Advertisement

Advertisement

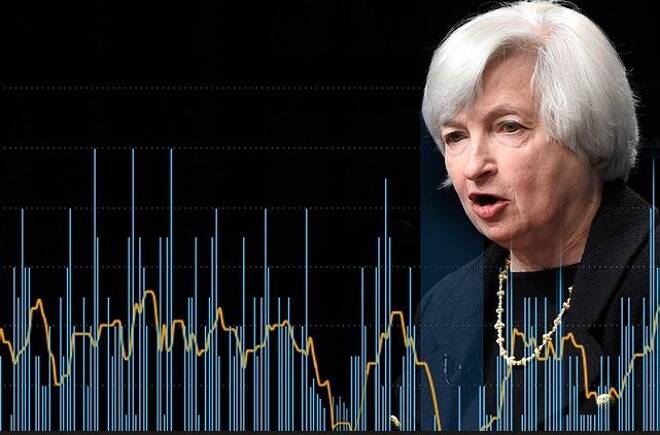

Stocks, Dollar Mixed as Yellen Drops Strong Hint at Rate Hike

By:

Late Friday, Fed Chair Janet Yellen surprised no one when she dropped a strong hint that the central bank was prepared to raise its benchmark interest

Late Friday, Fed Chair Janet Yellen surprised no one when she dropped a strong hint that the central bank was prepared to raise its benchmark interest rate later this month. Yellen said that economic improvements as of late will be the highlights of the next Federal Open Market Committee meeting on March 14-15.

“We currently judge that it will be appropriate to gradually increase the federal funds if the economic data continue to come in about as we expect,” Yellen said at a speech in Chicago, according to prepared remarks.

“Indeed, at our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate,” she added.

U.S. Equity Markets

U.S. stock traders held the major indexes rangebound as they digested the comments from Fed Chair Yellen. With Yellen basically greenlighting a March rate hike, the odds of a Fed rate shot to 81 percent. Earlier in week, the chances of a Fed rate hike on March 15 was about 30 percent.

What could shock stock traders is that the Fed jumped from hinting that there were too many concerns to raise rates in March just last week to basically saying this week that a rate hike was good to go. Stock traders have been used to hearing the Fed say they are taking a wait-and-see approach before hinting that a hike was coming. This time they just moved on it almost without warning. This could make investors nervous.

With this rate hike seemingly coming without warning, investors are worried the Fed may raise rates the three times they forecast at the December 2016 meeting. The stock market should be able to absorb at least one rate hike with incident. Two increases will take some getting used to, but not enough to derail the rally. However, three rate hikes in less than a calendar year could be a negative for stocks.

U.S. Dollar

The dollar gave back earlier gains after Yellen strongly hinted that an interest rate is likely later this month. This may mean the news was priced into the dollar, or a “buy the rumor, sell the fact” situation. Traders also said weaker stocks and diminished concerns over the presidential elections in France and far-right candidate Marine Le Pen’s chances of winning, helped underpin the Euro which limited the dollar’s gains.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement