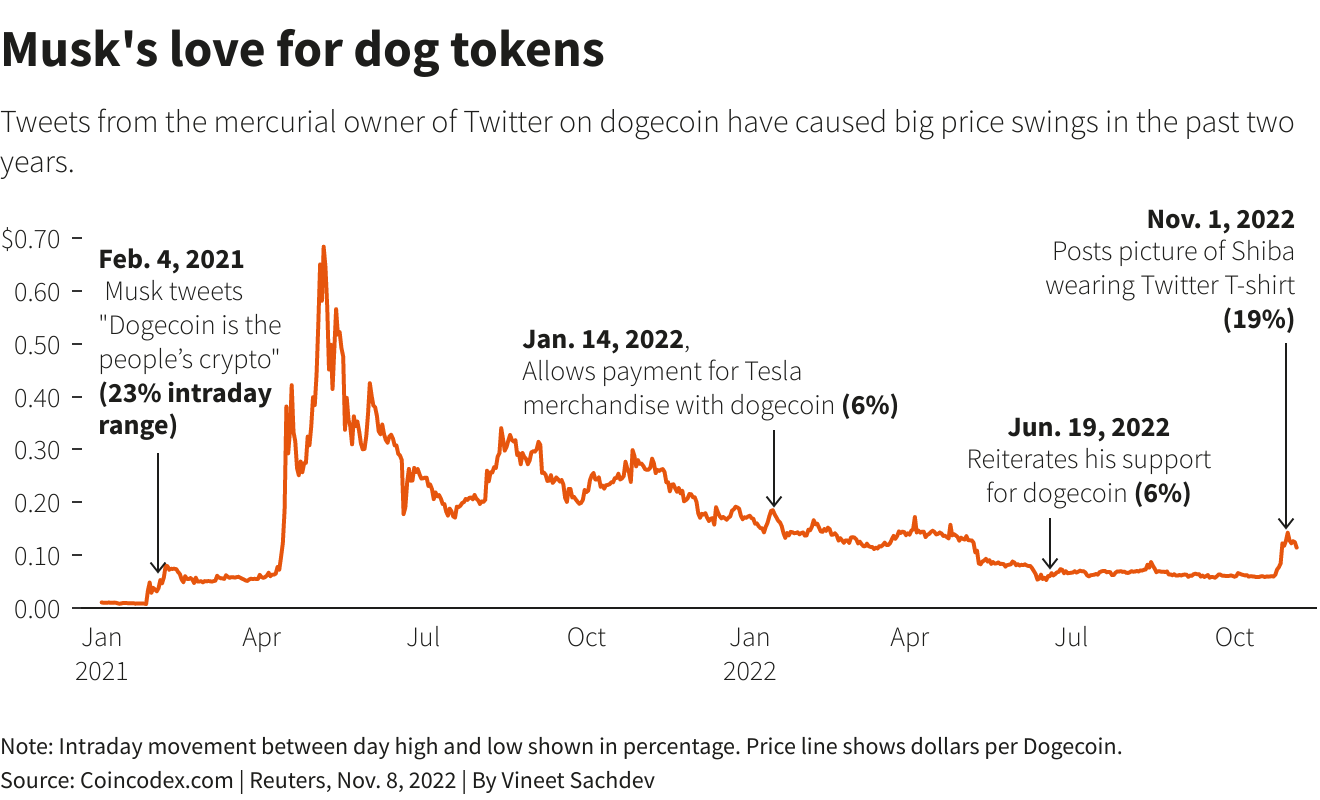

Dogecoin’s price doubled after the Tesla tycoon completed the $44 billion deal. It was trading at about $0.07 on Oct. 27 before Musk tweeted “the bird is freed” to announce his ownership. Five days later, it was at $0.16.

That may not sound like much, but it gave the highly volatile cryptocurrency a market value of $21 billion, according to data platform CoinGecko.

Not bad for a coin that was created as a “joke” satirizing wild speculation in the crypto market and named after an internet meme of a Shiba Inu dog.

“Trading dogecoin around Elon tweets has become a lucrative form of speculation,” said Matthew Dibb, chief operating officer of Singapore-based crypto investment manager Stack Funds.

Musk has indeed played a big role in the rise of dogecoin since its lighthearted launch by two software engineers in 2013. His tweets expressing support for the coin, including one calling it the “people’s crypto”, helped its price come from almost nowhere to surge about 4,000% in 2021.

Crypto watchers said the latest price jump, following the Twitter deal, was fuelled by investor bets that Musk would make doge a part of the platform’s payments system.

“There’s a lot of speculation that Twitter will provide a test bed for doge adoption and experimentation for different uses,” Dibb added.

Doge and shib

Dogecoin has since lost some of its gains and is hovering at about $0.12, which makes it the eight-biggest cryptocurrency, with a market cap of around $16 billion, according to CoinGecko.

The so-called meme coin hit a peak of $0.63 in May last year, but macro gloom and investor apathy to risky markets have since crushed it along with other prominent crypto assets such as bitcoin and ether. Even after the latest rally, doge is down 57% in the past 12 months.

Nonetheless, crypto market news website Coindesk said the doubling of its price had made doge the top performer among 150 digital assets in its CoinDesk Market Index in October.

Its share of the $1 trillion global crypto market cap through the year until the end of October was 1%, a fraction of bitcoin’s 39%, according to CoinMarketCap. Now it’s at 1.58%.

Doge has lifted other dog-themed coins in its wake, chiefly Shiba Inu, which has the same motif of the Japanese canine breed as doge and is designed to be compatible on the Ethereum blockchain. Shib, which trades at just $0.00001, jumped by a third in the days after Musk closed the Twitter deal.

Unlike bitcoin, both doge and shib have near unlimited supplies, meaning it would take more than mere speculative hoarding to drive their prices up.

At mercy of musk?

Bets that Musk may allow crypto payments with dog tokens were kindled by his tweet last week of a picture of the Shiba Inu dog wearing a Twitter T-shirt.

Yet the early rally has stalled, with many crypto investors stumped about how serious he really is about dogecoin.

Musk, the world’s richest person, called dogecoin a “hustle” on a talkshow in May last year, for instance, sending the price tumbling.

Then in January this year, Tesla started accepting dogecoin as payment for its merchandise, such as the “Giga Texas” belt buckles and mini models of electric vehicles.

Musk’s newly launched perfume “Burnt Hair” can also be bought with doge.

(Reporting by Vidya Ranganathan; Editing by Pravin Char)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Latest news and analysis

Advertisement