Advertisement

Advertisement

Analysis-Gloomy U.S. bank sector could yield payoff for contrarian options bets

By:

By Saqib Iqbal Ahmed NEW YORK (Reuters) - Weeks after a banking crisis pummeled financial stocks, some options strategists say the heightened pessimism in the sector presents an attractive opportunity to position for a rebound ahead of earnings season.

By Saqib Iqbal Ahmed

NEW YORK (Reuters) – Weeks after a banking crisis pummeled financial stocks, some options strategists say the heightened pessimism in the sector presents an attractive opportunity to position for a rebound ahead of earnings season.

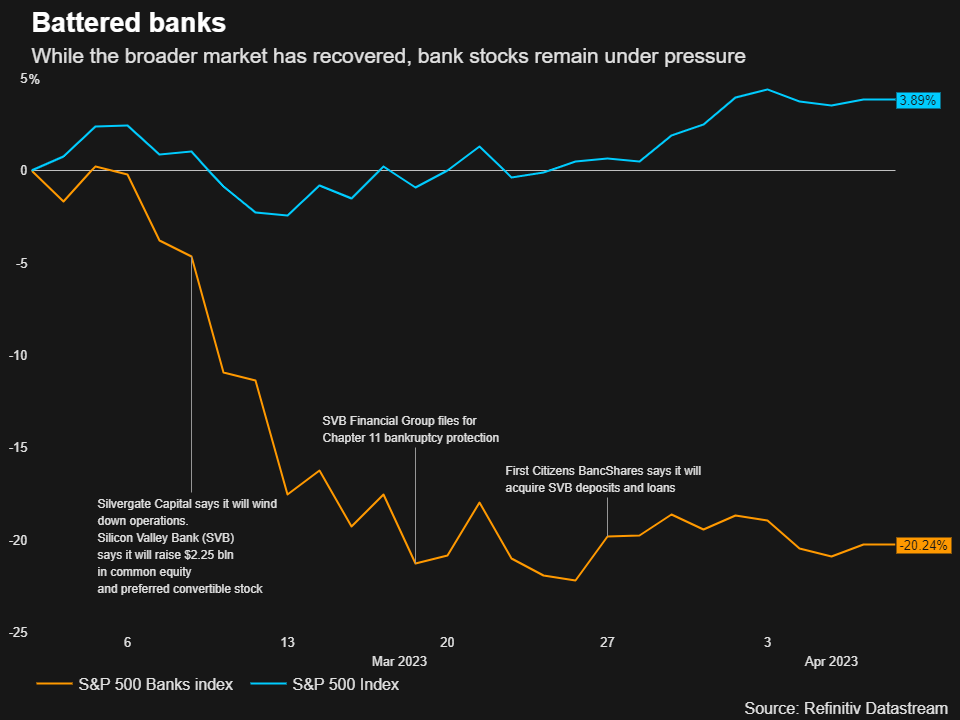

While the S&P 500 index has advanced 6% since mid-March, when the failure of Silicon Valley Bank (SVB) sparked tumult in the banking sector, investors have been more wary of financial stocks. The S&P 500 Banks Group is up just 3% from its March low and remains down 14% for the year.

The pervasive gloom around financial stocks has increased the cost for investors betting on more downside while making it relatively inexpensive to bet on a rebound. With banks set to kick off their earnings on Friday, the risk-reward may be favorable to investors brave enough to step in with contrarian wagers, option mavens say.

“Upside pricing is attractive relative to downside in many of these stocks,” said Anand Omprakash, head of derivatives and quantitative strategy at Elevation Securities.

JPMorgan Chase, Citigroup Inc and Wells Fargo are set to report results on Friday, while Goldman Sachs, Morgan Stanley and Bank Of America are on deck the following week.

Positioning in options markets illustrates the pessimism that has dogged the sector for weeks, even though worries over financial stocks have ebbed after U.S. regulators backstopped both depositors and financial institutions linked to SVB.

Thirty-day implied volatility skew – a measure of the relative demand for puts versus calls – on JP Morgan Chase is at 22.8%, higher than it has been about 85% of the time over the last year, data from Trade Alert showed. Bank of America and Citigroup also show similarly elevated skew. Calls convey the right to buy shares at a fixed price in the future, while puts offer the right to sell stock at a set price.

Still, some investors appear to smell a bargain.

“Recent conversations with clients suggest some believe upcoming earnings will be a positive catalyst for financials,” said Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets.

Better-than-expected earnings and positive messaging from CEOs could set the stage for investors to reverse a trade that has seen them bet on downside in financials while seeking safety in big tech stocks, according to Silverman. The S&P 500 tech sector is up 10% since March 10.

“Using options is a good way to play that,” she said.

Analysts expect S&P 500 financials to post year-over-year earnings growth in the first quarter of 4.3%, according to I/B/E/S data from Refinitiv, making it among just four sectors whose earnings are expected to climb. Investors will scrutinize banks’ balance sheets to assess how much capital they hold, their levels of uninsured deposits and the potential gains or losses from their securities portfolios.

For investors who believe financial earnings and guidance will come in better than expected, Elevation Securities recommended buying Financial Select Sector SPDR Fund call options at the 33 strike. On Monday, the XLF ETF was about flat at $31.95.

Over the last two years, buying XLF shares on the day the first of the big banks reported results and holding until the end of the month has yielded 1.3% on average, according to Refinitiv data.

“Given how beaten up bank stocks are, buying calls into earnings can make sense,” said Michael Purves, chief executive officer at Tallbacken Capital Advisors.

But using options to position for upside can be risky, especially for traders tempted by the richer put premiums to sell puts to fund the purchase of upside calls, analysts warned.

Such trades would likely suffer steep losses if the selloff in the sector resumed.

“(It’s) not for the faint of heart,” Silverman said.

(Reporting by Saqib Iqbal Ahmed; Editing by Ira Iosebashvili and Mark Porter)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement