- Coins Available14Accepted Countries195Payment Methods1

HTXReview

Our Verdict

Founded in 2013, HTX is a global cryptocurrency exchange based in the Seychelles and available in over 180 countries. It offers 700+ cryptocurrencies, comparatively low trading fees, and a range of trading tools, from staking and copy trading to API integration, to meet the demands of both beginners and experienced traders.

HTX has two versions: a desktop browser mode and a mobile app. The desktop version is suitable for active traders as it provides many tools, including social trading and automated bot creation. The mobile app features a more beginner-friendly interface for trading on the go. Additionally, HTX’s comparatively low trading fees make it an excellent choice for day traders.

HTX Pros and Cons

| Pros | Cons |

|

|

Is HTX Right for You?

Not all traders are the same. Some seek easy apps for trading on the go, while others look for advanced features like leverage or social trading. When reviewing exchanges, we cater to all types of traders, from beginners to advanced. We divided all traders into seven main target groups.

Our thorough yet straightforward method ensures a clear understanding of trading strategies and their requirements. By assessing, ranking, and recording key factors, we determine how well the exchange meets the needs of each target group. We use three types of rankings: perfect match, good choice, and not recommended. Here’s our verdict:

Casual Traders: Acceptable Choice

HTX is an acceptable choice for casual traders, offering robust security measures like Proof of Reserves and licenses in multiple countries. The platform supports easy crypto purchases with a debit or credit card, P2P and Quick Trade options for buying and selling crypto with no fees for crypto deposits.

However, HTX does have some drawbacks for casual users. While I successfully tested P2P trading and external wallet deposits, the lack of fiat deposit and withdrawal options, along with fees for crypto withdrawals, are notable cons.

| Pros | Cons |

|

|

Day Traders: Perfect Match

HTX is a perfect match for day traders, offering Spot, Margin, Futures, and Options trading. The integration with TradingView provides a variety of analytical tools to help traders execute their strategies. Additionally, trading fees are significantly lower than the industry average.

HTX implements industry-standard security measures to protect assets stored in its hot wallets, including Proof of Reserves. However, it’s important to note that HTX was hacked in 2023.

| Pros | Cons |

|

|

Hodlers & Position Traders: Acceptable Choice

HTX is an acceptable choice for hodlers and position traders. It offers 700+ tradeable assets with high liquidity, providing long-term investors access to many rare coins for portfolio diversification. The platform also offers different crypto-earning products like Shark Fin, ETH 2.0, and regular staking to help hodlers make use of their idle assets.

However, there are a few security concerns. HTX is not regulated by FCA or any other financial body. It was hacked in 2023 but fully reimbursed the victims in time.

| Pros | Cons |

|

|

Leverage & Derivatives Trading: Perfect Match

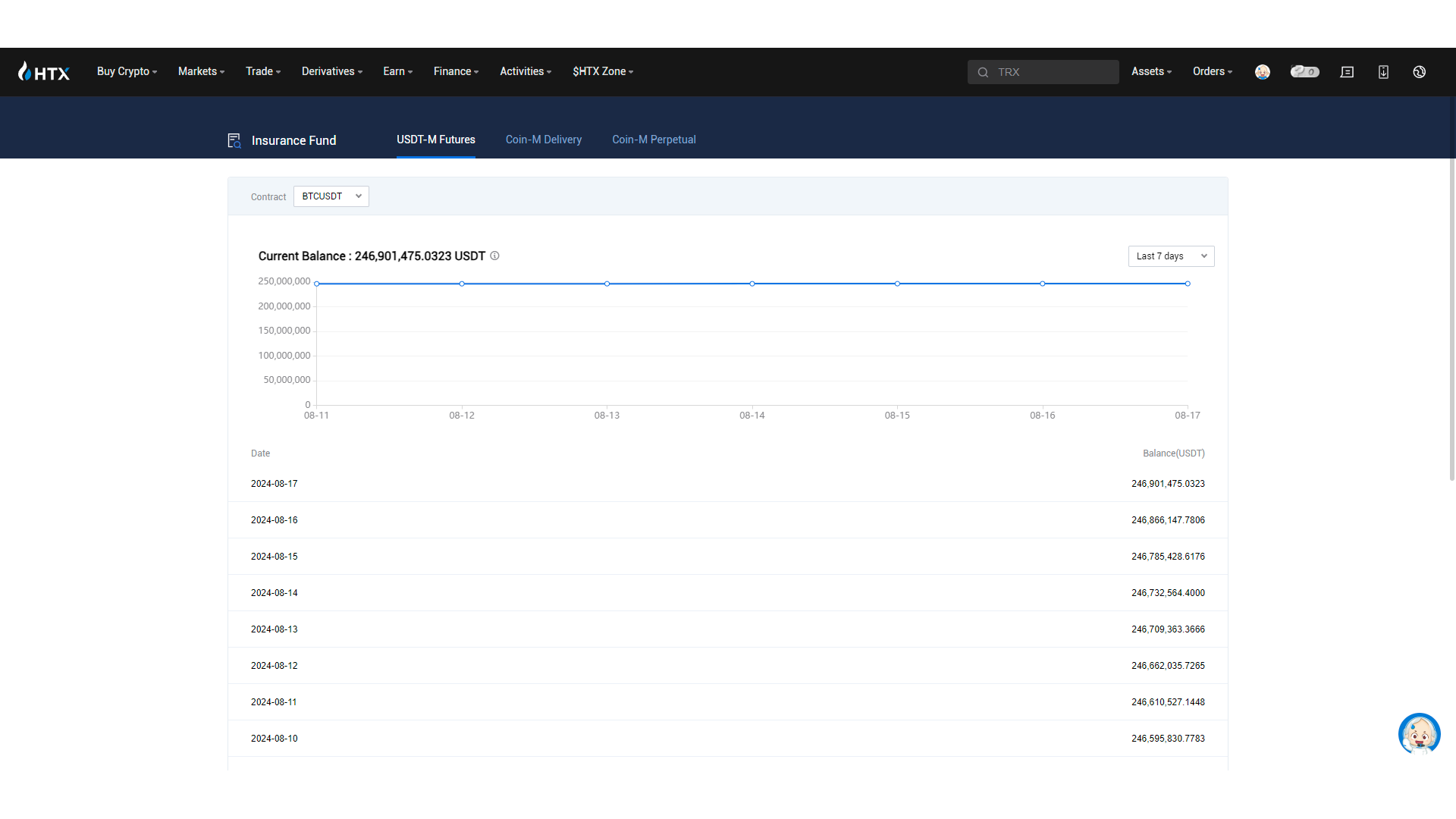

HTX is an excellent choice for traders interested in derivatives and futures, offering up to 200x leverage for derivatives and up to 100x leverage for futures. The platform also includes an insurance fund to cover traders’ profits, no matter the size. This makes HTX a strong choice for those looking to diversify their portfolios with high-risk assets.

| Pros | Cons |

|

|

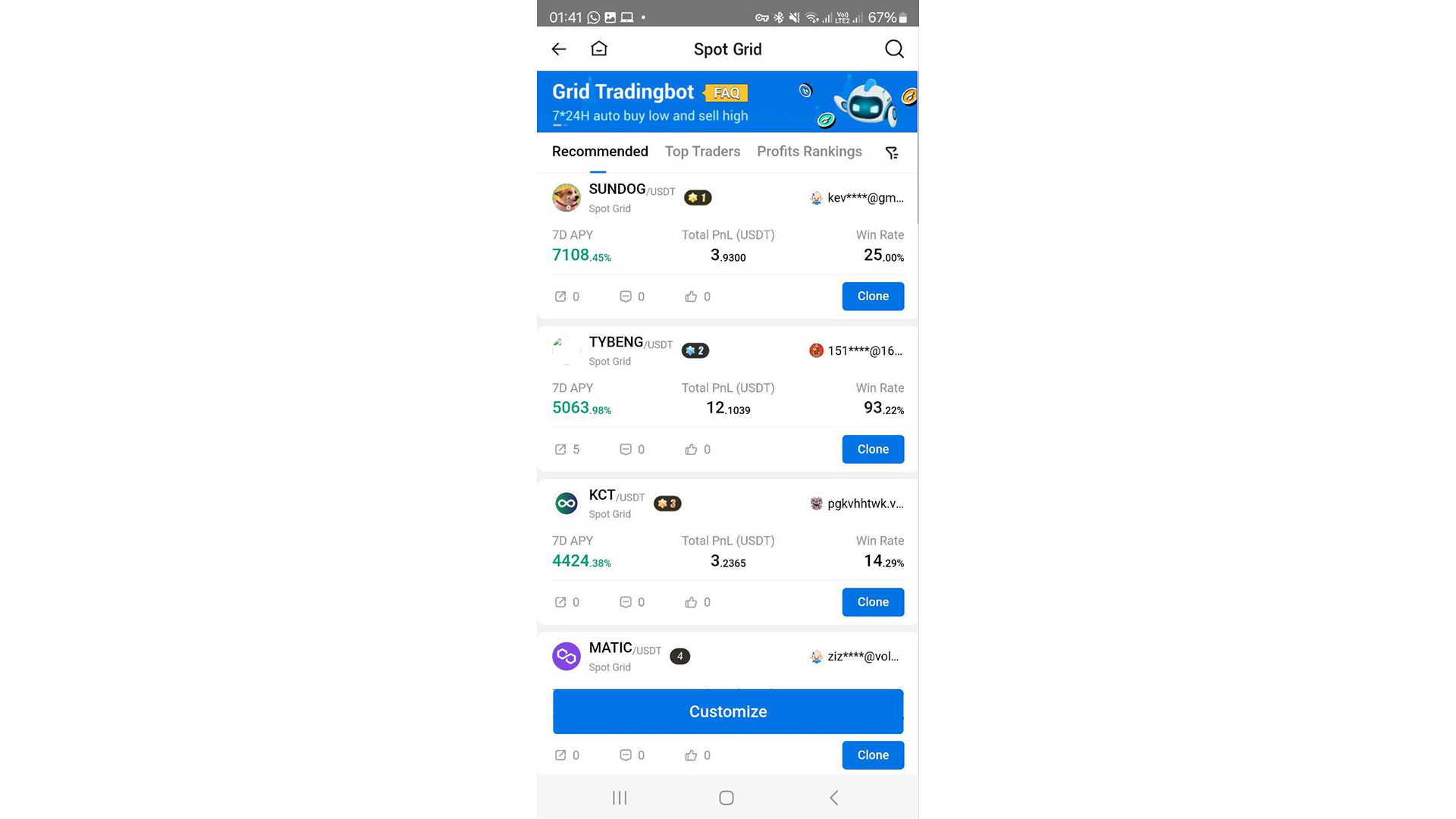

Auto, Social & Copy Trading: Perfect Match

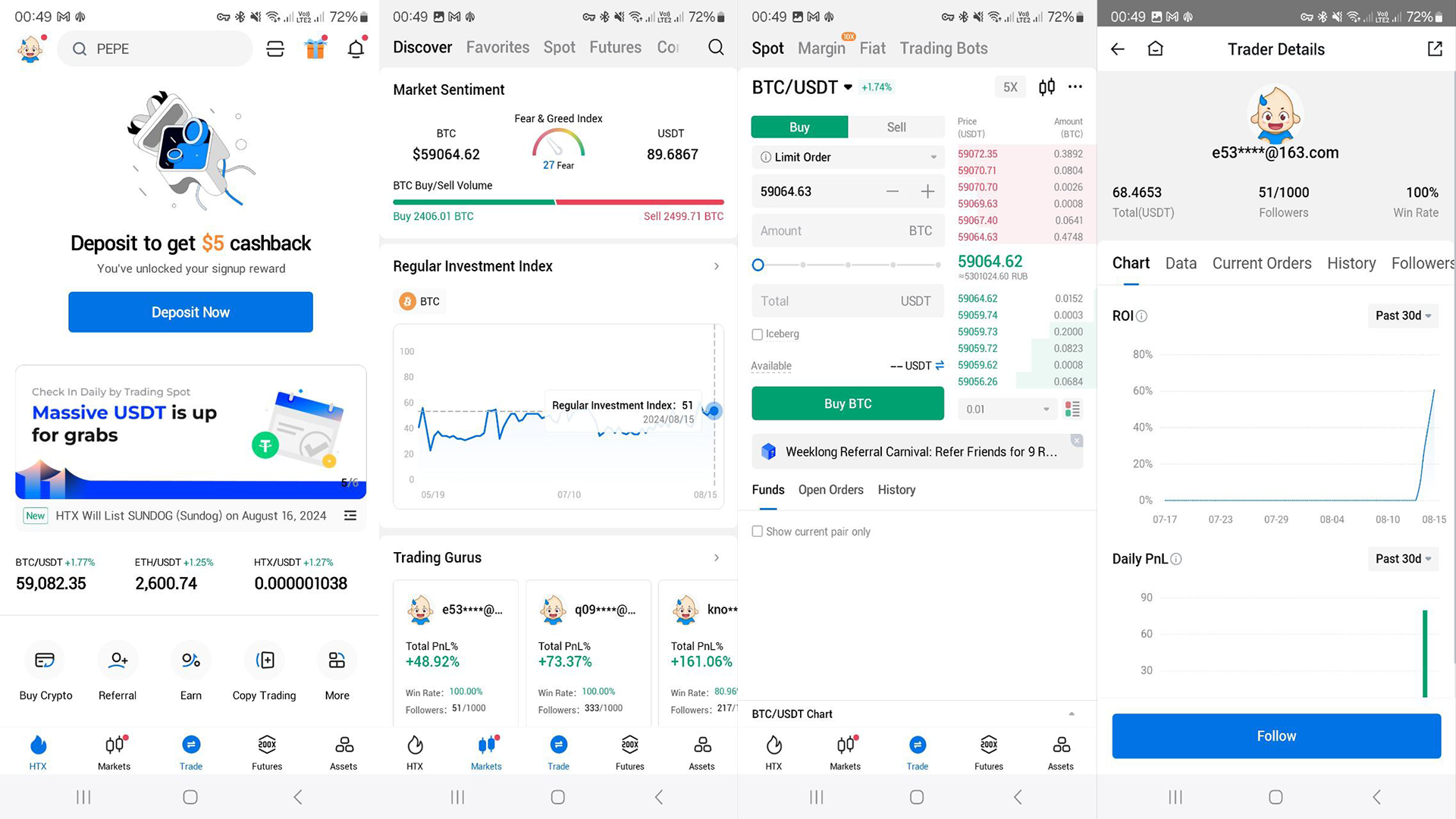

HTX is a perfect match for auto trading, copy trading, and social trading, as it offers all these features. It allows users to create bots for automated trading and copy other traders’ strategies seamlessly.

During my tests, I discovered that the HTX mobile app includes social features like following crypto experts, tracking trending topics, and joining group chats. The app also displays posts from crypto influencers, keeping traders informed about important news and events.

| Pros | Cons |

|

|

Algorithmic Traders: Not Recommended

HTX is not recommended for algorithmic traders. While it does offer API access and allows for bot creation, it lacks a sandbox environment for testing. Additionally, the platform has a low liquidity score, making it unsuitable for fast trade execution. Exchanges like Binance, Kraken, or Gemini may be a better fit for this type of trading.

| Pros | Cons |

|

|

DCA Investors: Not Recommended

HTX is not recommended for a Day-Cost-Average strategy since it doesn’t provide any functionality for its automation. In my opinion, platforms like UpHold, Coinbase, and Binance are better alternatives.

Supported Countries and Regions

HTX has earned licenses and registrations across the globe, allowing it to operate in over 200 countries. However, it does not cover the US.

The list of restricted regions includes:

- Mainland China and Hong Kong

- Cuba

- Iran

- North Korea

- Sudan

- Syria

- Venezuela

- Singapore

HTX also restricts derivatives trading in several regions, including Taiwan, China, Israel, Iraq, Bangladesh, Bolivia, Ecuador, Kyrgyzstan, Sevastopol, Spain, the UK, and New Zealand.

As the list of restricted regions may change, we recommend checking the up-to-date information in Article 1.2 of the HTX Platform User Agreement.

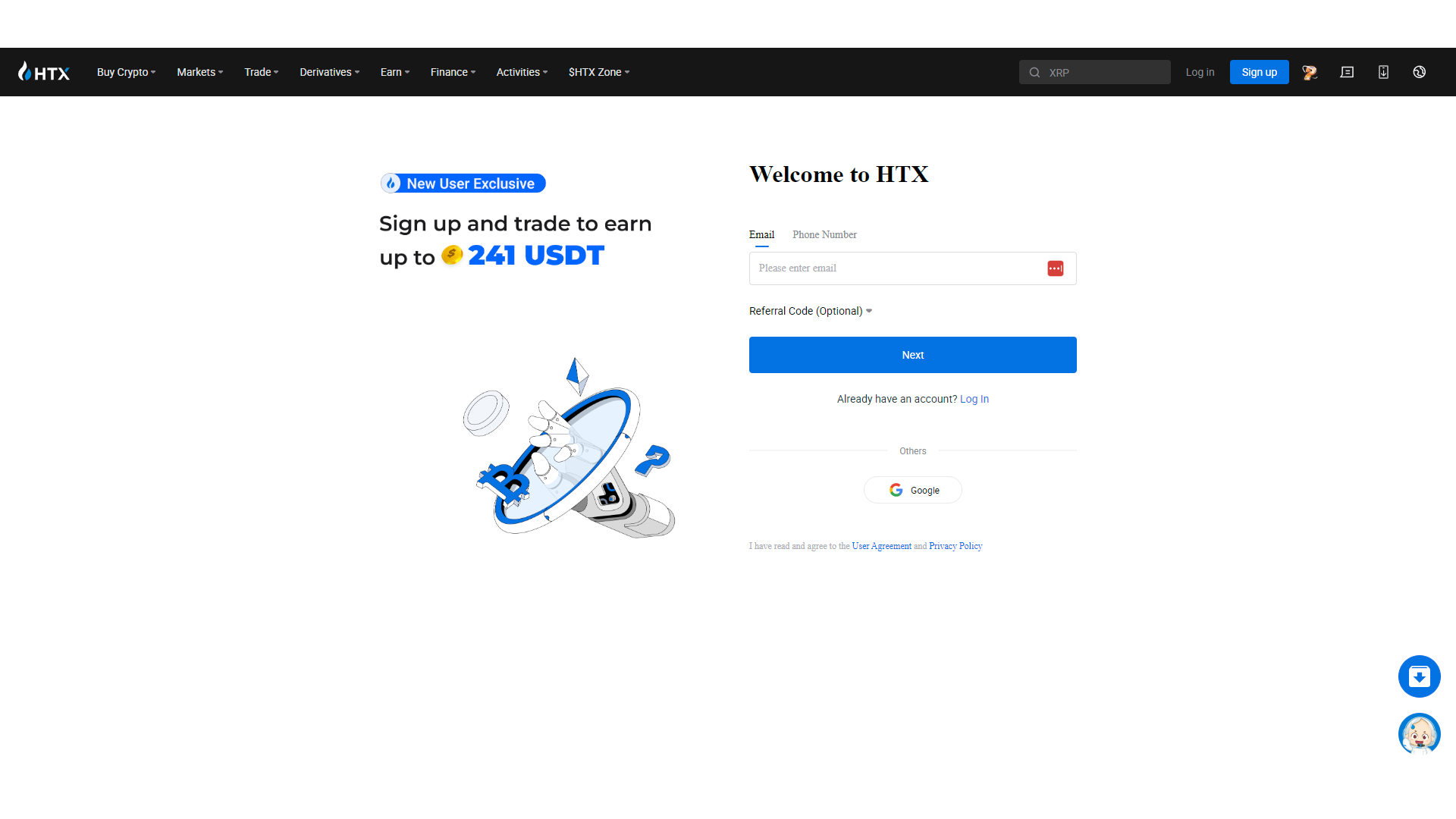

HTX Bonuses and Special Offers

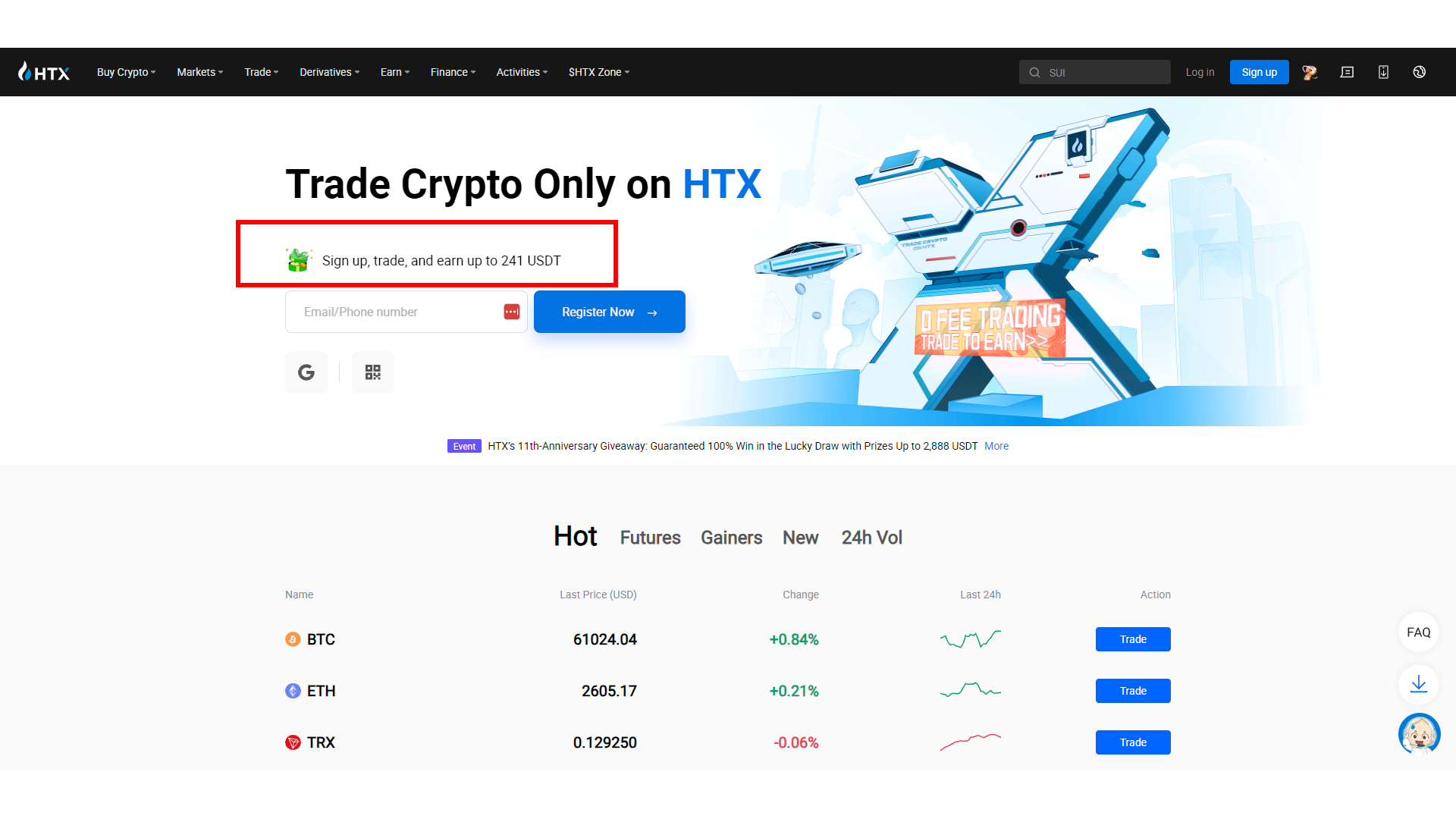

HTX has a welcome offer for new users: the desktop version advertises up to 241 USDT and the mobile app up to 800 USDT. However, after creating a new account, I couldn’t find any information on how to claim this bonus. If you already have an HTX account but haven’t logged in for over 90 days, you’re eligible for a 100 USDT bonus.

HTX doesn’t offer cashback. However, the platform occasionally launches promotional campaigns where users can compete for prize pools and earn rewards by completing specific tasks.

HTX offers rewards for new users but doesn’t explain how to get them

HTX features an affiliate program helping users earn additional rewards for inviting their friends.

Join HTX using our affiliate link and get welcome bonuses.

HTX Background

HTX was founded in 2013 in China under the name Huobi. In 2023, the platform rebranded as HTX as a part of its global expansion strategy.

Leon Li is the founder and CEO of HTX. As an alumnus of Tsinghua University’s Department of Automation, he previously worked as a computer engineer at Oracle, the world’s largest database provider.

HTX is active on key social media, regularly posting its latest news on Twitter (X), LinkedIn, and Telegram.

Security & Transparency

HTX implements strong security protocols to protect users’s funds. However, its reputation and ranking are not without blemishes.

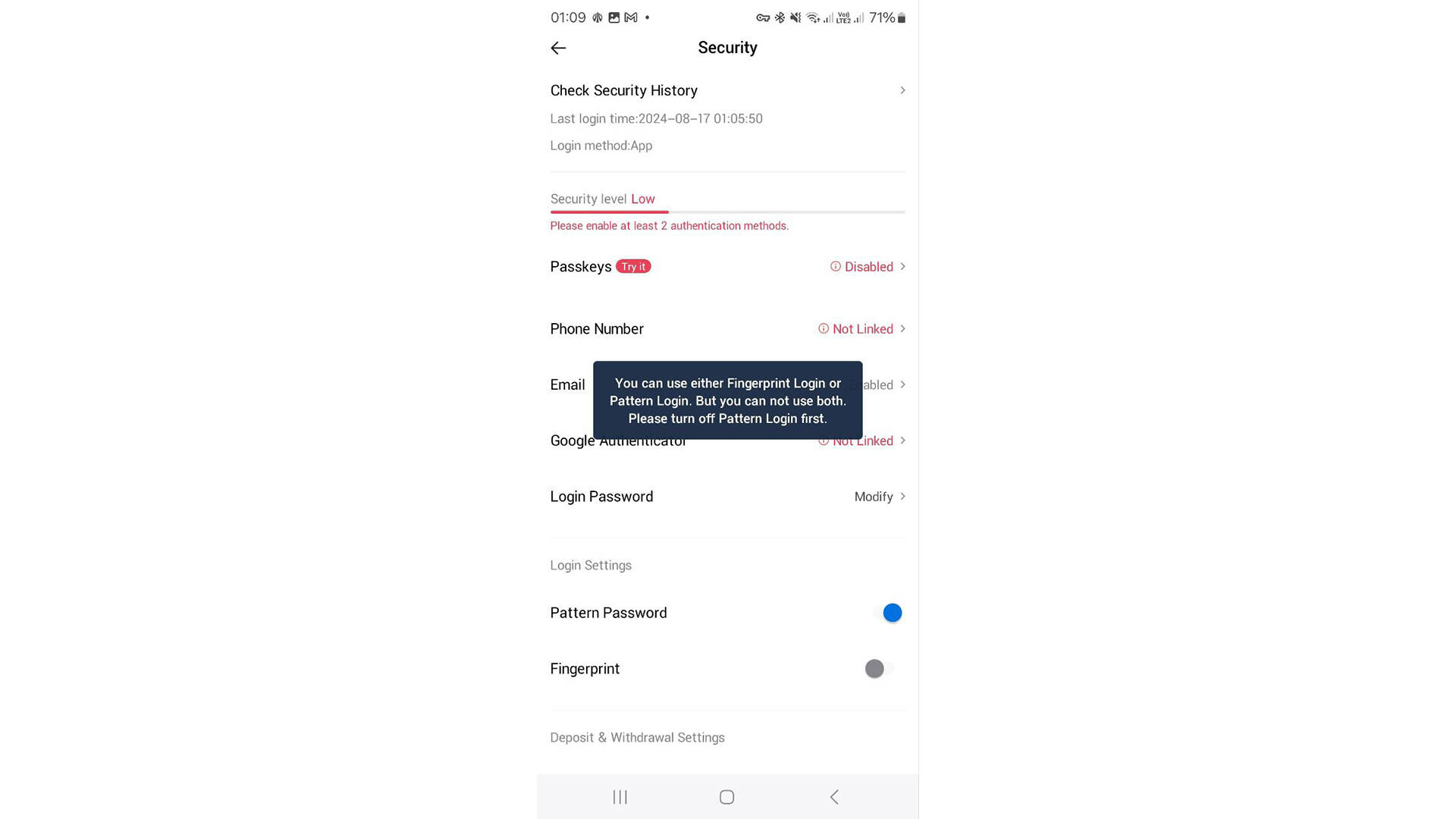

HTX offers full Proof of Reserves for users’ assets through internal mechanisms like the Merkle Tree Proof of Reserves, which they regularly update and publish. However, we couldn’t find information about any external audits. Additionally, users can enhance their account security with measures like 2FA, fingerprint authentication, and pattern passwords.

In 2023, HTX experienced several successful hacks, with the largest breach resulting in a loss of $258 million. Since then, HTX has operated an Investor Protection Fund, replenishing it with 20% of its income to compensate users in the event of a hack. While the platform claims to have fully compensated all affected users, this incident raises concerns.

| HTX Security Overview | Details |

| Proof of Reserves (PoR) | ≥100% reserve ratio for BTC, ETH, USDT, HTX, TRX |

| Insurance | No coverage |

| KYC Verification | KYC is mandatory |

| Security Audits | N/A |

| Account Security | Support for 2FA (Google Authenticator), Trading password, Anti-phishing code, Emergency contact, Passkey, and Support for MBA (Fingerprint scanning & FaceID) |

HTX is a global licensed business offering trustworthy services to its users. To ensure its eligibility, the platform has obtained licenses in the following regions:

- Lithuania: Deposit Virtual Currency Wallet Operator and Virtual Currency Exchange Operator Registration

- Dubai: VARA Virtual Asset MVP Provisional License

- British Virgin Islands: SIBA Investment Business License- Custody and Operation of Investment Exchange

- Australia: AUSTRAC Digital Currency Exchange Provider Registration

Verified Trusted Scores

As part of our review, we refer to the industry’s most respected independent security auditors for cryptocurrency exchanges. Each has its own ranking criteria. For example, CoinMarketCap considers factors like traffic, liquidity, and volume, while CER.live scores based on proof of reserves, bug bounty programs, and compliance with standards like ISO 27001. Each auditor provides a unique score, ranging from 0.00 to 10 for some, like CoinMarketCap and CoinGecko, or from AAA to D for others.

| Ranking | Score |

| Coinmarketcap | 6.9 |

| Skynet.certik.com | BBB |

| Cer.live | AA |

| Coingecko | 9 |

| CryptoCompare | N/A |

HTX is generally well-regarded across multiple platforms due to its strong security and reliability ratings. However, exchanges like Binance and Coinbase typically outperform HTX in certain rankings.

During my tests, I found that HTX offers several security measures to protect users’ assets. Let’s take a closer look at these features.

Proof of Reserves: HTX claims to fully cover the following assets: USDT, BTC, ETH, HTX, and TRX. Users who store any of these cryptos on the platform can independently verify these reserves using the Merkle Tree Proof of Reserves available on the platform.

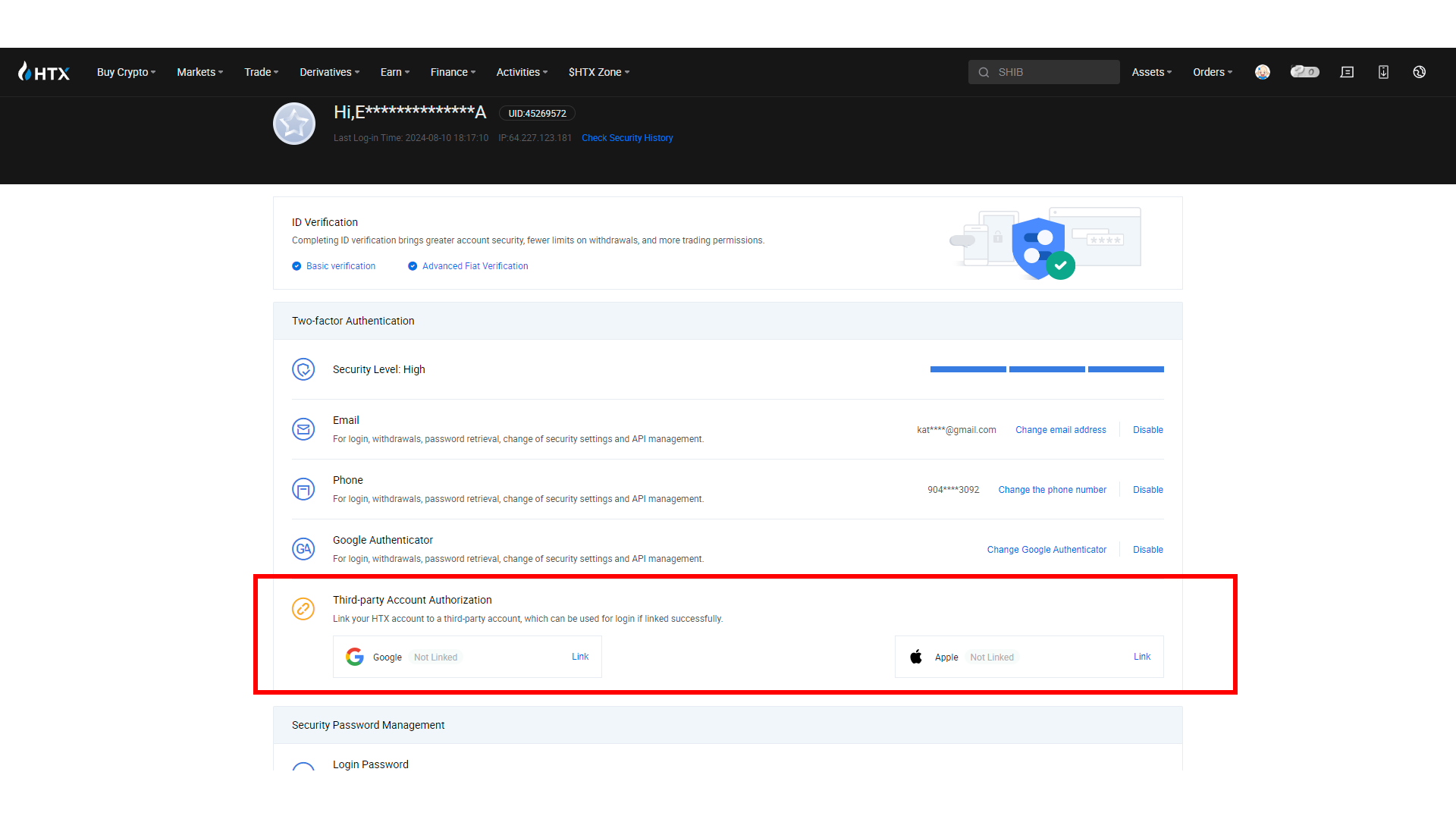

Cyber Security Measures: The desktop version offers three basic types of 2FA: email, phone, and Google Authenticator. During my tests, I also found a Trading password, an Anti-phishing code, and an Emergency contact. The mobile version enhances security with a Pattern password and Fingerprint authentication.

General Reliability: HTX operates an active Bug Bounty Program with rewards ranging from $100 to $10,000 based on the severity of the bugs discovered.

Know You Customer (KYC)

KYC is mandatory on HTX, with four available levels. When I opened an account, I reached the 3rd level, which granted me the maximum withdrawal limit. The process was straightforward but not particularly fast: I had to wait about 24 hours for my documents to be verified.

| Verification level | Required information | Privileges |

| Level 1 Basic Permissions | Submit personal data:

|

24h withdrawal limit: 5 BTC |

| Level 2 Basic Verification | Submit a photo of an ID card | 24h withdrawal limit: 200 BTC |

| Level 3 Advanced Verification | Complete facial recognition | 24h withdrawal limit: 3,000 BTC |

| Investment Capability Assessment | Submit an application and a proof of residence document. Any of the following would fit:

|

|

Is HTX Safe to Trade With?

In summary, our findings indicate that HTX can be regarded as having a moderate level of trust and stability due to the following factors:

- Proof of Reserves with full coverage

- HTX has experienced hacks in the past, but has provided strong reimbursements to affected users.

- Active bug bounty program up to 10,000$

- Verifiable team profiles: Leon Li (the Founder and CEO)

- Active social networks: Twitter (X), LinkedIn, and Telegram

Trading Experience

HTX is available on both desktop and mobile, but unlike exchanges like Coinbase and Kraken, it offers only one mode. In my opinion, HTX suits both beginners and advanced traders as it combines a user-friendly interface with various advanced features like bots, copy trading, and social trading.

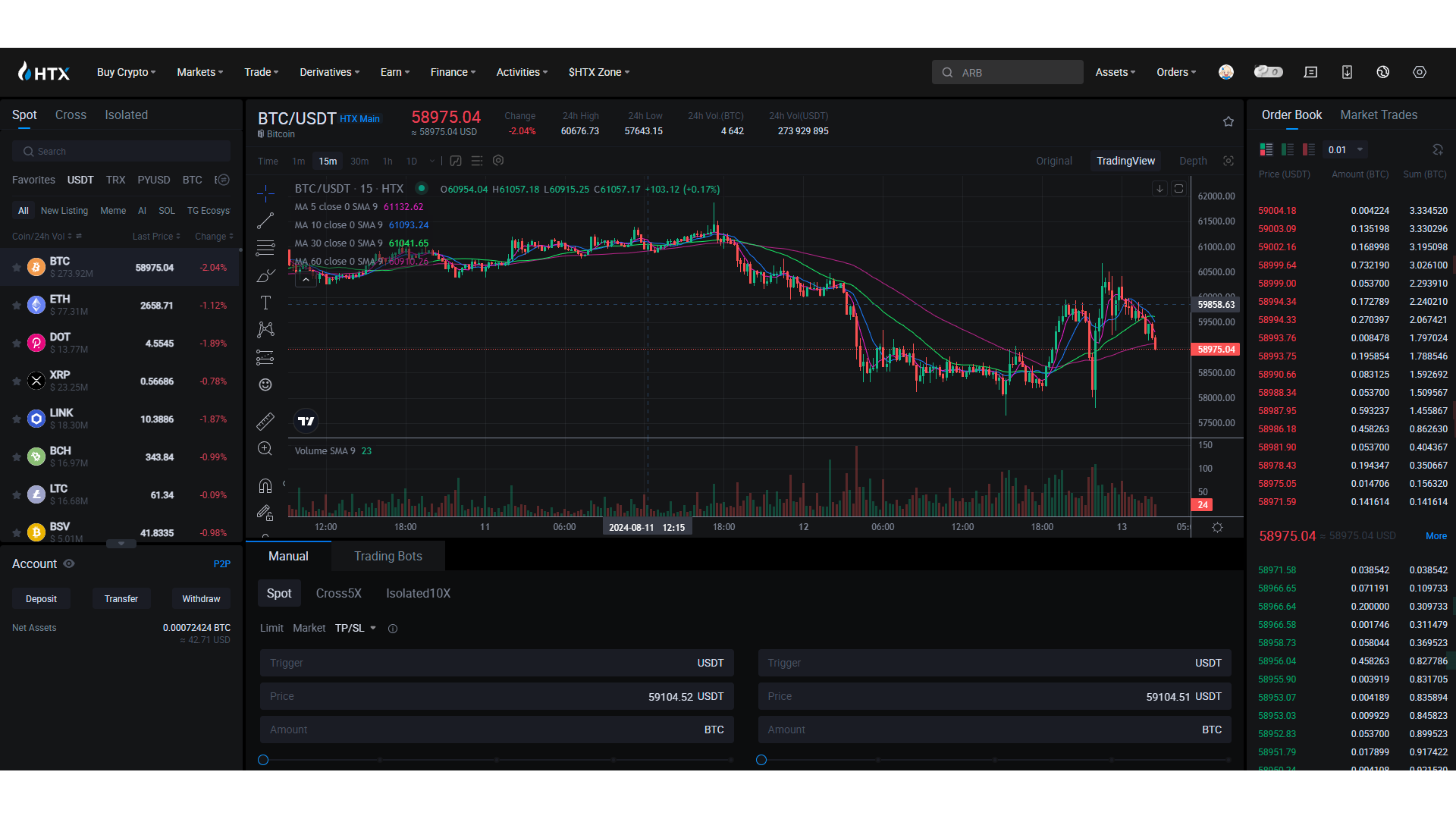

During my tests, I primarily used the desktop version of the Chrome browser. HTX demonstrated excellent performance, with transactions being executed instantly.

| Trading options and additional features | Availability |

| Conditional orders |

|

| Derivatives Trading | Yes |

| Lending | Yes |

| Borrowing | No |

| Leverage Trading | Yes |

| Staking | Yes |

| Copy/Social Trading | Yes |

| tradingview.com Integration | Yes |

| Auto Trading (Bots) | Yes |

| API Access | Yes |

| P2P Trading | Yes |

| Demo account | No |

| Token Launchpad | No |

| NFT Marketplace | Yes |

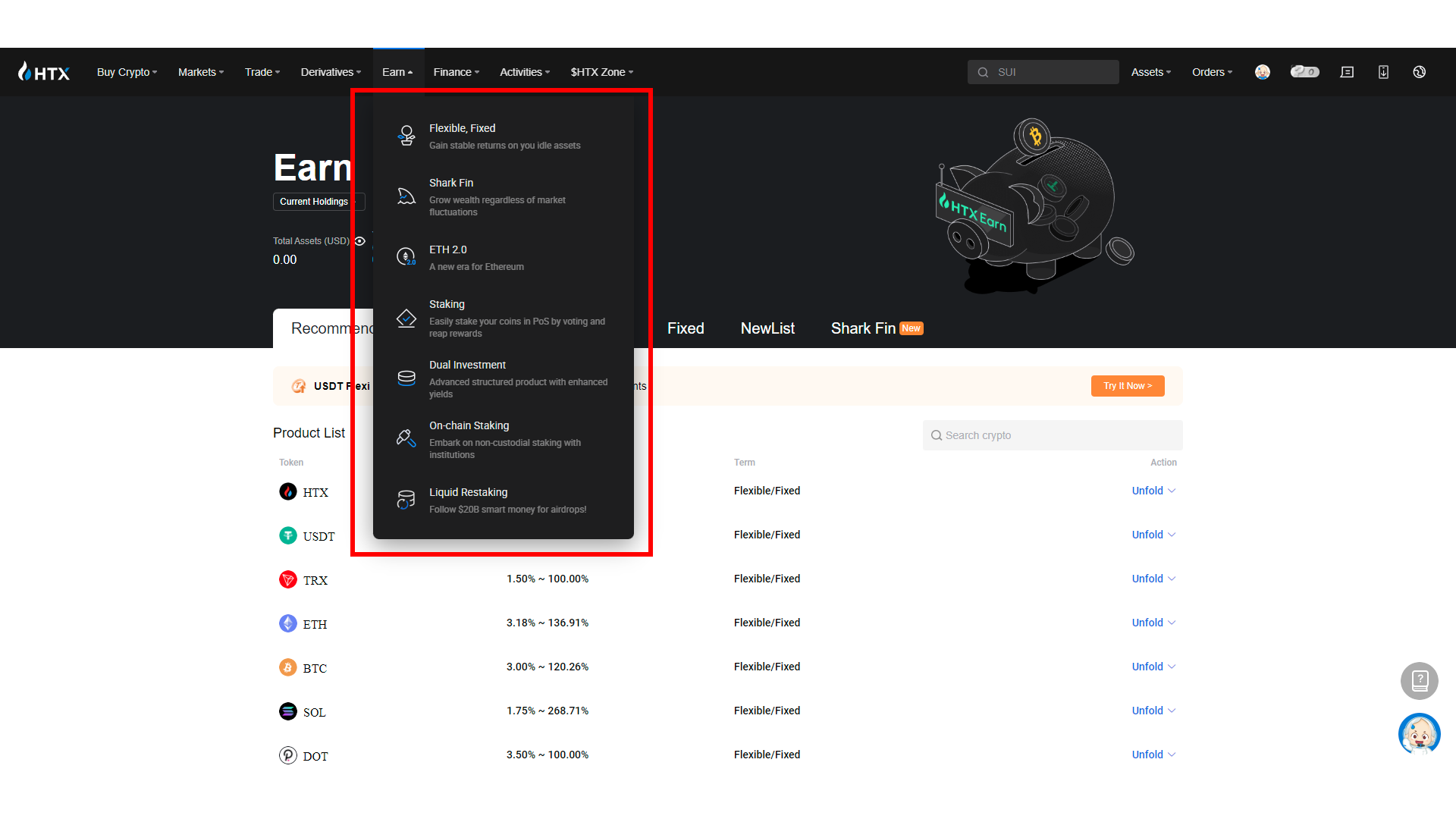

Staking on HTX

On HTX, users can earn passive income by staking their crypto. You can choose between flexible or fixed-term staking options to put your idle assets to work. The platform offers several straightforward staking methods:

- SharkFin. This investment product provides a safe way to earn interest based on the price movements of a specific cryptocurrency over a set period, typically 7 days.

- ETH 2.0. Users can stake their ether on ETH 2.0, earning stable interest rates ranging from 4% to 10%.

- Dual Investment. This product allows users to buy or sell crypto at a favorable price while earning interest. Users select two different cryptos for investment and receive one of them depending on market conditions at the end of the investment period.

- On-chain Staking. HTX offers institutional-level staking services for on-chain staking, providing stable earnings in a non-custodial format.

- Liquid Restaking. This feature helps users benefit from free rewards and early airdrops by automatically staking them for higher income.

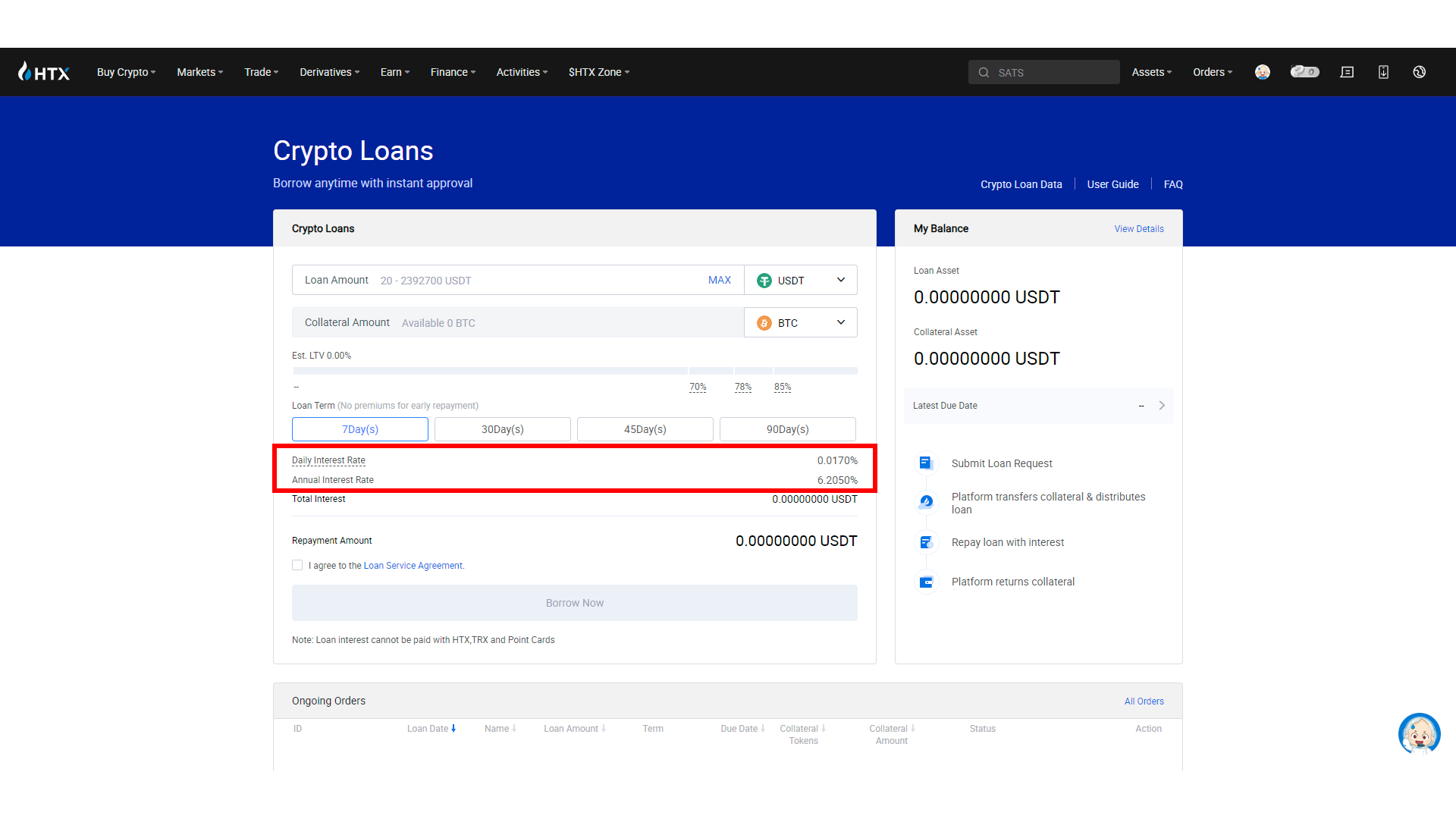

Crypto Loans on HTX

HTX offers Crypto Loans, which help users borrow crypto on profitable terms by pledging other assets as collateral. There is also an OTC Loan for institutional customers with customized VIP loan services.

Derivatives Trading on HTX

HTX offers derivatives catering to the requirements of risk-hungry traders. The list of available products includes:

- USDT-M. Futures products settled in USDT.

- Coin-M. Futures products settled in cryptocurrencies.

- Options. European and American-style options to help users multiply their assets.

The maximum leverage level for the majority of derivatives is up to 100x. The insurance fund created by the exchange covers its expenses should traders make high profits using these derivatives.

Note. HTX offers two key types of leverage: Isolated and Cross. The first one implies risking only a specific amount of funds for a particular trade. The second one uses the entire balance to support the trades and is, therefore, more risky.

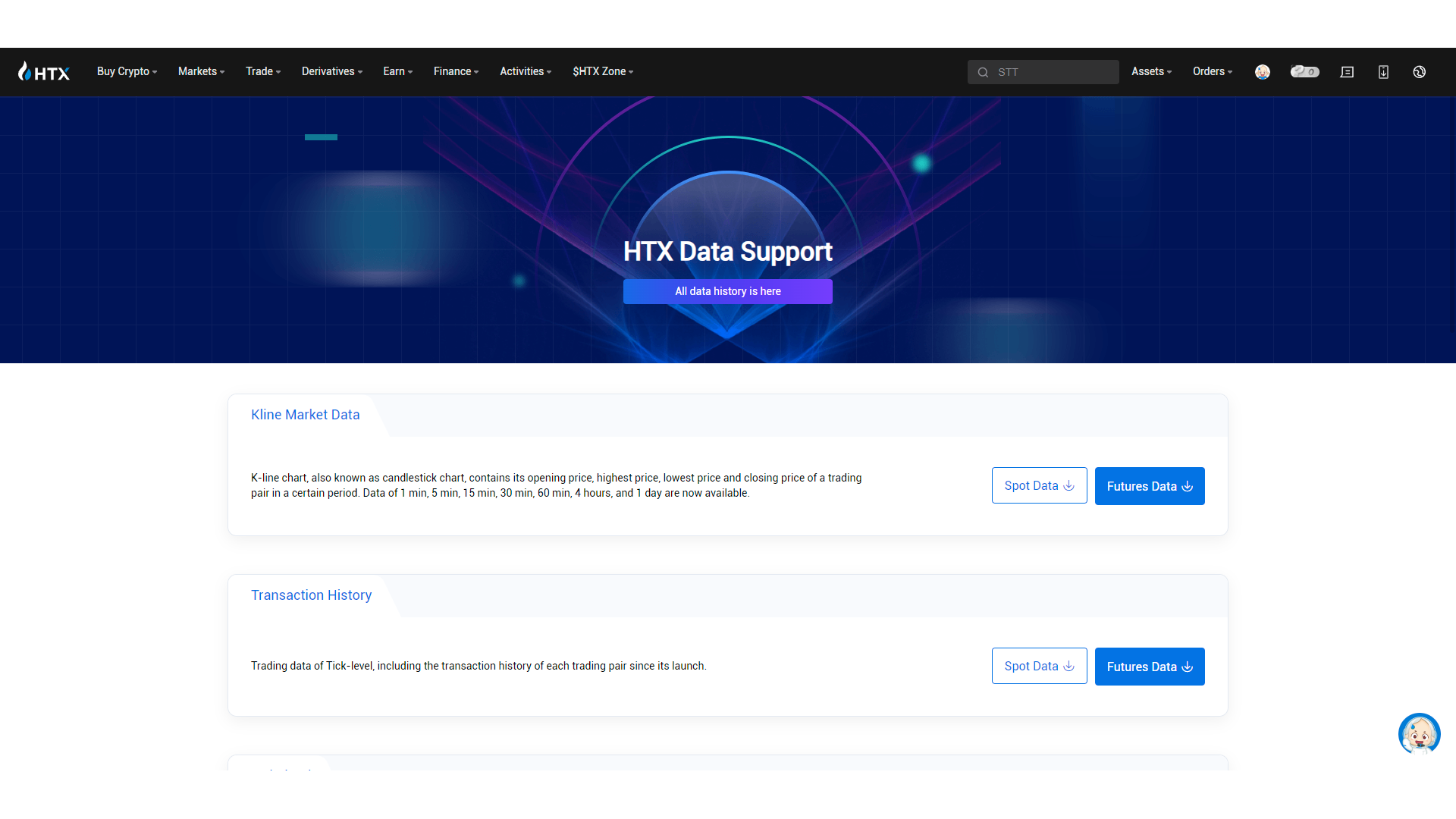

Download data history on HTX

HTX allows experienced traders to download data history for each trading pair. It may be particularly useful to tech-savvy users who want to backtest their trading strategies using existing data. HTX provides various data sets, including K-line charts, transaction history, Orderbook, Mark Price, and more. These data sets are available for both spot and futures trading.

Trading Test

For our trading test, we thoroughly evaluated the HTX platform. Our process included signing up, completing the KYC (Know Your Customer) verification, logging in, depositing funds, and making withdrawals. We also tested the trading functionalities by exploring different trading pairs and conversions and assessed the associated fees for transfers and withdrawals. This comprehensive test allows us to provide an informed and reliable review of the exchange’s usability, features, and actual costs. Here’s our detailed analysis:

Step 1: Setting Up and Funding Your Account

To create a new account on HTX, you can provide your address, a phone number or simply register using your Google account. During my tests, I chose the Google account option because it was quicker.

To verify my account, I had to upload a photo of my ID card and complete a face scan. The verification process took around 24 hours. After that, I got the 1st level of verification and was able to deposit funds. Reaching the 2nd and 3rd levels of verification was just as easy, as I simply repeated the same procedure.

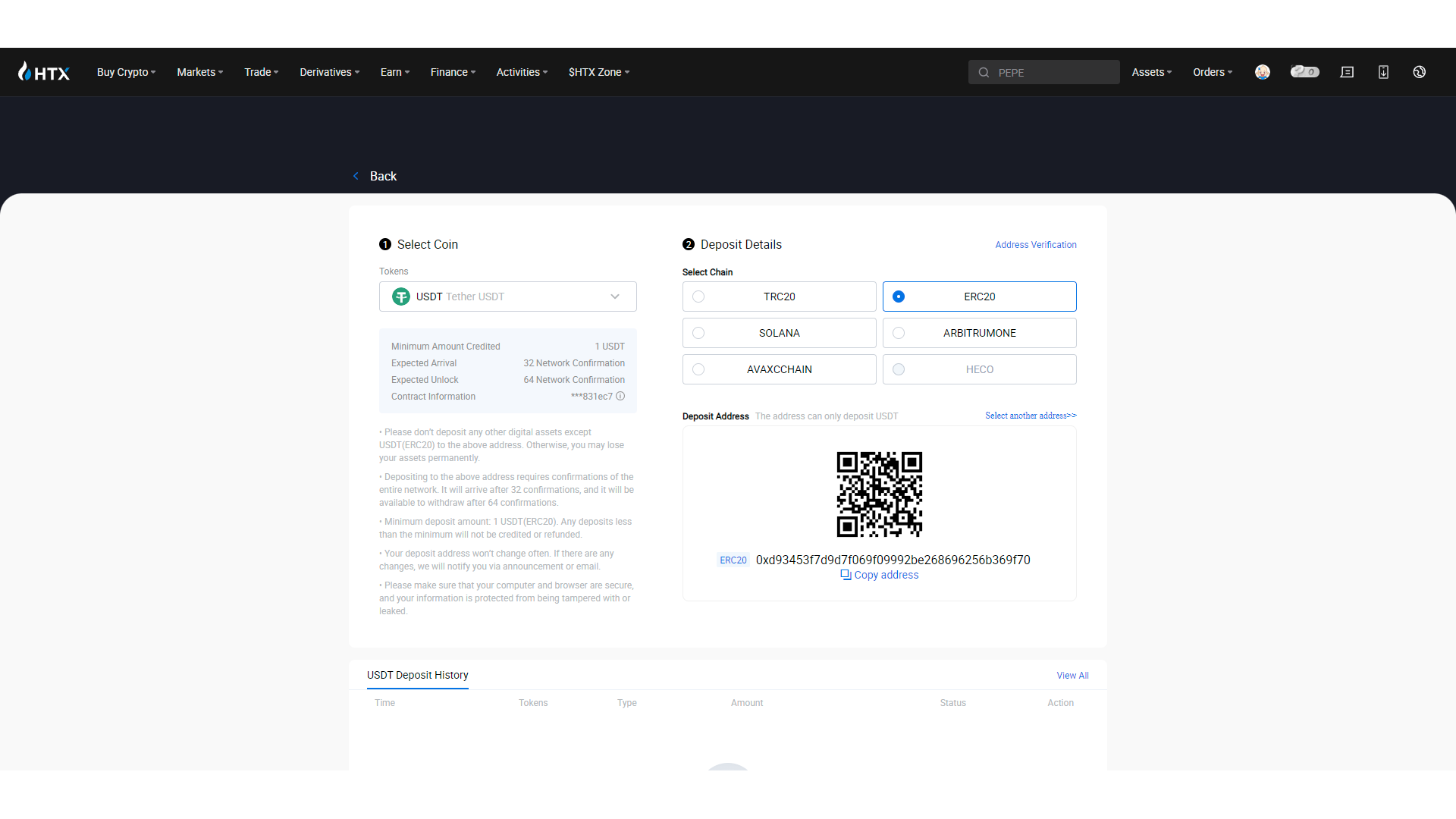

When I tried to deposit fiat, HTX notified me that this option was only available through the P2P trading service. I already had some USDT in my Metamask wallet, so I selected a crypto deposit option. The platform generated a wallet address with a QR code to avoid typos and sent this information to my email for convenience.

The process went smoothly, and the funds arrived in only a few minutes. I had to pay a $4 network fee to Ethereum, but there were no additional charges on the platform.

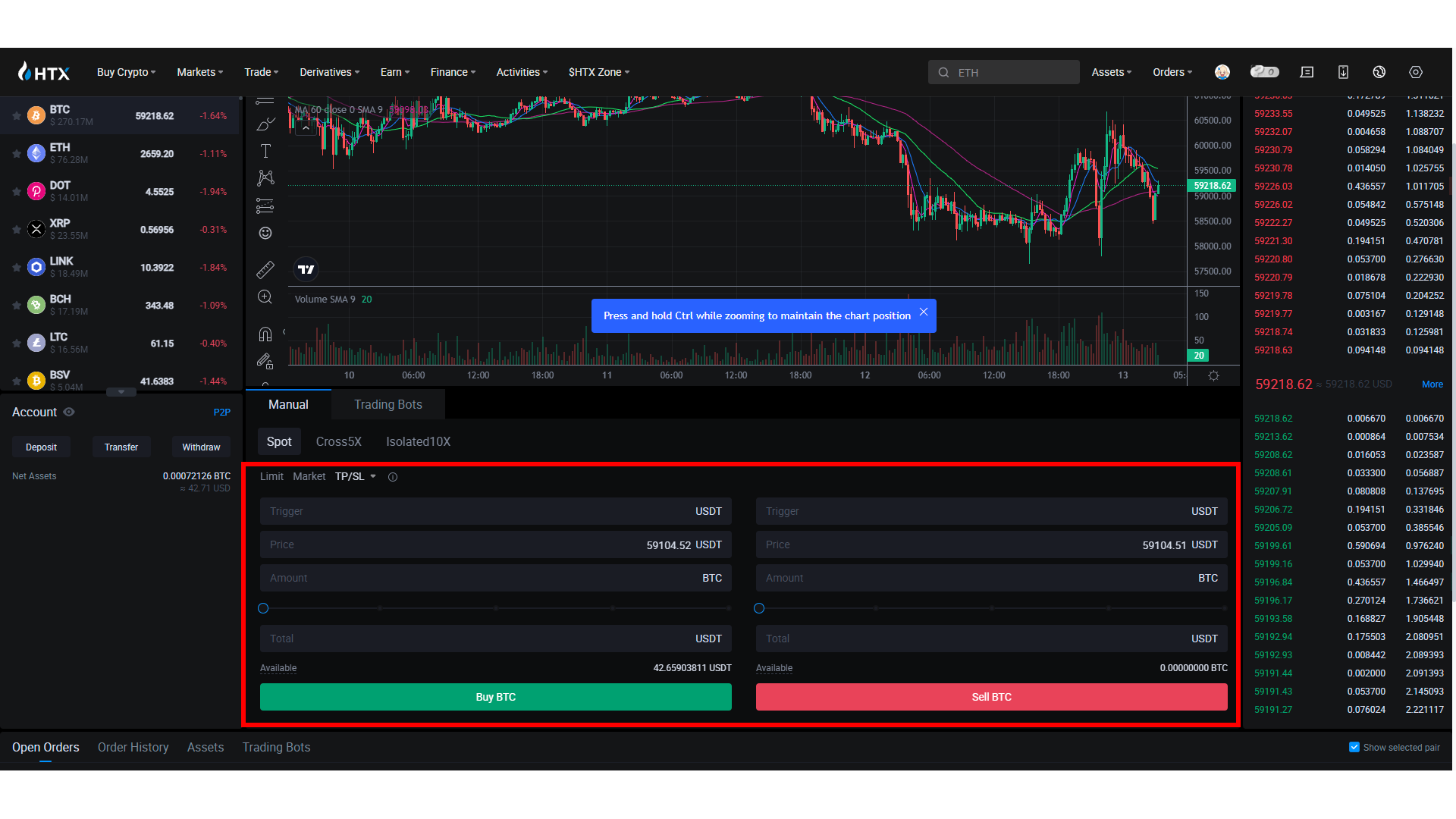

Step 2: Trading

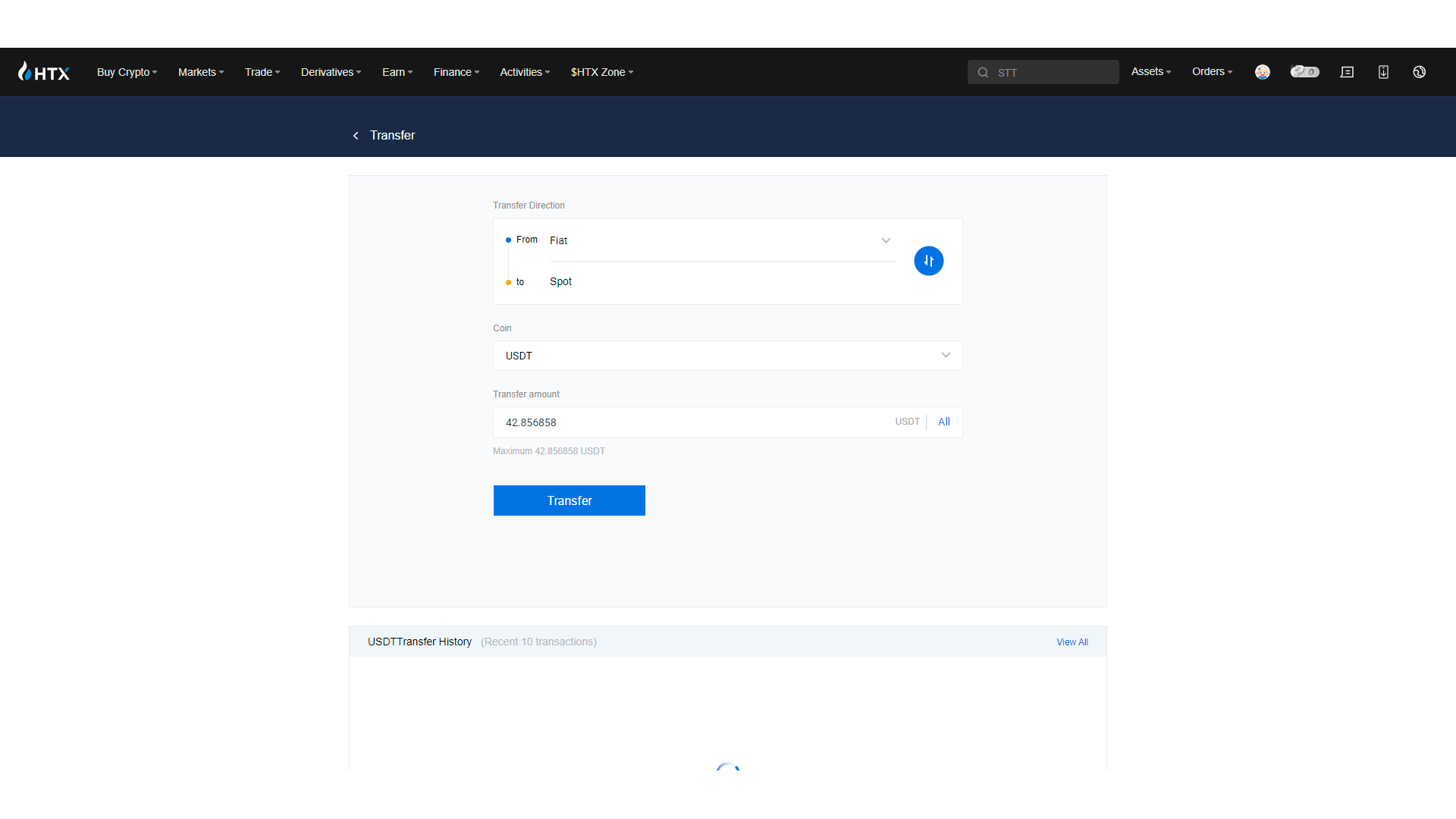

HTX features different accounts for different purposes: Spot, Futures, Fiat, Earn, Margin, and Options. When I deposited USDT, the funds arrived in the “Fiat” account. To start trading, I had to perform an additional step and transfer them to the Spot account.

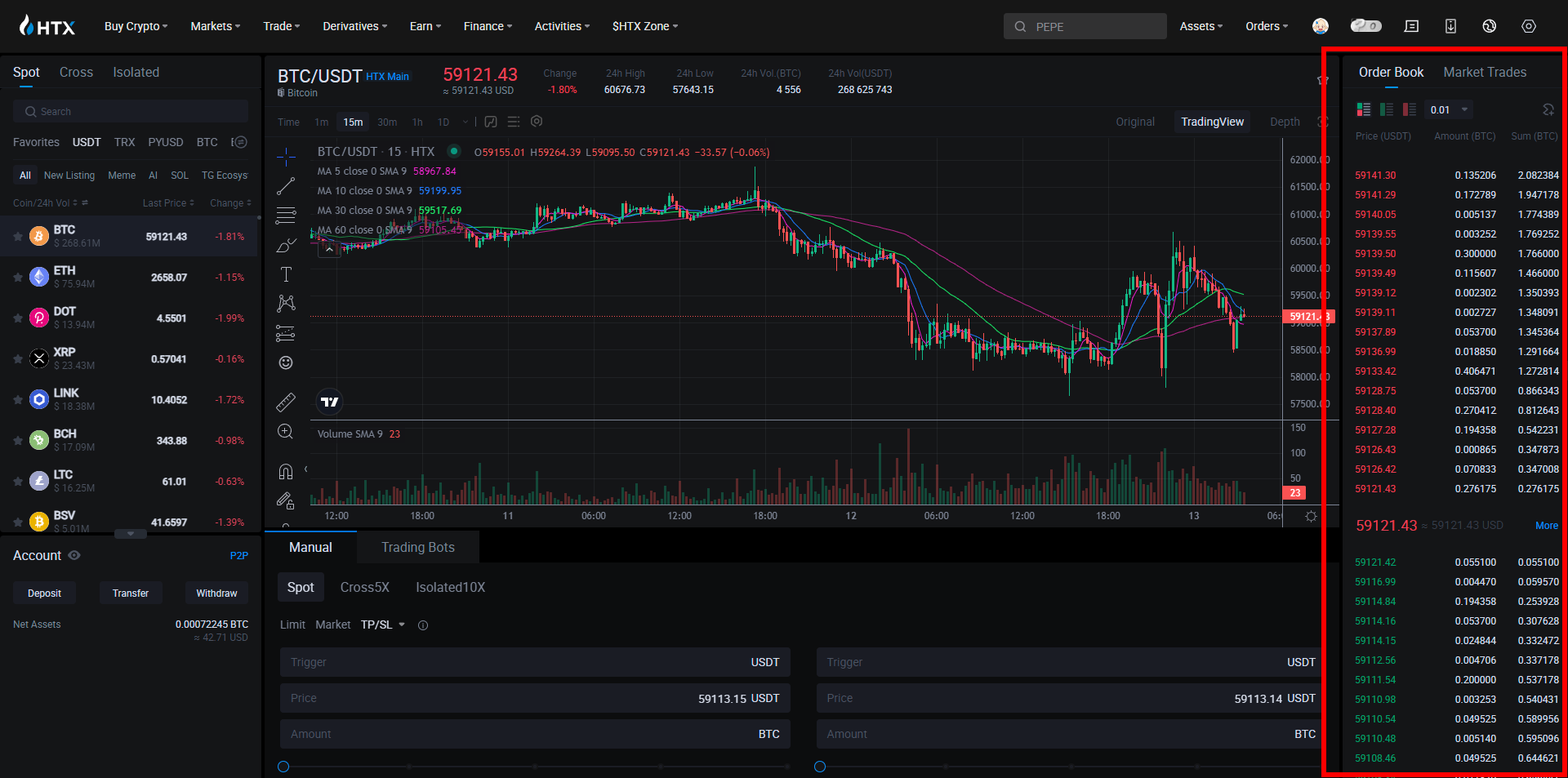

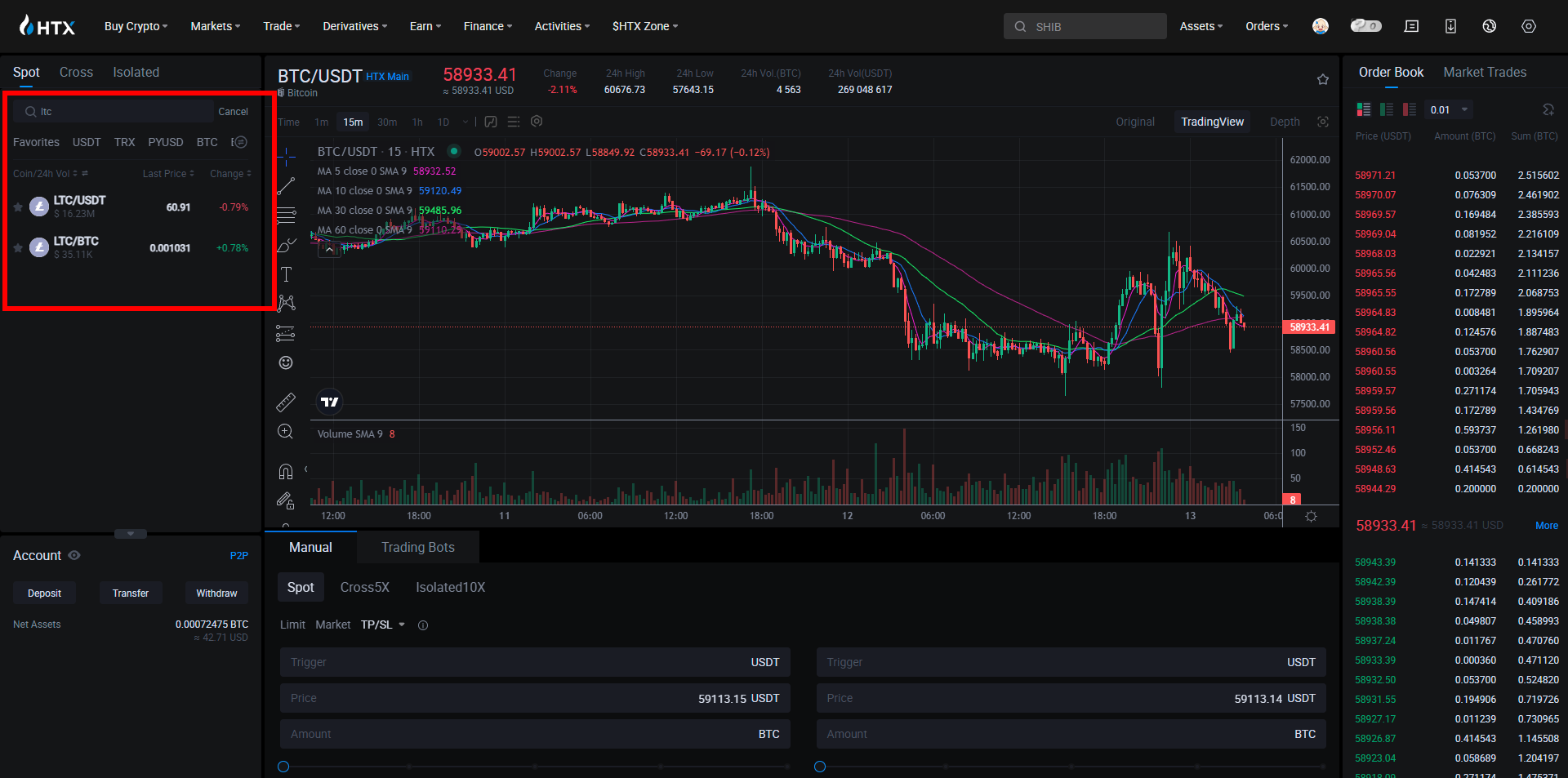

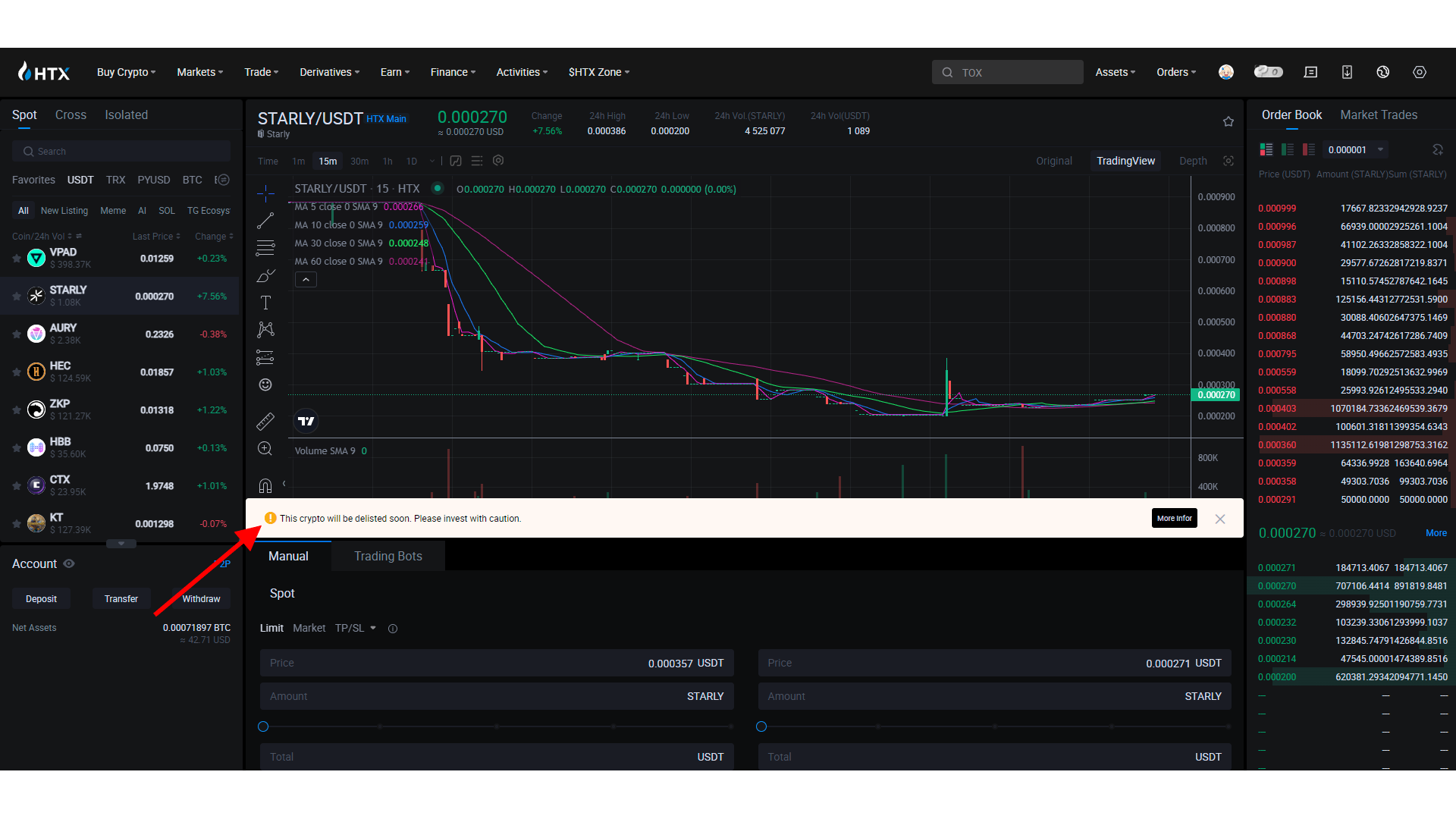

The trading interface of HTX was a bit overwhelming for a casual trader like myself. However, the layout was fairly standard, and after a few minutes, I was able to navigate it with ease.

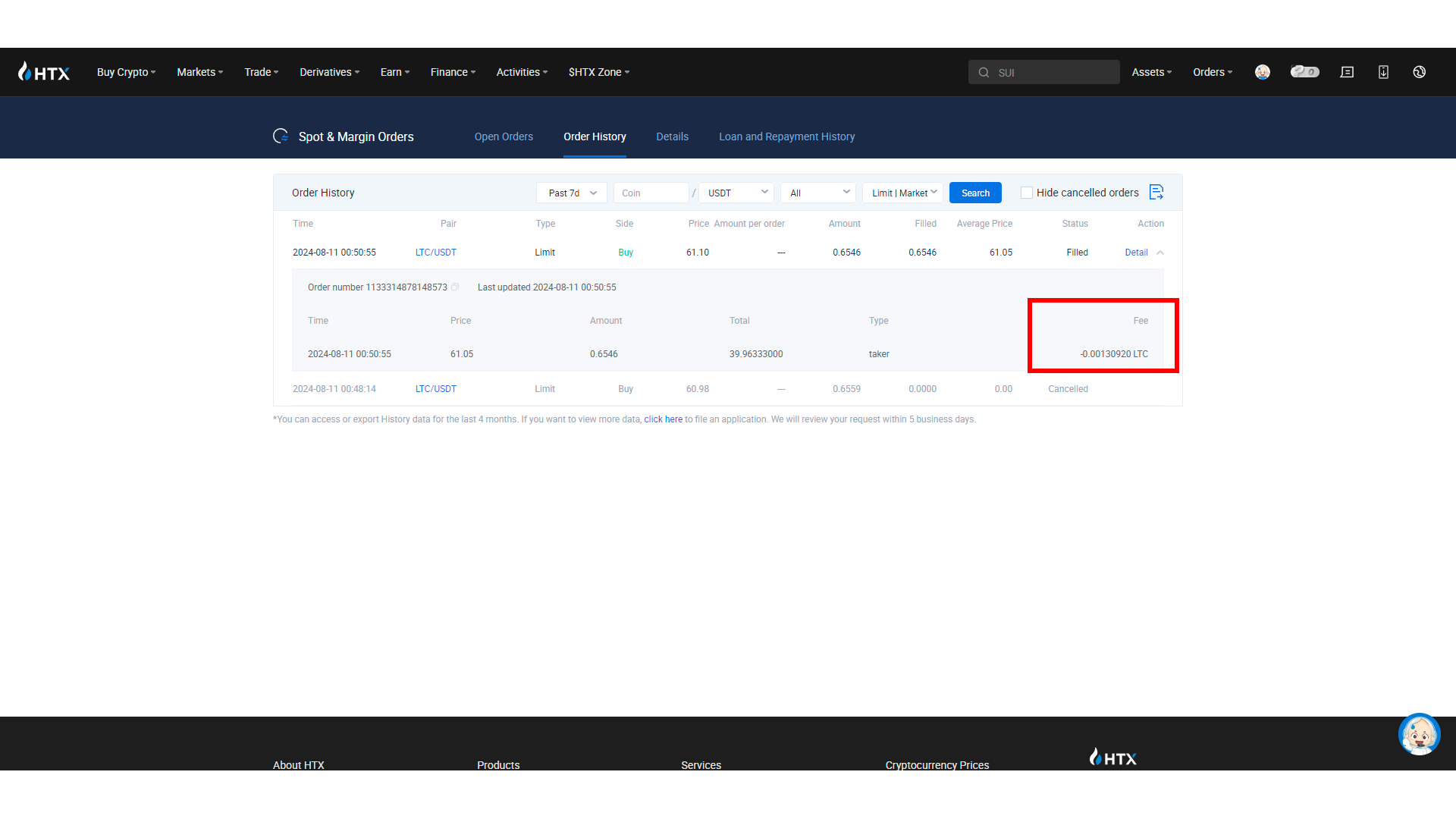

When I purchased LTC for USDT, the order was executed instantly. I found the transaction fee listed in the Order History, but it was stated in LTC rather than USDT, making it harder to estimate. After some calculations, I determined that the fee was 0.2%, which matched the rate declared on the dedicated page.

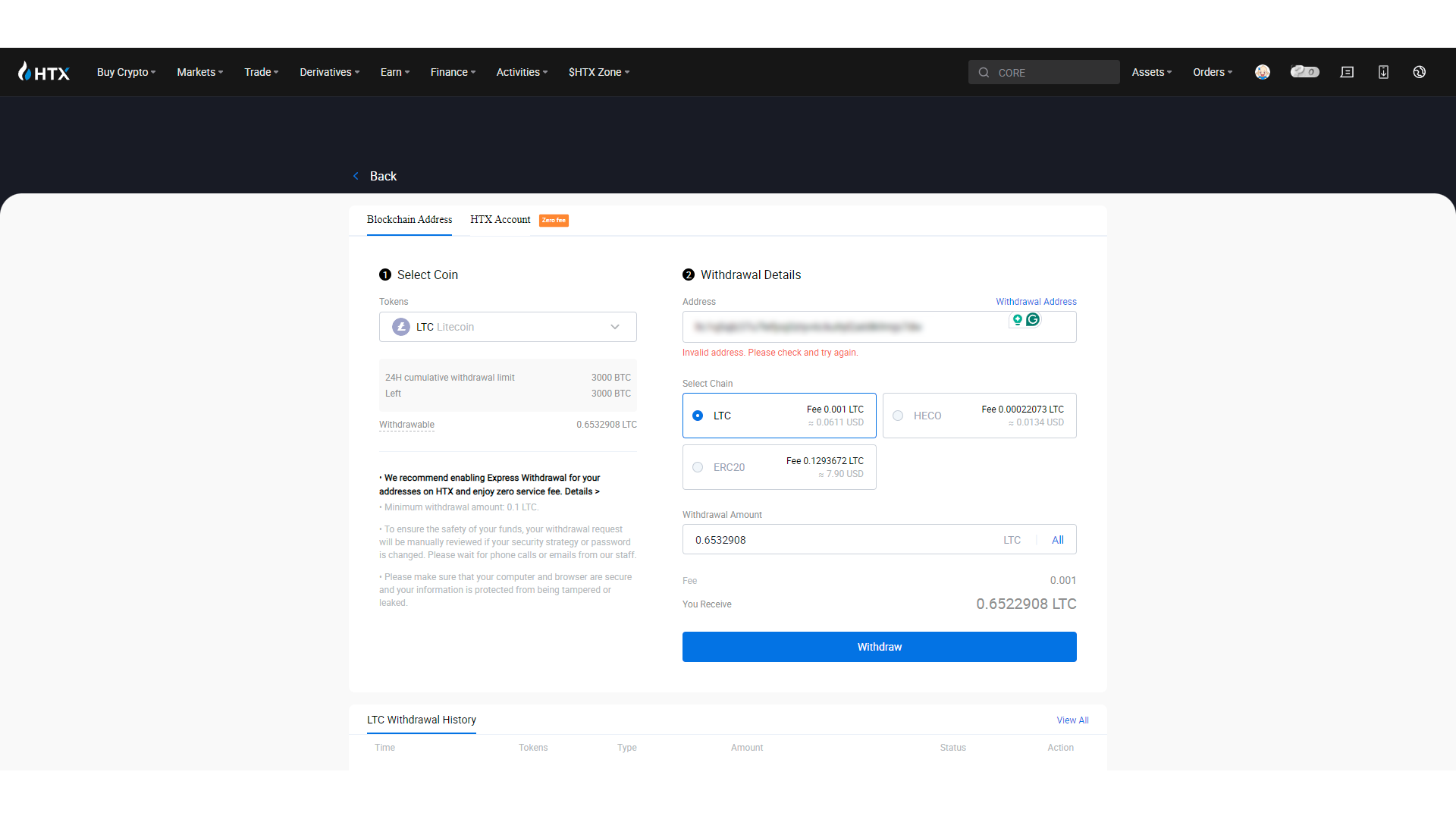

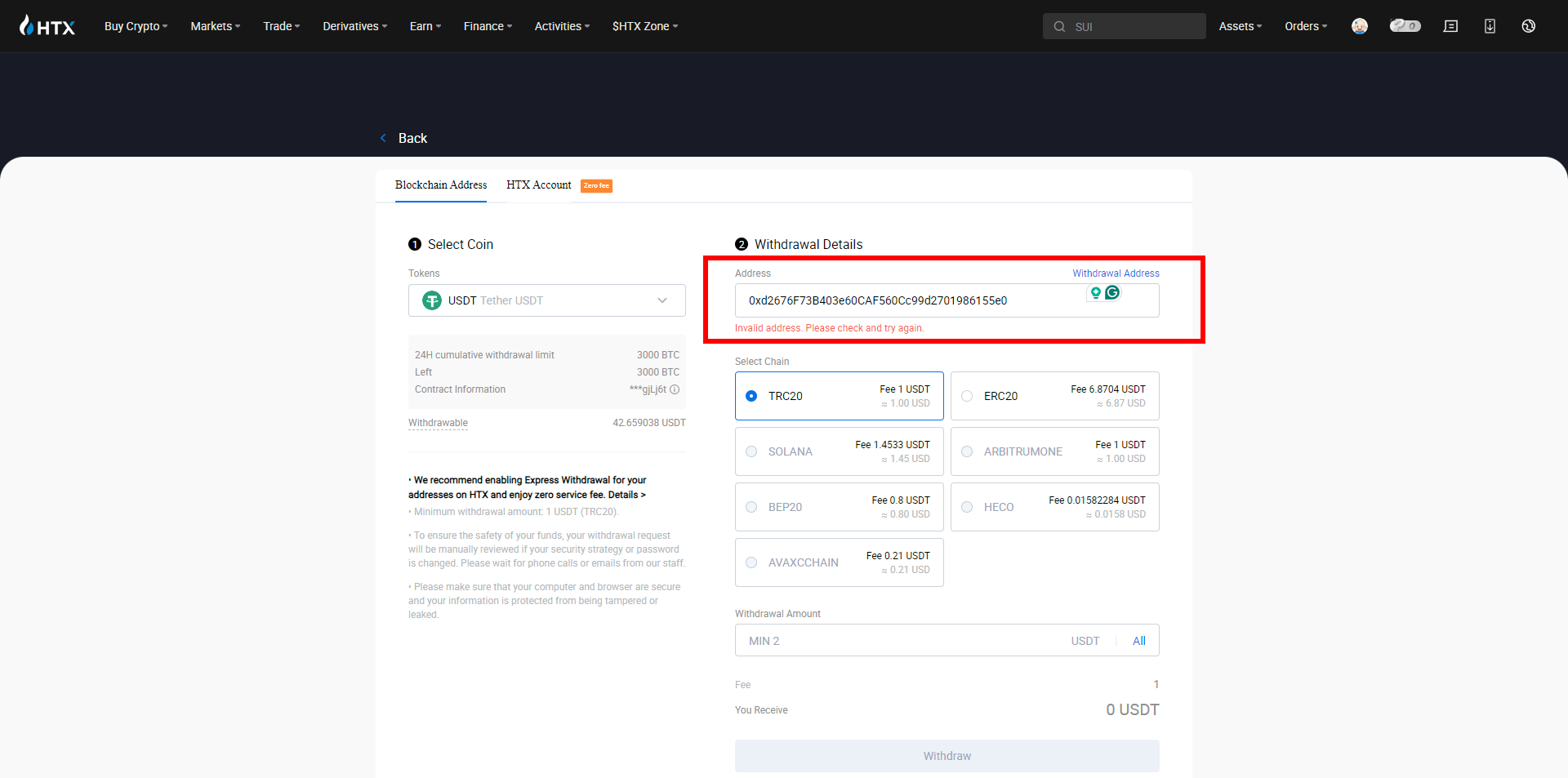

Step 3: Withdrawal and Review

During my tests, I attempted to withdraw LTC over the Litecoin network to TrustWallet. However, the platform wouldn’t allow it, stating that the address was invalid, even though I had copy-pasted it directly from my wallet. Interestingly, when I used the same address on KuCoin, the process went smoothly.

HTX charged me a withdrawal fee of 0.001 LTC, which is 5x less than KuCoin’s 0.005 LTC fee. In addition, the withdrawal process went smoothly, as the funds reached my KuCoin account in less than 10 minutes.

In summary, the trading test on HTX went smoothly. Transactions were executed instantly, and the fees corresponded with those declared on a dedicated webpage.

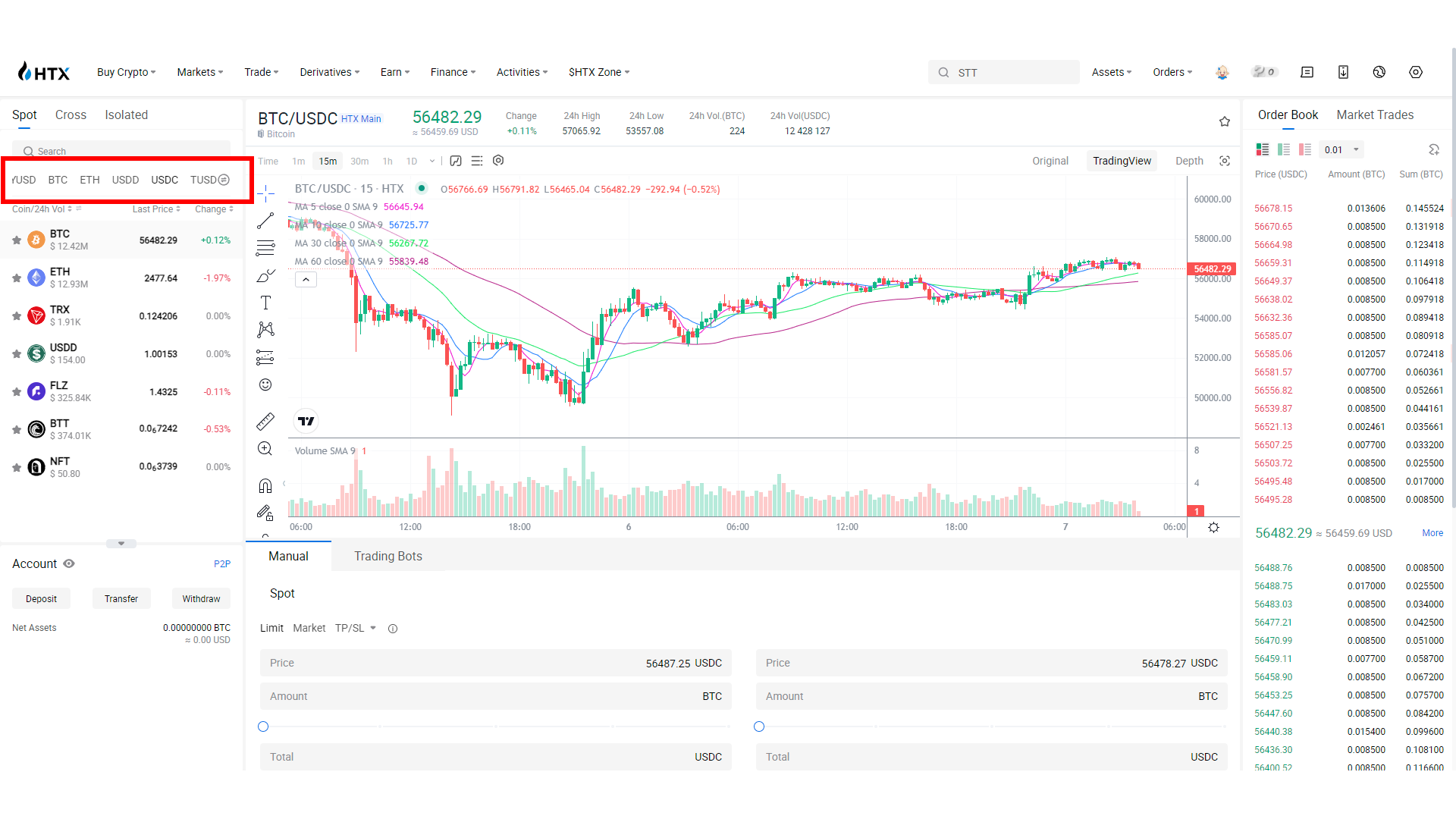

HTX Desktop Version

I also tested the desktop version of HTX. As a casual trader, I found the interface a bit overwhelming and complicated. However, more experienced traders should have no trouble navigating it, as the trading layout is pretty standard.

| Tools for active traders | Availability |

| Order book depth | Available |

| Advanced charting | Yes |

| Technical indicators | More than 30 technical indicators |

| Drawing Tools | Yes |

| Watch list | Yes |

Navigation ease. Navigation was initially a bit complicated. For example, it wasn’t immediately obvious whether I had a positive balance for a selected trading pair. However, after spending some time on the platform and completing a few activities, the process became more intuitive. Exchanging assets is straightforward and involves three basic steps: selecting a trading pair, choosing the order type, and setting the price and quantity.

Charts. HTX offers advanced charting features, including TradingView integration, which is great for experienced traders. These tools can help strengthen your trading strategies.

Withdrawal and Wallet Protection. When withdrawing assets, I had to specify both the wallet address and the network. There’s an option to save the address for future transactions, simplifying the process and avoiding the need to re-enter it. If a typo is made, the platform alerts you to an incorrect address. HTX also offers the convenience of direct transfers between users via email, phone number, or user ID.

The Order Book on HTX follows a standard layout, showing the list of buy and sell orders, along with the amount of assets and the price. You can also adjust the number of decimals for the asset prices.

Coin Search. Finding the coins I wanted to trade was easy, thanks to the standard coin search function. The platform also shows the last price of the asset and its change over the selected period.

Third-Party Sign-in. HTX offers easy login via Google, and I found an option in the settings to link my account with AppleID.

Watchlist. HTX makes it easy to add coins to the watchlist. All you need to do is click on the star icon on the left of the selected currency

My Key Takeaways After Testing HTX

The HTX Trading Platform offers a wide range of tools for experienced traders – a variety of conditional orders, lending, borrowing, staking, copy and social trading, bots, and API access, which can initially feel overwhelming for a newbie or casual trader like myself.

However, after running a few tests, I was able to navigate the interface. The platform follows industry best practices and uses a standard layout, making it easy for traders to transition from other platforms like Binance or KuCoin.

HTX Mobile App

HTX Mobile App is available for Android and iOS. While it mostly mirrors the tools and features available in the desktop mode, it also has a cleaner and more user-friendly interface, making it a better fit for beginners.

The HTX mobile app offers industry-standard security measures helping users protect their assets. These include passkeys, Pattern Password, Google 2FA, Touch ID, and an Emergency contact. However, when I tried to set up 2FA and TouchID, it didn’t work out as expected.

Key features and tools on HTX Mobile include:

- Trading features. The app offers Market, Limit, TP/SL, Iceberg, and Trigger Order. Stop Limit and Stop Loss are not available, and users can only use them in desktop mode.

- Market Discovery. The app’s index page offers many different insights, such as Gainers and Losers, industry news, hot social posts, a celebrity list, and live streams.

- Portfolio clarity. The list of available assets can easily be accessed on a corresponding tab.

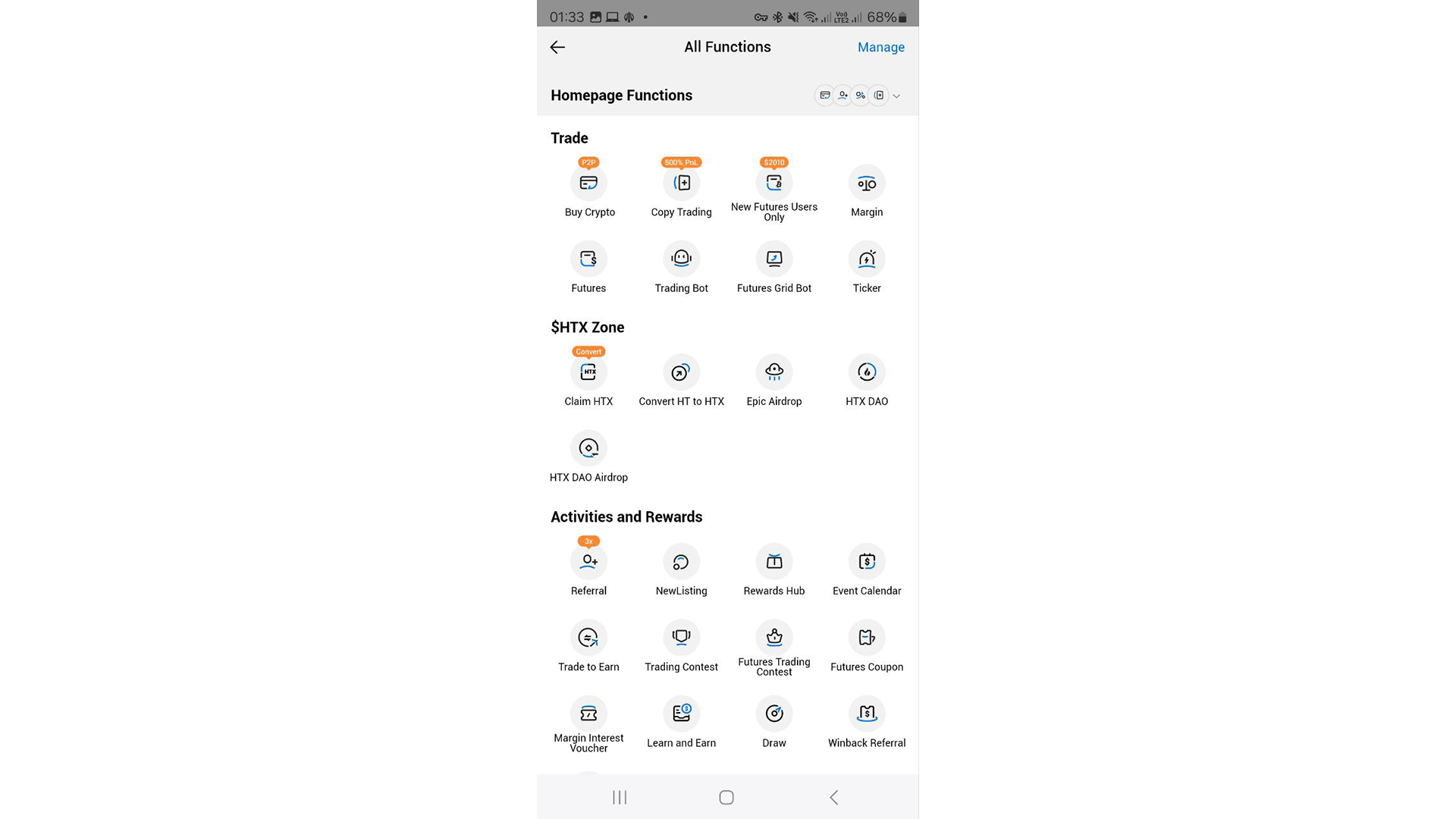

- Available functions. To ease the navigation, HTX Mobile offers a separate page that combines all the available features and tools.

- Trading bot. The HTX Mobile App offers a wider variety of options compared to the desktop mode. It also allows you to create trading bots by following the strategies of other traders.

My Key Takeaways After Testing HTX on HTX Mobile

The HTX Mobile App offers the same set of features and tools available on the desktop mode. However, its interface is much lighter and user-friendly, which makes it a better fit for beginners or casual traders like me.

However, the inability to set up additional security measures is a significant drawback worth considering.

Fees

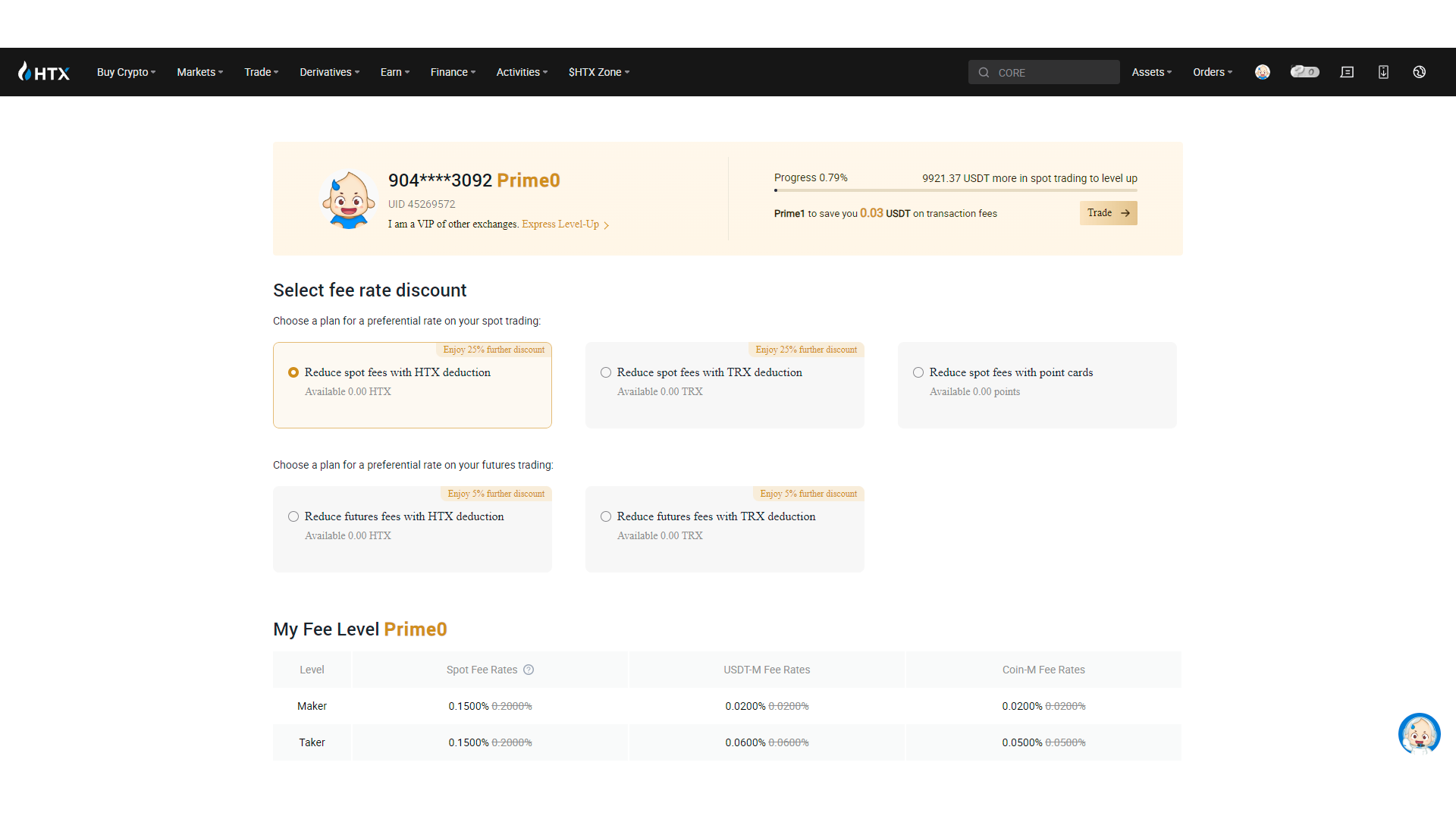

HTX charges significantly lower fees than the industry average. The exchange uses a standard Maker/Taker fee structure for spot and futures trading, with discounts available for different VIP levels.

- Spot: 0.2% Maker/ 0.2% Taker

- Futures: 0.2% Maker/ 0.5% (Coin-Margined) / 0.6% (USDT-Margined) Taker

Another way to reduce trading fees is hodling a native token. Holders of TRX and HTX tokens can enjoy discounts that range between 5% and 25%, depending on the selected plan.

Spot Maker/Taker Fees

In our review of spot fees, we examine spot fees across three distinct tiers, focusing on the fees for different trading volumes. We focus on the essentials and potential savings through native tokens and various discount schemes. Our unique methodology provides a clear view of fee structures and how they benefit traders of all levels.

The first tier typically represents casual traders, as they don’t usually trade more than $10,000 per month, while the higher tiers often relate to more advanced traders. Using this method, we’re categorizing users not only by their trading style but also by the amount of money they spend on the exchange.

Additionally, we also compare these fees with industry standards to give a thorough perspective on each exchange’s affordability.

| Pricing tier | Maker/Taker Fee | Maker/Taker (Discounted) | Industry Average |

| Up to $10K | 0.2%/0.2% | 0.15%/0.15% | 0.41% / 0.51% |

| Up to $100K | 0.14%/0.15% | 0.105%/0.112% | 0.33% / 0.37% |

| Up to $500K | 0.1%/0.1% | 0.075%/0.075% | 0.25% / 0.29% |

Deposit fees

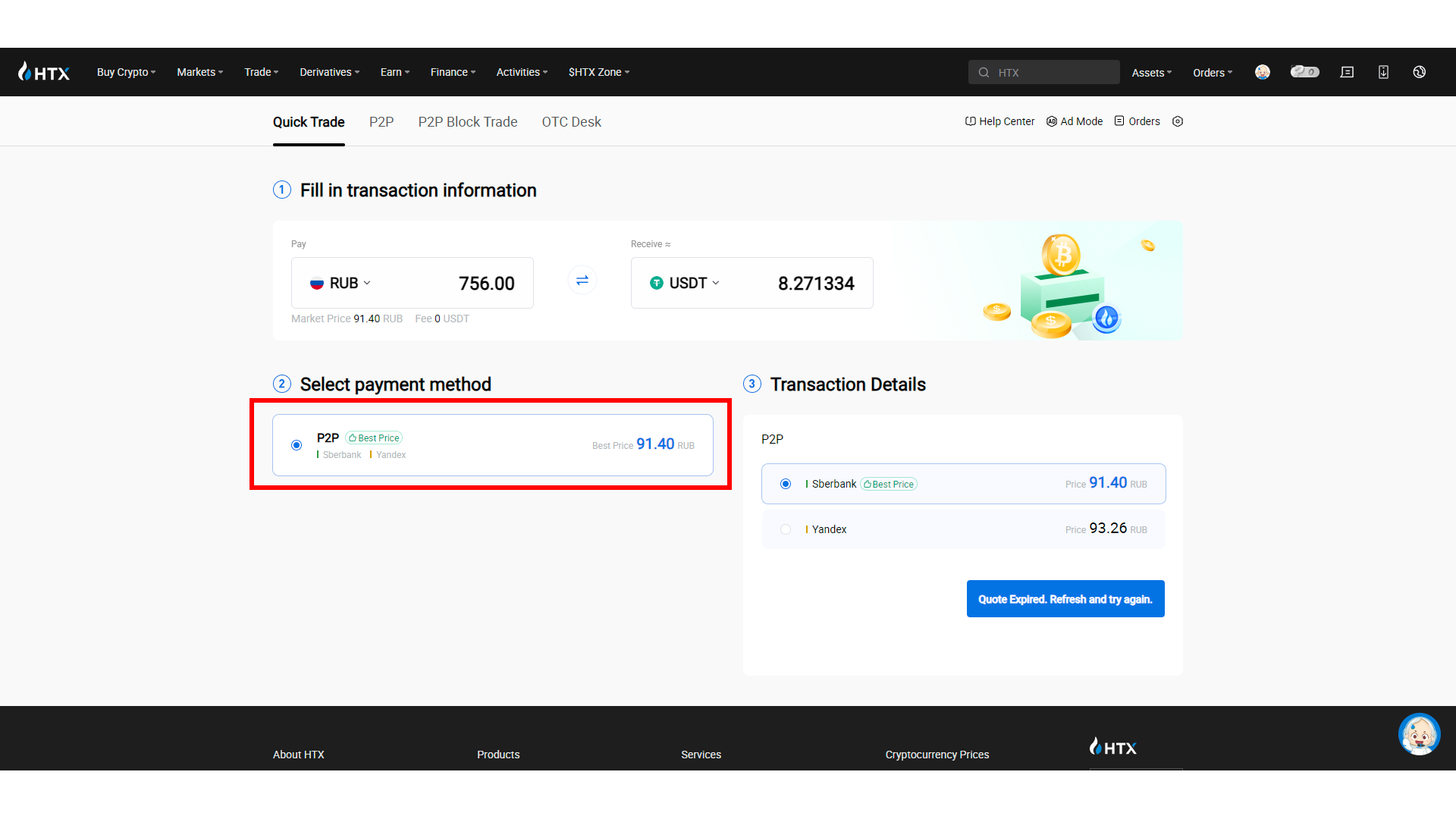

Due to geographical restrictions, I wasn’t able to test direct fiat deposits. These limitations are a significant drawback, while I had no issues buying crypto with fiat on KuCoin or Binance. For me, the only way to buy crypto for cash on HTX was through the P2P trading service.

Withdrawal fees

Fiat withdrawals are not available on HTX. When withdrawing crypto to an external wallet, a small fee is applied, which varies depending on the selected network. For example, withdrawing ETH to an ERC20 network comes with a fee of 0.0042 ETH, while BEP20 network requires paying only 0.00012 ETH.

Leverage And Futures Trading Fee Rate

On HTX, the fees vary depending on the type of futures and whether you are a Maker or a Taker. The full fee structure is represented in the table below:

| 30-Day Volume | USDT-Margined (Maker) | USDT-Margined (Taker) | Coin-Margined (Maker) | Coin-Margined (Taker) |

| $0 – $100,000 | 0.016 – 0.020% | 0.050 – 0.060% | 0.012 – 0.02% | 0.045 – 0.05% |

| $100,001 – $1,000,000 | 0.014% | 0.045% | 0.009% | 0.042% |

| $1,000,001 – $5,000,000 | 0.010% | 0.040% | 0.006% | 0.040% |

| $5,000,001 – $10,000,000 | 0.005% | 0.030% | 0.003% | 0.036% |

| $10,000,001 – $20,000,000 | 0.004% | 0.0295% | 0.00% | 0.035% |

| $20,000,001 – $50,000,000 | 0.0030% | 0.0285% | -0.0020% | 0.0330% |

| $50,000,001 – $100,000,000 | 0.0020% | 0.0280% | -0.0030% | 0.0320% |

| > $100,000,001 | 0.0000% | 0.0275% | -0.0040% | 0.0300% |

The fees are lower for futures trading due to the higher risk associated with these investment products. Investors looking to diversify their portfolios may find these tools suitable. However, it’s important to note that fees and available methods may vary by country.

From my experience, HTX trading fees are quite competitive and significantly lower than the industry average. This fee structure is particularly beneficial for high-volume traders.

Fee Discounts

HTX offers several methods to help traders reduce their trading fees. These include:

- HTX native tokens. Traders who buy and hold HTX, the native token of the platform, can reduce their fees by 25% for both spot and futures trades.

- TRX. The same applies to TRX holders.

- High trading volume. Advanced traders can get fee discounts by reaching specific volumes over the past 30 days or by cumulating the total trading volume over the whole period of using the platform. The minimum discount starts at 10,000 USDT for both spot and futures trading.

Are HTX Fees Competitive?

In summary, the trading fees at HTX are competitively priced compared to the industry average, making it a suitable choice for professional traders. While performing my tests, I made sure that the real fees charged by HTX corresponded with those listed on its website and that there were no hidden fees.

Please note that fees may vary, and it’s advisable to check HTX’s official website for the latest information.

Cryptocurrencies Available on HTX

HTX offers over 700 cryptos and around 800 trading pairs, competing with industry giants like Binance and KuCoin. However, due to its wide range of offerings, the platform struggles to maintain high liquidity for some assets.

At HTX, users can trade popular cryptos like BTC, ETH, SOL, DOT, and ADA. The platform also offers rare assets and niche offerings like Beer Token and Lovely Finance. Since 2022, HTX doesn’t have a launchpad for listing new coins.

HTX offers a wide variety of stablecoins. Aside from the most popular stablecoins – USDT and USDC, HTX also offers other fiat-collateralized assets like PAX Dollar (USDP) and True USD (TUSD). In addition, one may also find crypto-collateralized DAI and algorithmic CELO here.

HTX boasts deep liquidity for popular digital assets like LTC, ETH, BNB, and XRP. Despite offering a wide variety of tradable assets, the platform actively monitors liquidity and regularly delists those with low trading volumes. It outperforms some other major CEXes like KuCoin, which don’t offer the same level of asset management.

Deposits & Withdrawals

HTX is supposed to support direct fiat deposits and withdrawals via various payment methods, including credit cards, but they were unavailable to me due to geographical restrictions. This puts HTX at a disadvantage compared to other centralized exchanges like KuCoin or Binance.

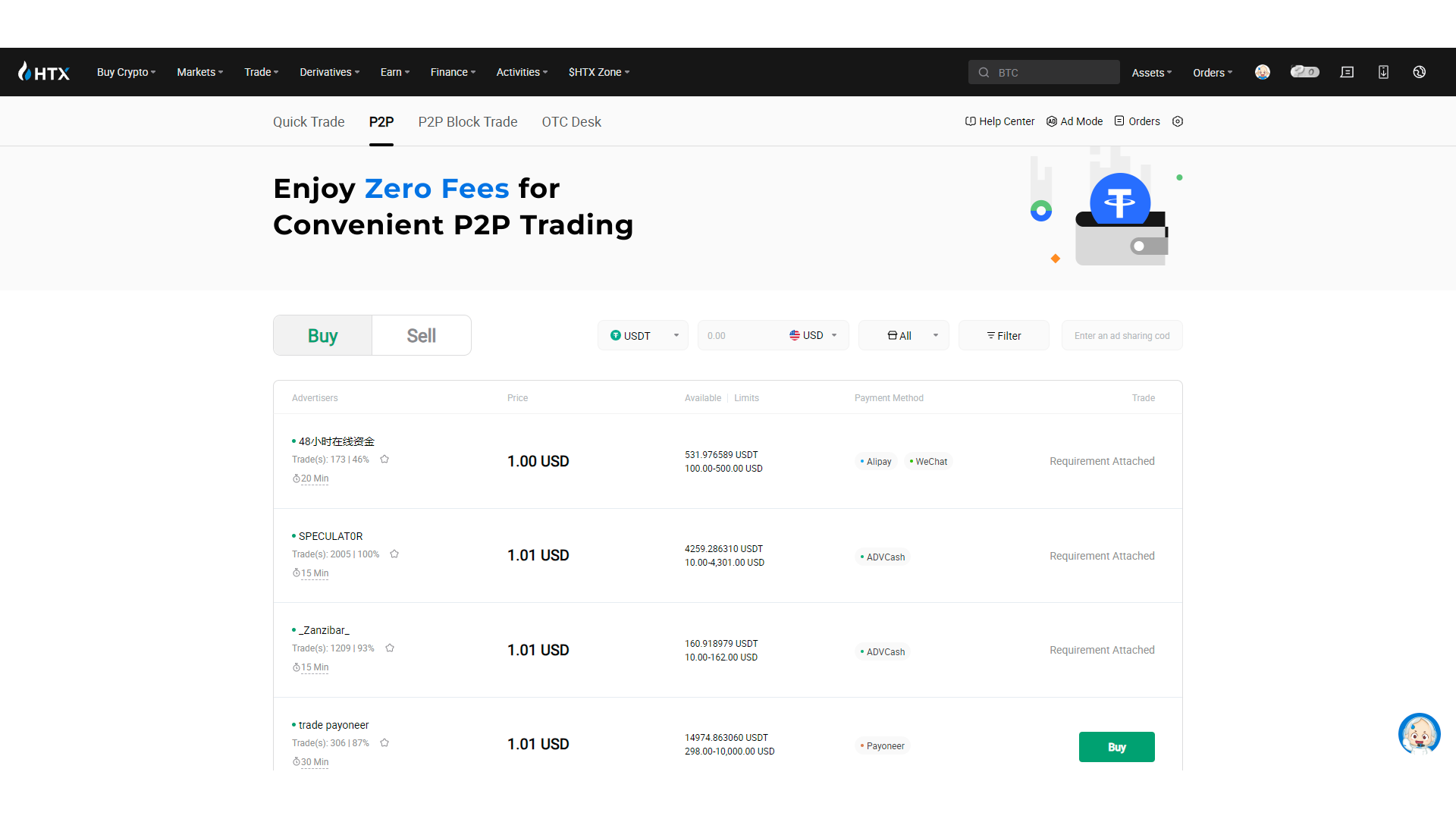

However, users can still buy crypto through the P2P service or deposit digital assets from another source. The P2P service offers various fiat payment gateways, making the platform more accessible for crypto beginners.

HTX Deposit Options

Fiat One-Click Buy Options: HTX offers a Quick Trade service, which is supposed to allow users to buy crypto with a bank card or other quick payment methods. However, during my tests, I only had access to the P2P payment option in this section, which was rather frustrating.

Peer-to-peer service (P2P): P2P enables buyers and sellers to connect within the same region and select a convenient payment method, including fiat.

The list of available payment gateways is conveniently displayed for each user. In account settings, it is also possible to set up the payment method and link a bank card upfront.

I had a positive experience testing the P2P trading service on HTX: I found a seller who accepted payments through my local bank and transferred the correct amount. The platform automatically completed the transaction and transferred the crypto to my account.

HTX Withdrawal Methods

The withdrawal process on HTX is straightforward. The platform allows users to withdraw crypto to an external wallet or transfer digital assets to another HTX user.

During my tests, HTX charged me a small withdrawal fee, like many other platforms I’ve used. However, the fee was reasonably small. The service clearly displayed the cost of a transaction for each available network. Sending funds to another HTX account is free of charge.

Minimum withdrawal amounts for most cryptocurrencies are around $2 equivalent. When cashing out crypto via the P2P trading service, the limits vary depending on buyers’ requirements.

HTX doesn’t have a dedicated page displaying withdrawal limits. During my tests, I reached out to support with this question. The agent said my personal daily withdrawal limit was 3,000 BTC. Note that this sum may be different for users with different levels. Therefore, it’s advisable to contact HTX support to find out the exact amount.

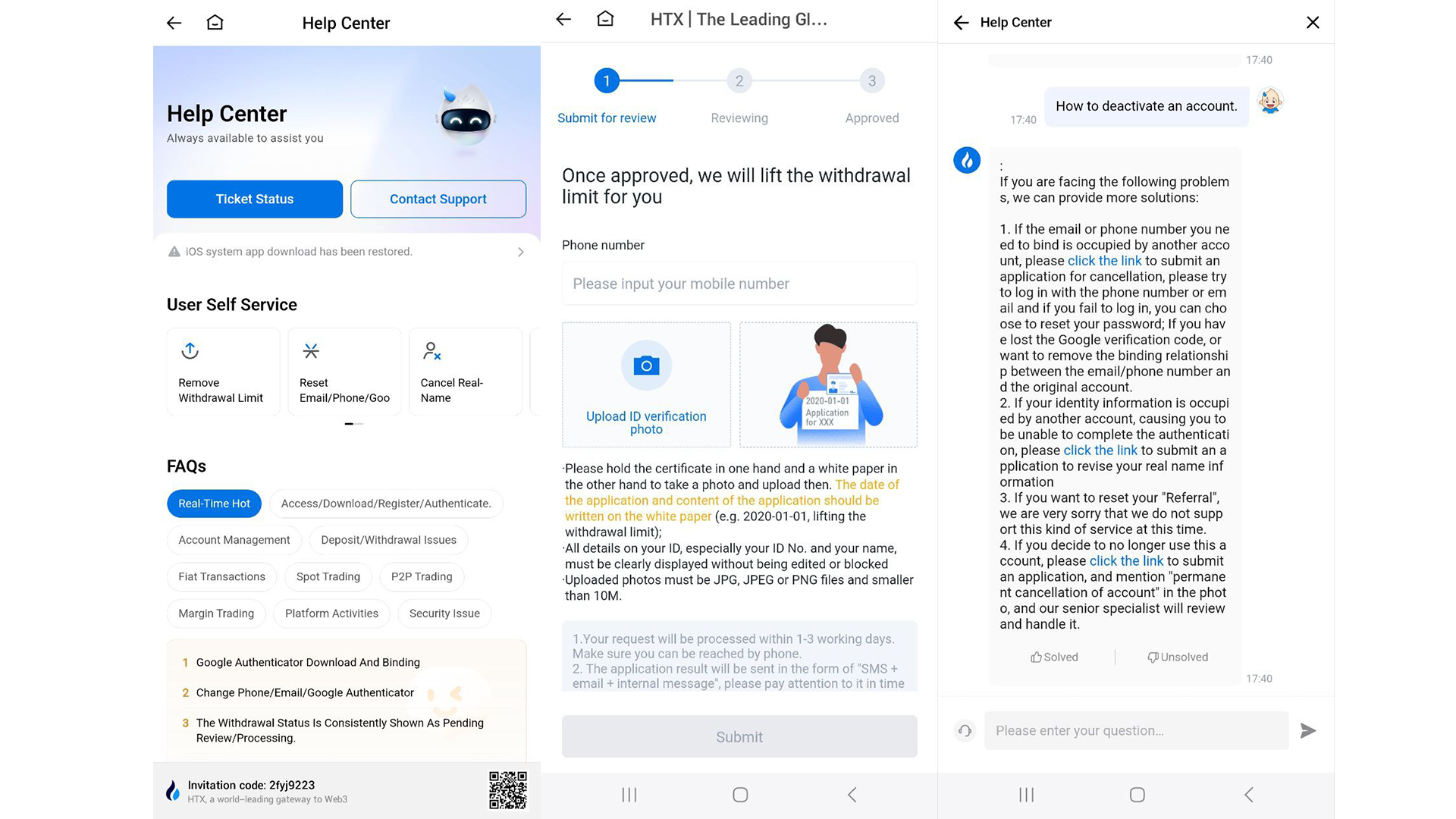

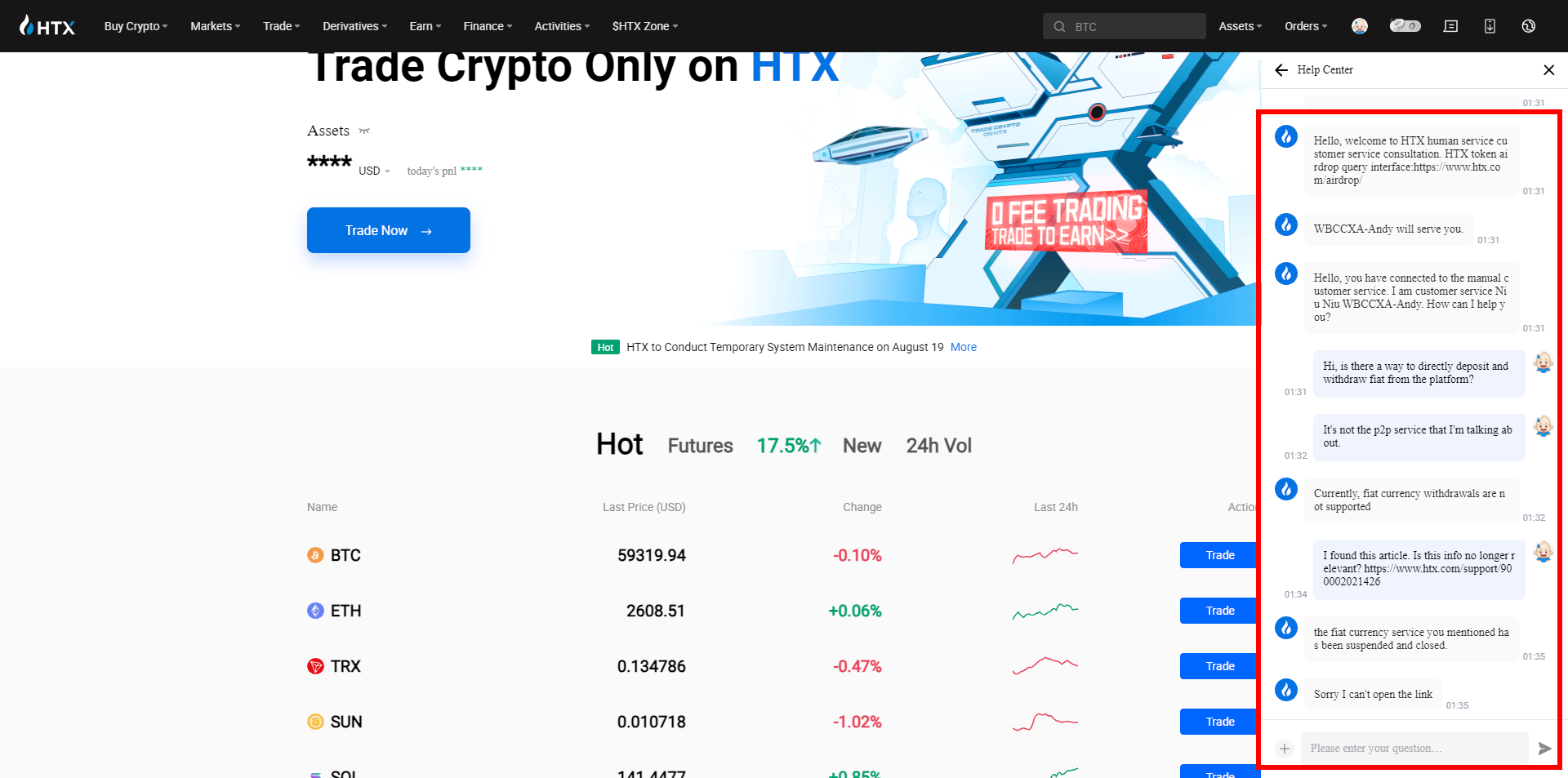

Customer Service

HTX offers customer support via live chat, which is available only in English. Phone support and email are not supported. The response speed and quality from real agents are excellent, with agents able to submit tickets on behalf of customers. The status of these tickets can be easily checked within the Live Chat window. The platform also features a User Self Service where users can reset 2FA, remove the withdrawal limits, and perform other activities that do not require a live agent.

However, the FAQ section differs between the desktop and mobile versions. The mobile FAQ is well-structured and provides answers to most basic questions about the platform. The desktop FAQ is unstructured and outdated The last article was posted in 2020.

| Live Chat | Phone | Languages | |

| 24/7 | N/A | N/A | English |

HTX Customer Support Test

HTX offers top-notch customer service. During my tests, I was able to reach out to a real agent via Live Chat in just seconds, and the responses to nearly all of my questions were both informative and helpful. Compared to KuCoin and other large CEXes I’ve tested, HTX support is a real gem.

The mobile app includes an option to check the ticket status, though I couldn’t find a way to open a ticket directly. I also tried sending an email to a generic support address, but it resulted in a delivery failure notification.

FAQ

Is HTX trustworthy / Can HTX be trusted? Is HTX legit?

Based on our analysis, we can say that HTX is a legitimate trading platform with high trust scores on reputable ranking platforms. The exchange is partially certified as it has licenses in such regions as Lithuania, Dubai, the British Virgin Islands, and Australia.

Can US Citizens Use HTX?

No, HTX doesn’t operate in the US, so US citizens don’t have access to the platform.

Has HTX ever been hacked?

Yes, HTX lost $30 million worth of crypto in a hacking attack in November 2023. The exchange promptly reimbursed all the affected customers after the event.

Does HTX require KYC?

Yes, HTX requires its customers to pass obligatory KYC to get access to its trading functionality. The verification has four basic levels with different withdrawal limits.

Can I use leverage or margin trading on this exchange?

Yes, HTX offers different futures products with up to 100x leverage. It is possible to trade derivatives based on USDT or other altcoins.

Is my money safe on HTX?

Yes, HTX is a trustworthy exchange that offers multiple layers of protection to its customers. In addition, it has introduced Proof of Reserves and regularly updates with its state.

Is HTX regulated?

Yes, HTX claims to have licenses in many different regions including such regions as Lithuania, Dubai, Australia, BVI, and South America. Thus, it covers most of the active crypto trading regions.

Does HTX offer any bonuses, welcome offers, or referral rewards to its users?

Yes, HTX runs a variety of such offers. There is an affiliate program that can help influencers make additional profits by inviting other users. Other perks include welcome offers for newcomers and occasional promo campaigns.

HTXFeatures

- Bitcoin

- Ethereum

- Zcash

- Dash

- Ripple

- Litecoin

- Bitcoin Cash

- Ethereum Classic

- OmiseGO

- EOS

- NEO

- Qtum

- aelf

- NEM

- Australia

- Cameroon

- Chad

- Canada

- Denmark

- France

- Greece

- Haiti

- Iceland

- Libya

- Mexico

- Nepal

- Belize

- Romania

- Senegal

- Cape Verde

- Sri Lanka

- United Kingdom

- Eritrea

- Gambia

- Indonesia

- Lebanon

- Angola

- Malta

- Bahamas

- Benin

- Chile

- Ghana

- Gibraltar

- Grenada

- Serbia

- Guinea-Bissau

- Tonga

- Kenya

- Finland

- Namibia

- Oman

- Palau

- Jamaica

- Solomon Islands

- Kyrgyzstan

- Tunisia

- Montenegro

- Peru

- Sweden

- Trinidad and Tobago

- Yemen

- Bahrain

- Bulgaria

- Colombia

- Belarus

- Cuba

- Cyprus

- Algeria

- Burkina Faso

- Cambodia

- Kuwait

- Russian Federation

- Saint Lucia

- South Sudan

- Tanzania

- Turkey

- Virgin Islands, British

- Japan

- Malawi

- Netherlands

- Maldives

- Botswana

- Qatar

- Saint Kitts and Nevis

- Saint Vincent and the Grenadines

- Slovenia

- Sudan

- Taiwan

- Tuvalu

- Vatican City

- Uruguay

- Malaysia

- Moldova

- Nauru

- Papua New Guinea

- Zambia

- Andorra

- Bolivia

- Afghanistan

- Congo

- Cote d'Ivoire

- Laos

- Dominican Republic

- Mauritania

- Egypt

- Gabon

- Morocco

- Uganda

- Nigeria

- Swaziland

- Vietnam

- Austria

- Barbados

- Bosnia and Herzegovina

- Djibouti

- Equatorial Guinea

- Comoros

- Estonia

- Fiji

- Ethiopia

- Mali

- Hong Kong

- Ireland

- Italy

- Philippines

- Macedonia

- Poland

- Madagascar

- Sierra Leone

- Vanuatu

- Panama

- Portugal

- Samoa

- Saudi Arabia

- Albania

- Burundi

- Guinea

- Iran

- Timor-Leste

- Armenia

- Bangladesh

- Belgium

- Kiribati

- Lithuania

- Bhutan

- Mongolia

- Cayman Islands

- Myanmar

- Niger

- Rwanda

- Sao Tome and Principe

- Slovakia

- Czech Republic

- Thailand

- United Arab Emirates

- Ecuador

- Germany

- India

- Liberia

- Luxembourg

- Liechtenstein

- Marshall Islands

- Monaco

- Mozambique

- New Zealand

- Pakistan

- Togo

- Uzbekistan

- Venezuela

- Zimbabwe

- Antigua and Barbuda

- Croatia

- Argentina

- Guyana

- Kazakhstan

- Lesotho

- Central African Republic

- Norway

- Paraguay

- San Marino

- Spain

- Suriname

- Switzerland

- Tajikistan

- Guatemala

- Honduras

- Iraq

- Mauritius

- Nicaragua

- Singapore

- Somalia

- Azerbaijan

- Brazil

- Brunei

- China

- Costa Rica

- El Salvador

- Georgia

- Hungary

- Israel

- Jordan

- Latvia

- Micronesia

- Seychelles

- South Africa

- Turkmenistan

- Ukraine

- Isle of Man

- Kosovo

Payment Method

| Exchange Details | Info |

|---|---|

| Headquarters Country | Singapore |

| Foundation Year | 2013 |

| Type | exchange |

| Trading Allowed | Yes |

Top Wallets

- Your capital is at riskRead Review

- Your capital is at riskRead Review

- Your capital is at riskRead Review