Advertisement

Advertisement

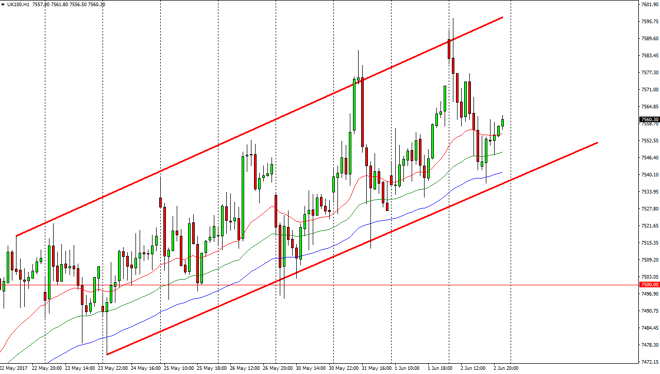

FTSE 100 Price Forecast June 5, 2017, Technical Analysis

Updated: Jun 3, 2017, 01:56 GMT+00:00

The FTSE 100 had a negative session on Friday, dropping down to the 72-hour exponential moving average. We also tested the bottom of the uptrend in

The FTSE 100 had a negative session on Friday, dropping down to the 72-hour exponential moving average. We also tested the bottom of the uptrend in channel, so this signifies that the buyers are still very much in control. In fact, I believe that we continue to go higher, as the dips have offered such reliable buying opportunities. The FTSE 100 is very export laden, and this of course is highly influenced by the value of the British pound. The British pound has been historically week as of late, and that should continue to help export coming out of the United Kingdom. Because of this, I am a buyer and I believe that the uptrend in channel holds.

Buying on the dips, and small increments

One of the common threads that I see in all of my analysis is that buying on the dips continues to work in indices around the world, and in small position seems to do even better. This allows us to build up a larger trading positions over time, and do something similar to averaging in to the market. This cuts down on some of the potential losses, and makes it much more psychologically comfortable to be involved in these markets. Ultimately, I believe that the market will try to reach towards the 7600 level but it may take some time to get there. I would not be interested in shorting this market anytime soon, least not until we break down below the 7500 level at the very least. I think going forward, every time we drop, smart money comes back into the marketplace and starts taking advantage of value.

FTSE 100 Video 05.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement